Investing, that grand and often perilous art, is a game of numbers where the score is written in profit and loss. One might assume that the question “Has such and such stock been good for investors?” would be as simple as counting coins in a dragon’s hoard. Yet even the most arithmetically gifted among us would do well to remember that markets are less a ledger and more a labyrinth. Take, for instance, the tale of DraftKings (DKNG), a company that has turned its shareholders into the proverbial donkey in a chess match: watching helplessly as the pieces are moved by forces beyond their comprehension.

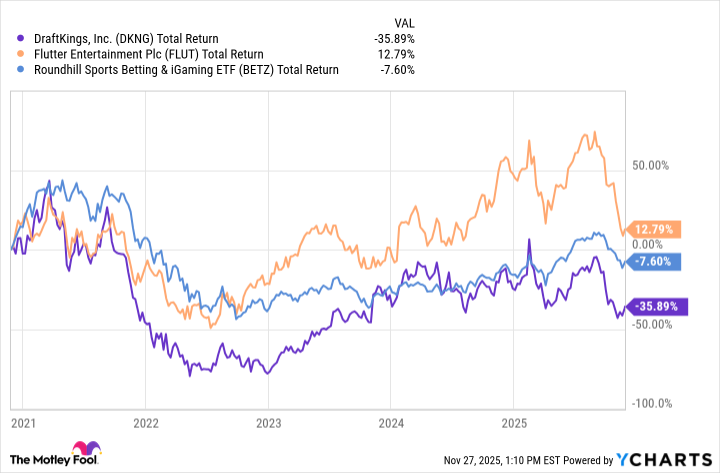

DraftKings, that intrepid purveyor of wagers and whims, has shed 36.95% of its value over the past five years. A figure so bleak it could make a grumpy troll weep into his ale. One might reasonably ask: what manner of folly could reduce a stock to such a state, especially in an industry where the winds of legal change have been blowing in its favor? The answer lies in a curious cocktail of missteps, from the fickle gods of sports betting to the ever-hungry tax collectors of the modern age.

The U.S. sports wagering industry, you see, is a land of milk and honey-or at least milk and sports-themed honey. With 39 states, Puerto Rico, and Washington, D.C. now sanctioning bets, the industry’s revenue has swelled to $13.71 billion in 2024, up from $11.04 billion the year prior. The handle-that is to say, the total amount bet-has ballooned to $172.55 billion, a sum that would make even a dragon pause to count twice.*

Yet here lies the rub: DraftKings has been a masterclass in how not to turn a profit. Its fundamentals resemble a bridge made of sand-flimsy, doomed, and destined to collapse under the weight of expectations. Third-quarter results were particularly grim, with revenue falling short of forecasts and losses widening like a chasm. The company’s guidance for the year? A polite way of saying, “We’re sorry, but we’ve run out of magic coins.”

The NFL, that most sacred of sports arenas, has also played its part in DraftKings’ woes. Bettors, those clever creatures, have enjoyed a string of victories that would make a bard weep with envy. Two straight seasons of profitable wagers have left DraftKings’ bottom line looking more like a deflated balloon than a thriving business. And it’s not just football. The NCAA Tournament, affectionately known as March Madness, saw favorites win 82% of their games. A delightful outcome for fans, but a nightmare for companies whose customers bet on the underdog like it’s a moral obligation.

Then there’s the matter of taxes. States, ever the gluttons for profit, have begun levying heavier duties on sports betting. Illinois, in particular, has taken a sly approach: a graduated tax system that hits the biggest operators-DraftKings and FanDuel-with a hammer. The result? A per-bet tax that escalates like a villain’s monologue in a tragic opera. For every 20 million bets, the fee doubles. It’s as if the state of Illinois has declared war on the very concept of fun.*

Predicting a Rebound

All hope is not lost, however. Prediction markets-a realm where bets are placed on events rather than sports-have emerged as both a curse and a potential savior. DraftKings’ foray into this space, with its own prediction market called “DraftKings Predictions,” is a gamble in the truest sense. Analysts at Macquarie have even forecasted a $5 billion addressable market in the U.S. for the company, a figure that would make even the most jaded investor raise an eyebrow.

If DraftKings can capture even a fraction of this market, it may yet find a way to turn its fortunes around. The company’s ability to expand into states like California and Texas-where the Wagering Plague has yet to take hold-could prove as valuable as a phoenix’s tears. But let us not mistake hope for strategy. The road ahead is paved with uncertainty, and the only guarantee is that the gods of finance will continue to throw curveballs.

* Handle, for the uninitiated, refers to the total amount bet, not the handle on a broomstick or a particularly enthusiastic handshaker.

This phenomenon is sometimes called the “March Madness Paradox,” wherein favorites win so often that it becomes a paradox of its own. Some say it’s the work of a mischievous god who enjoys watching bettors squirm.

* Illinois’ tax scheme is so elaborate it could be mistaken for a riddle posed by a grumpy wizard. The key to solving it lies in a combination of arithmetic and sheer despair.

And so, dear reader, we come to the end of our fable. Whether DraftKings will rise from the ashes like a phoenix or crumble into a pile of charred parchment remains to be seen. One thing is certain: the stock market is a place of wonders and woe, where every bet is a story waiting to be told. 🎲

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 39th Developer Notes: 2.5th Anniversary Update

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Top Actors Of Color Who Were Snubbed At The Oscars

- TON PREDICTION. TON cryptocurrency

2025-12-05 14:18