with the content. Replace the original text with the rewritten content, ensuring all elements are there: images, divs, etc.

The critical rewriting instructions mention deepening the analysis through the dividend hunter lens. So, discuss AMD and Nvidia’s financials in terms of their sustainability, growth rates, margins, and how that affects their ability to pay dividends in the future. Even if the original doesn’t mention dividends, imply that as a dividend hunter, you’re looking for companies that can grow and sustain profits, thus supporting future dividends.

Eliminate any template-like content. Make sure the text flows naturally, as a seamless piece. Use metaphors and similes typical of Márquez, blending the technical with the poetic. For example, comparing the AI market growth to a “jungle of numbers” or something.

Finally, add a single thematically appropriate emoji at the end. Maybe a 🚀 or 💻, but ensure it’s inside the last

tag.

Now, putting it all together. Start with a Márquez-style opening, weave in the AMD vs. Nvidia comparison with rich imagery, analyze their financials and market positions from a dividend hunter’s perspective, and conclude with the investment recommendation, keeping the emoji in the last paragraph.

End of Thought (18.71s)

Many years later, when the silicon dust of the AI revolution settled and historians dissected the great data center gold rush of the 2020s, they would speak of two colossi who straddled the chasm between ambition and arithmetic – one with the swagger of a conquistador, the other with the patience of a monk copying sacred texts by candlelight.

Under fluorescent skies where server farms hummed like cicadas in a digital summer, the question persisted: would the alchemy of Nvidia (NVDA 1.96%) with its golden CUDA threads continue to spin fortune from algorithms, or would the quiet machinations of AMD (AMD 0.63%) – a company that had learned to measure time in nanoseconds and patience in geological strata – finally crack the vault?

The answer, like all matters of empire-building in the cloud, lay not in the circuits themselves but in the invisible arithmetic of compounding – the kind that makes rivers carve canyons and dividends bloom from reinvested sorrows.

AMD’s Sisyphusian Spring

In the beginning, there was CUDA – a digital Excalibur that Nvidia plunged into the stone of artificial intelligence, pulling forth fire while AMD’s ROCm software languished in the shadow of obscurity, its downloads trickling like desert springs. But time, that great equalizer, has a habit of turning parched earth into fertile ground. By the time AMD’s financial oracle spoke to the court in 2025, the software’s downloads had multiplied tenfold, a quiet rebellion coded in hexadecimal.

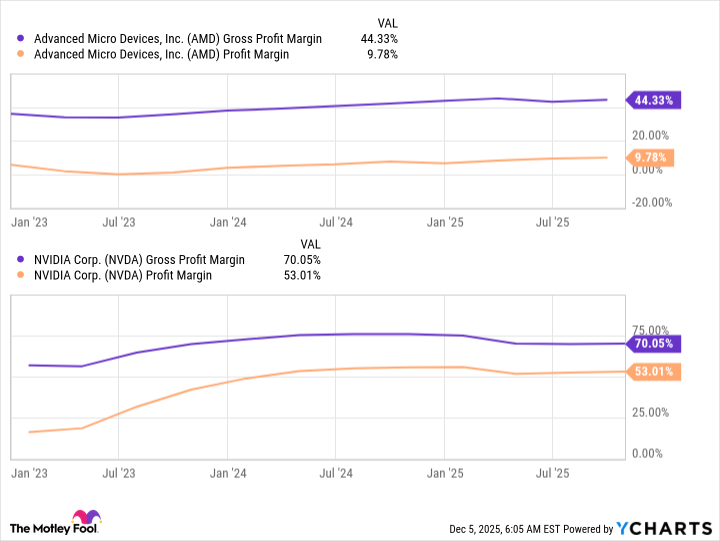

Consider the margins: Nvidia’s gross profits rise like skyscrapers in a speculative boom, their GPUs priced with the confidence of a Renaissance jeweler. AMD’s offerings, meanwhile, whisper promises of frugality to cash-strapped hyperscalers – a cheaper ticket to the AI casino, where performance might dip like a hummingbird’s wing but dividends could compound like interest in a forgotten savings account.

Yet the kingdom remains locked in Nvidia’s embrace. Jensen Huang, its mustachioed maestro, conducts a symphony of sold-out cloud GPUs while AMD waits at the gates like a suitor bearing slightly less dazzling jewels. But remember: empires crumble not from frontal assaults, but from the slow rot of alternatives – especially when budgets tighten like nooses and procurement officers grow nostalgic for arithmetic.

Should AMD’s hardware prove palatable to these reluctant pilgrims – should its chips run AI models with only minor heresies against speed – the stage is set for a transfer of wealth disguised as a procurement decision. The dividend hunter sees this: not in the flash of quarterly earnings, but in the slow fermentation of market share turning to cash, cash to compounding, compounding to yield.

The Oracle’s Numbers

Both titans prophesy a Promethean future. Nvidia claims the data centers of 2030 will burn $3-4 trillion in offerings to the cloud gods, while AMD’s vision is narrower but no less hungry – a $1 trillion altar dedicated solely to compute. These are not numbers; they are incantations.

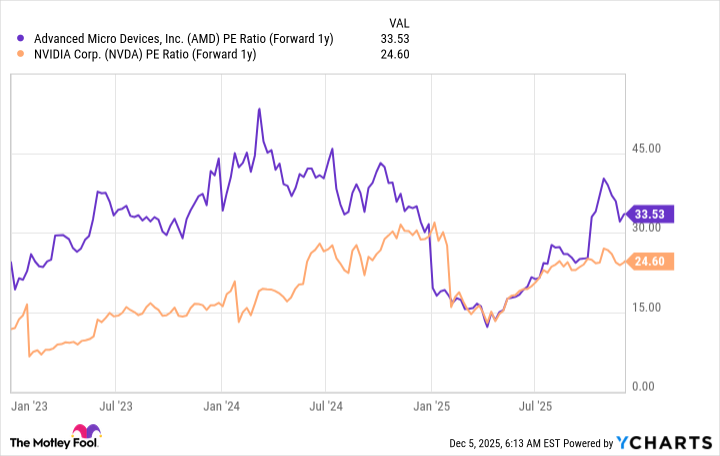

AMD promises 60% annual growth as if swearing eternal devotion, while Nvidia – trading at 25x earnings like a stock market Ulysses – sails closer to the sirens of expectation. The dividend hunter, ever skeptical of parades, watches the margins: Nvidia’s profits swell like monsoons, but AMD’s discipline whispers of dry seasons survived.

So which to choose for 2026? The safer bet swims in Nvidia’s moat, where CUDA’s spells and fat margins create a fortress. But should AMD’s quiet revolution bear fruit – should ROCm become the lingua franca of frugal AI – its shares might bloom like desert flowers after a rare rain. Both paths lead to compounding; one simply carries more thunder in its arithmetic.

As the data centers hum their eternal hymn, the dividend hunter closes his ledger. He knows time favors neither the swift nor the thrifty, but the patient who understands that all empires – digital or divine – eventually yield to the quiet mathematics of reinvested hope. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2025-12-11 23:52