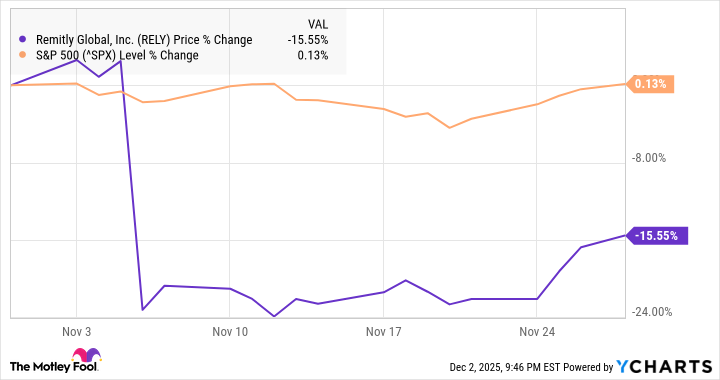

So here we are, peering at Remitly Global’s stock, which dropped 16% in November because the market, in all its infinite wisdom, decided the future is scarier than the past. Darlings and disasters. The company posted solid third-quarter numbers: 8.9 million active customers, $19.5 billion send volume, revenue up 25%-yet the stock hit a 52-week low. Go figure. Money, that fickle beast, loves to chase trouble while ignoring triumph.

The earnings report was overshadowed by a forecast that made investors reach for their panic buttons. Rising credit risk in a wobbly U.S. economy, sigh, because nothing says “buy me” like looming macro problems. The stock danced like a penguin on thin ice-plunging post-earnings before salvaging a few crumbs in November’s dying days.

What’s Ailing Remitly

Remitly’s story is a bold one: disrupting Western Union, strutting into the fintech arena with all the swagger of a startup that thinks money doesn’t matter. But here we are, staring at a stock price that’s more “pathetic” than “perseverance.” Classic market theater: praise the chorus of growth, then boo at the faintest hint of maturity.

Quarterly numbers: check. 21% customer growth, 35% send-volume surge, EBITDA up 29% to $61.2 million. Yet the narrative fixates on the drop in the “take rate”-because obviously that matters more than a GAAP-profit forecast. Remitly’s been busy adding products (stability coins? “Send now, pay later”?) which, to be fair, sounds like the kind of idea you pitch when you’ve drunk too much venture capital. The market, though? Not convinced. Credit risk alarm bells start ringing, and boom-anxiety becomes a self-fulfilling prophecy.

Fourth-quarter guidance? Generic. $426-428 million revenue, below the $430.5 million consensus. Management underpromises so it can barely exceed no one’s expectations. It’s a sad, sad game.

Can Remitly Bounce Back? (Or Is This Just a Rehearsal for My Eulogy?)

Let’s talk valuation. Price-to-sales ratio? Under 2. Expected EBITDA multiple? 12. That’s like finding a $400 Gucci bag at a discount bin-except it smells faintly of regret. Remitly’s predicted to hit GAAP profitability this year, which is a feat in its own right because GAAP standards are about as forgiving as a bad breakup.

But hear me out: this feels like a buying opportunity. The stock’s path doesn’t exactly scream “market darling.” It whispers “misunderstood genius.” The company’s playing the long game-targeting high-value senders, expanding into new products. It’s messy, yes. But isn’t that the price of growth? Especially when the competition is a string of dinosaurs in pinstripes.

So, will the stock’s “discount” price stick? Doubtful. But maybe it’s the last laugh we can afford to take. For now, it’s the kind of stock that makes a value investor say, “Well… I suppose I’m on the bus?” 😊

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

2025-12-03 07:23