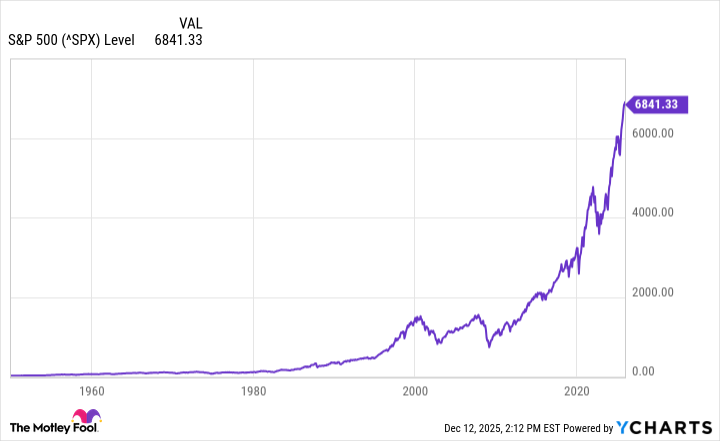

Many years later, when the grandchildren of this era’s traders would gather to hear tales of the great AI surge, they would speak of a time when silicon valleys hummed with the electric breath of machines, and stock tickers glowed like constellations in a speculative sky. The year 2025 arrived with the scent of freshly printed prospectuses and the metallic tang of server farms sweating under the weight of neural networks. It was then that the S&P 500, that ancient barometer of human ambition, climbed a stairway of light toward a 70% ascent, its trajectory bending under the gravity of artificial stars.

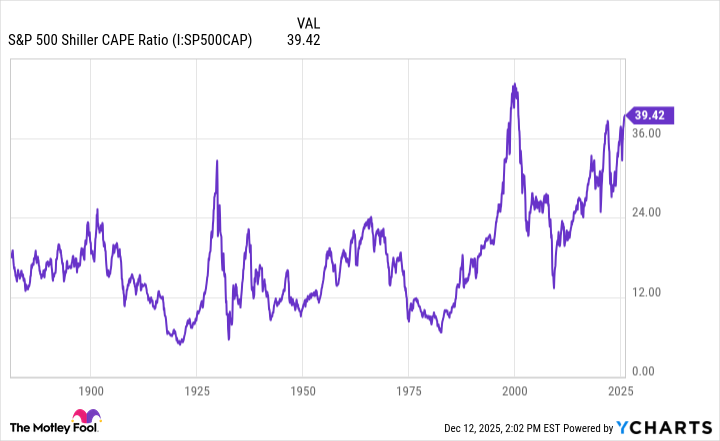

Yet in the marrow of this progress lingered the ghost of 2000, when tulips last bloomed in digital soil. The Shiller CAPE ratio-a relic forged by sages to measure the temperature of market fevers-had climbed to 39.4, a number that made actuaries cross themselves and whisper of 1929’s autumnal sigh. Investors, those eternal gamblers with portfolios stitched from hope and rumor, felt the air thicken with the viscosity of pending correction.

The year’s carnival ride

April arrived like a jester bearing poisoned roses. On the third Tuesday of Trump’s tariff proclamation-a document drafted in the fever-dream dialect of economic nationalism-the market convulsed. The S&P 500, that gilded canary of investor sentiment, plummeted 15% in three days, dragging cloud-computing darlings and semiconductor oracles into the abyss. The floor of the NYSE seemed to pulse like a living thing, traders’ voices merging with the clatter of ticker tape into a dirge for evaporating fortunes.

But summer brought amnesia, as it always does. Earnings reports bloomed like desert flowers after rain, and the index clawed its way back, adding 16% with the stubbornness of ivy scaling a brick wall. Yet beneath this verdant growth, the soil shifted. The CAPE ratio’s current reading hung in the air like a prophecy half-remembered, its digits echoing the fever dreams of 1999 and the jazz-age exuberance of 1928.

Bubbles and their discontents

To speak of “bubbles” in this age of algorithmic whispers is to invoke a word that has lost its teeth through overuse. The dot-com rupture had been a carnival of empty vessels-companies whose business models evaporated like morning dew under the scrutiny of reality. Their modern descendants, however, bore silicon hearts: Nvidia’s glowing chips, Microsoft’s cloud cathedrals, Palantir’s data vultures circling above the carcass of analog industry.

The market’s present fever differs from its ancestors in the same way a thunderclap differs from a whisper. AI’s economic engine already churns out $220 billion annually, its pistons greased by actual revenue rather than the sweet poison of speculation. Yet history’s pendulum swings regardless of technological virtue-witness the railroad barons’ graves, the automobile kings’ forgotten palaces.

Predicting the impredictable

When the Great Depression’s shadow fell in 1929, it arrived with the suddenness of a snapped harp string. The dot-com crash came as a slow poison, seeping into the bones of day traders and venture capitalists alike. The coming correction-if indeed the CAPE ratio’s augury proves true-may announce itself with neither trumpet nor funeral bell, but as a quiet unraveling of assumptions.

Consider this paradox: the S&P 500’s 140-year chart resembles less a financial instrument than a topographical map of human perseverance. Peaks carved by hubris crumble into valleys where ingenuity takes root. To invest is to practice divination with balance sheets, to buy shares in the collective delusion that tomorrow will resemble today with minor variations.

So let the Cassandras wail and the bulls snort their defiance. The market’s true nature reveals itself only in retrospect, when the alchemy of risk and reward solidifies into textbook footnotes. For those willing to sift the rubble of the next downturn, history offers its sole certainty: the phoenix always rises, though its feathers change hue with each generation. 🕰️

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2025-12-17 04:25