Cryptocurrency markets are facing heightened volatility as the Bank of Japan (BOJ) prepares to raise interest rates, a move that could have ripple effects on Bitcoin, Ethereum, XRP, and other digital assets globally. 🚨 (But let’s be honest, it’s just another day in the crypto circus.)

BOJ Prepares Historic Rate Increase

Japan has maintained ultra-low interest rates for decades to stimulate economic growth through cheap borrowing. However, rising inflation and a weakening yen have prompted the BOJ to signal a rate hike. Economists predict a 0.25% increase from the current 0.5%, potentially reaching 0.75%, the highest level in decades. 🤯 (Because nothing says ‘we’re finally doing something’ like a 0.25% increase.)

The rate increase, although seemingly small, represents a major shift in Japan’s monetary policy and is expected to influence both local and global financial markets. 🤝 (Or just make everyone panic and sell their crypto for snacks.)

Why Crypto Investors Should Take Notice

Cryptocurrency markets thrive on liquidity, with cheap money fueling investments in high-risk assets. When central banks tighten monetary policy, borrowing costs rise and liquidity dries up. Historically, these conditions trigger sell-offs in speculative markets, including crypto. 📉 (Because who needs stability when you can have chaos?)

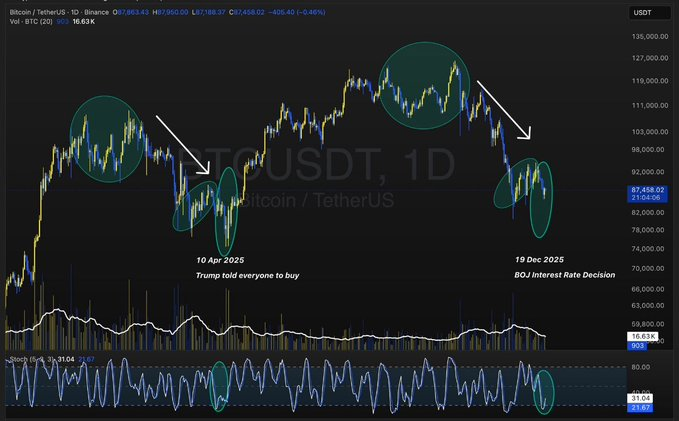

Bitcoin often feels the first impact. During the 2022 U.S. Federal Reserve rate hikes, Bitcoin prices plunged from over $60,000 to under $20,000 in a matter of months. Analysts say a similar effect could be seen if the BOJ proceeds with the anticipated hike. 💸 (Because nothing says ‘I’m a safe investment’ like a 66% drop.)

The Role of the Yen and Global Carry Trades

A stronger yen could also impact global carry trades. Investors often borrow yen at low rates to invest in higher-yielding assets such as U.S. stocks or crypto. A rate hike may reverse these trades, creating additional selling pressure in crypto markets. 🔄 (Because why have a stable currency when you can have a rollercoaster?)

“This is not isolated to Japan,” said one market analyst. “Japan is the world’s third-largest economy, so their moves create ripples.” 🌊 (Or just a tiny pebble in a very large pond.)

Current Market Trends

As of Dec 17, cryptocurrency markets are showing early signs of stress. Bitcoin is trading around $86,589, down over 1% in the past 24 hours. Ethereum has fallen to $2,834, losing more than 4% of its value. XRP is also under pressure, trading at $1.86 with a decline of nearly 4%. The total market capitalization of cryptocurrencies stands at $2.92 trillion. 📉 (Because who needs sleep when you can watch your savings vanish?)

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2025-12-18 06:22