In the shadow of the relentless march of time, the Eric Trump-backed digital asset treasury (DAT) firm, American Bitcoin, found itself ensnared in a paradoxical embrace-hoarding 4,367 BTC while its stock, ABTC, descended into the abyss of despair. Ah, what a cruel jest this is, where the very coin they cherish becomes the instrument of their ruin! 📉💸

ABTC Snaps up 502 🧠 BTC Over 38 Days

Another bitcoin-focused DAT has topped up its holdings, as the Nasdaq-listed American Bitcoin (ABTC) revealed on social media that its reserves now stand at 4,367 BTC – about $404 million based on exchange rates on Dec. 4, 2025. One might say, “How poetic! While the stock flounders, the coins multiply like a Dostoevskian fever dream.” 🧠💥

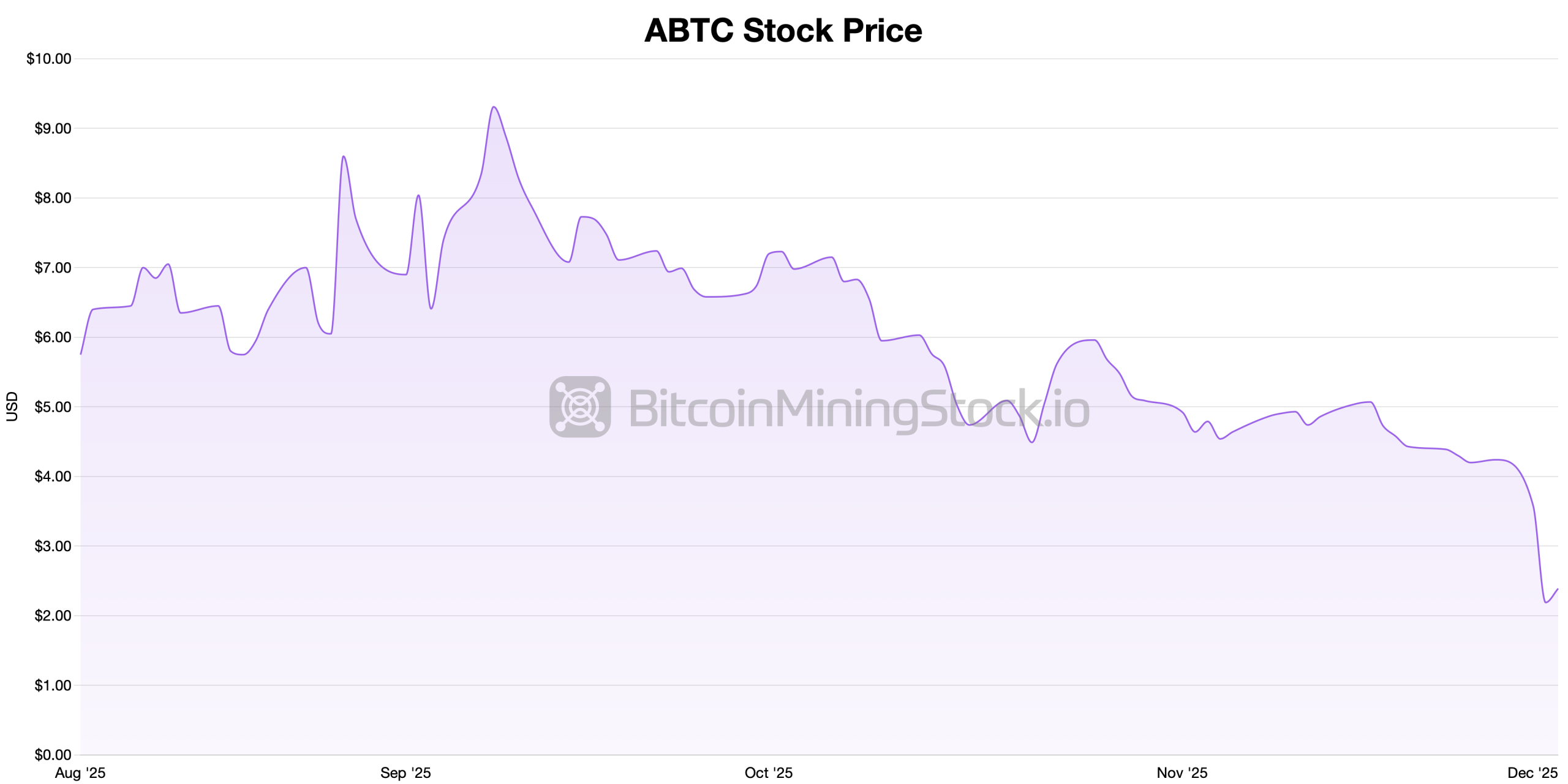

On Oct. 27, ABTC held 3,865 BTC, and across the following 38 days, the firm padded its reserves by 502 BTC. Meanwhile, its stock has been plumbing new lows, shedding more than half its value in the past month. ABTC traded at $4.92 last month, and today it’s going for $2.39 after a small lift during Thursday’s market open. 📈📉

Eric Trump and the ABTC crew appear unfazed by the dip and continue to project confidence. In a press announcement on third-quarter results, ABTC co-founder and chief strategy officer Trump stressed the firm benefits from a leg up compared to standard DATs that don’t mine. “While others paid spot, we generated bitcoin below market through scalable, asset-light mining operations,” he said. One wonders if this is a testament to their genius or a quixotic gamble. 🧠💰

His cheerleading extends to social media as well. On Dec. 2, Trump declared ABTC’s “fundamentals are virtually unmatched.” Gemini co-founder Tyler Winklevoss chimed in with support, writing, “Short-term profit takers make good money, long-term holders make generational money-We’re long-term holders of ABTC.” A noble sentiment, though one might question the sanity of such long-term bets. 🧠📈

ABTC isn’t the only DAT feeling the squeeze of low crypto prices and choppy markets. A hefty portion of DATs are dealing with slumping stocks, trading below mNAV, and carrying heavy debt loads. Only one BTC-DAT has sold bitcoin so far, but critics think more could follow if BTC prices drift lower. The picture is one of a new sector of financial vehicles trying to keep its chin up while the market tests everyone’s patience. 🧠📉

FAQ ❓

- What is American Bitcoin (ABTC)?

American Bitcoin is a Nasdaq-listed digital asset treasury and mining firm backed by Eric Trump. A curious alchemy of ambition and hubris. 🧠💰 - How much bitcoin does ABTC currently hold?

ABTC reports holdings of 4,367 BTC as of Dec. 4, 2025. A treasure, or a curse? Only time will tell. 🧠💰 - Why is ABTC’s stock down?

The company’s shares have dropped more than 50% over the past month amid broader pressure on DAT stocks. A tale of two assets: one climbs, the other plummets. 📉📈 - Are other digital asset treasuries facing similar challenges?

Yes, many DATs are trading below mNAV and carrying heavy debt as crypto prices remain weak. A symphony of despair, played on a volatile instrument. 🎻📉

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- 39th Developer Notes: 2.5th Anniversary Update

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2025-12-04 19:28