Tom Lee says the future of finance is being built on Ethereum, and he’s betting big that tokenization-not nostalgia for four-year bitcoin cycles-will drive the next decade of digital-asset growth.

Fundstrat’s Founder and Bitmine Boss Tom Lee Makes the Case for an Ethereum-Powered Future

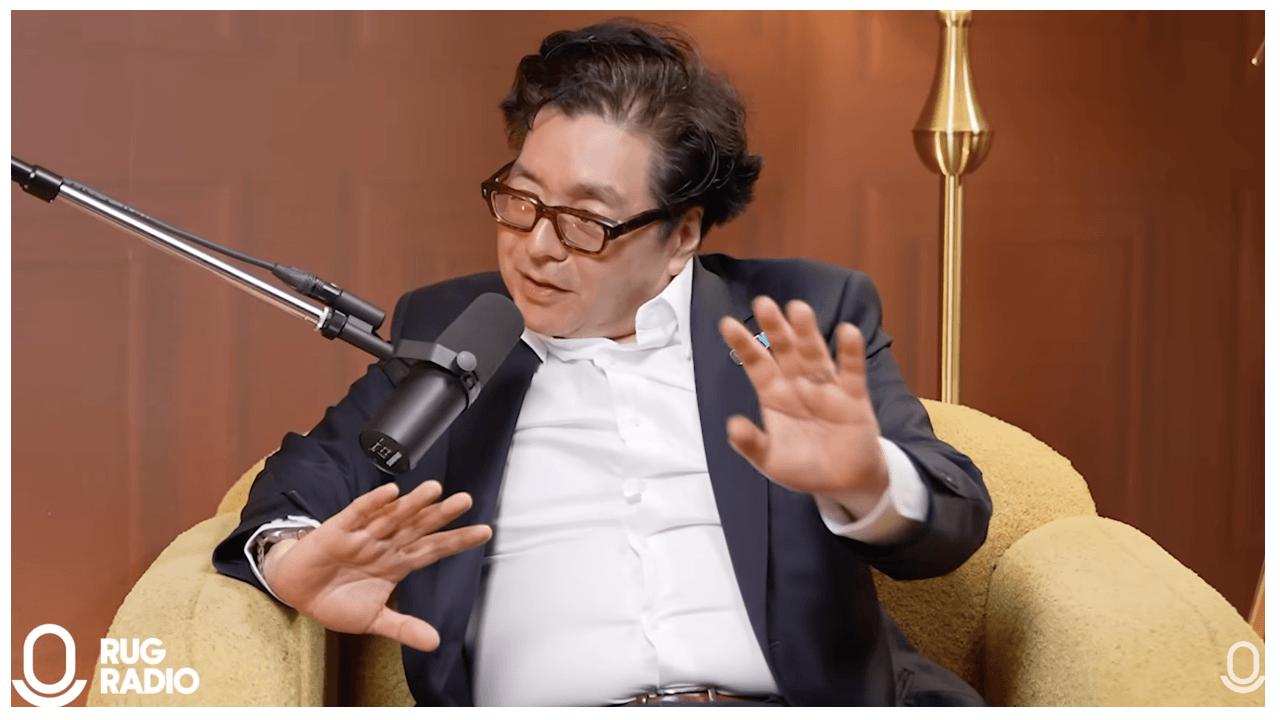

Tom Lee, the Wall Street strategist turned crypto evangelist who wears many hats at Fundstrat and Bitmine, joined Farokh Sarmad on Rug Radio for a candid chat about everything from early stock tips to Ethereum’s eventual dominance of the global economy. Spoiler alert: it’s all about tokenization.

The conversation covered the 1990s telecom upheaval, the early glory days of stock picking, and why Ethereum ( ETH) is poised to become the financial system’s anchor. Lee reminisced about his Wall Street days, where his ability to spot misunderstood technologies was almost legendary (even though he would’ve preferred a superhero cape).

Lee recounted a memorable story about a 27-cent stock that later surged to $21. Remember, kids-27 cents. Who knew? His thesis today is that big technological shifts always start at the edges, mature slowly, and eventually rewrite entire systems. And in Lee’s view, crypto is exactly at that edge, ready to break into the mainstream, despite some old-timers feeling “bored” by it.

Lee told Farokh that the issue isn’t the technology-it’s the industry’s original participants getting old and tired. But the next wave of global users is coming, ready to discover digital assets for the first time. And Ethereum’s role? Well, it’s the structural foundation of the new financial world. Wall Street is already on board, with investors no longer seeing stablecoins as novelties, but as actual infrastructure.

“They’re not building on some shiny new experimental chain,” Lee pointed out. No, they’re choosing Ethereum, the reliable, been-around-for-a-decade chain that isn’t just a fad. Even as new chains innovate, Lee believes Ethereum’s network effects and uptime make it the institutional go-to. Tokenizing dollars was just the first step. Next, we’re tokenizing everything from equities to intellectual property. Welcome to the future, where markets aren’t just measured in trillions-they’re measured in… quadrillions. Let that sink in.

In Lee’s mind, Ethereum is set to become the global settlement layer. A future where ETH hits $3,000 or $5,000 is just the beginning-he’s already eyeing much higher numbers. And for all you crypto doubters who whine about volatility, Lee has a message: “Price swings? That’s opportunity, not dysfunction.” A shrug and a wink, people.

Bitmine, now holding nearly 4% of the total ETH supply, is still accumulating even in market downturns. “It’s easier to buy ETH at $3,000 than at $30,000,” Lee joked. Ah yes, the wisdom of buying low. And if you’re wondering whether Ethereum has hit its bottom this cycle, Lee says it’s already in the rearview mirror. Don’t look back.

“Ethereum at $5,000 or $3,000, it’s still got a $100,000 price in the future.”

Lee isn’t concerned about the rise of Digital Asset Treasuries (DATs), either. While 80 DATs emerged in 2025, only two-Bitmine and Strategy-have meaningful liquidity. The rest? Just noise in the market’s inevitable symphony. Investors tend to flock to the strongest players, not the cheapest.

Lee also insists it’s time to retire the outdated notion of four-year crypto cycles. Bitcoin’s last surge? The “cycle” narrative should officially be abandoned by January 31. No more “wait for the halving” talk, folks.

Looking ahead to 2026, Lee sees a banner year for digital assets. Tokenization, developer momentum, and institutional participation-not nostalgia for cycles gone by-will power the next phase of growth. Ethereum will, of course, anchor it all.

By the end of the interview, Lee’s central theme emerged loud and clear: success is about long-term conviction. Whether you’re talking about 1990s telecom, the early crypto days, or the tokenization era we’re in now, Lee’s message is the same: big transformations seem boring to those who stop paying attention. The next decade won’t be about who got in early-it’ll be about who stayed focused. Now, go grab some popcorn and watch it unfold.

FAQ 🎤

- Why does Tom Lee favor ethereum for long-term growth?

He believes Wall Street’s tokenization wave requires ethereum’s reliability and scale. - How much ethereum does Bitmine hold today?

Bitmine controls close to 4% of the ETH supply and continues accumulating. - Does Tom Lee still believe in four-year crypto cycles?

No, he argues those patterns have broken and expects new highs to confirm it. - What theme does Lee see driving 2026?

He says tokenization and L1 adoption will define next year’s crypto expansion.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2025-12-11 02:55