Right. So, cryptocurrency. It’s supposed to be the future of finance, but honestly, looking at the charts lately feels a bit like watching a particularly depressing screensaver. A sort of digital tumbleweed rolling across a vast, arid landscape of regret. There’s a distinct lack of… oomph, wouldn’t you say? Volatility seems to be taking a vacation, and liquidity has gone so thin, a stiff breeze could send the whole thing into a tailspin. 📉 A cheerful thought, that.

XRP needs help (Seriously)

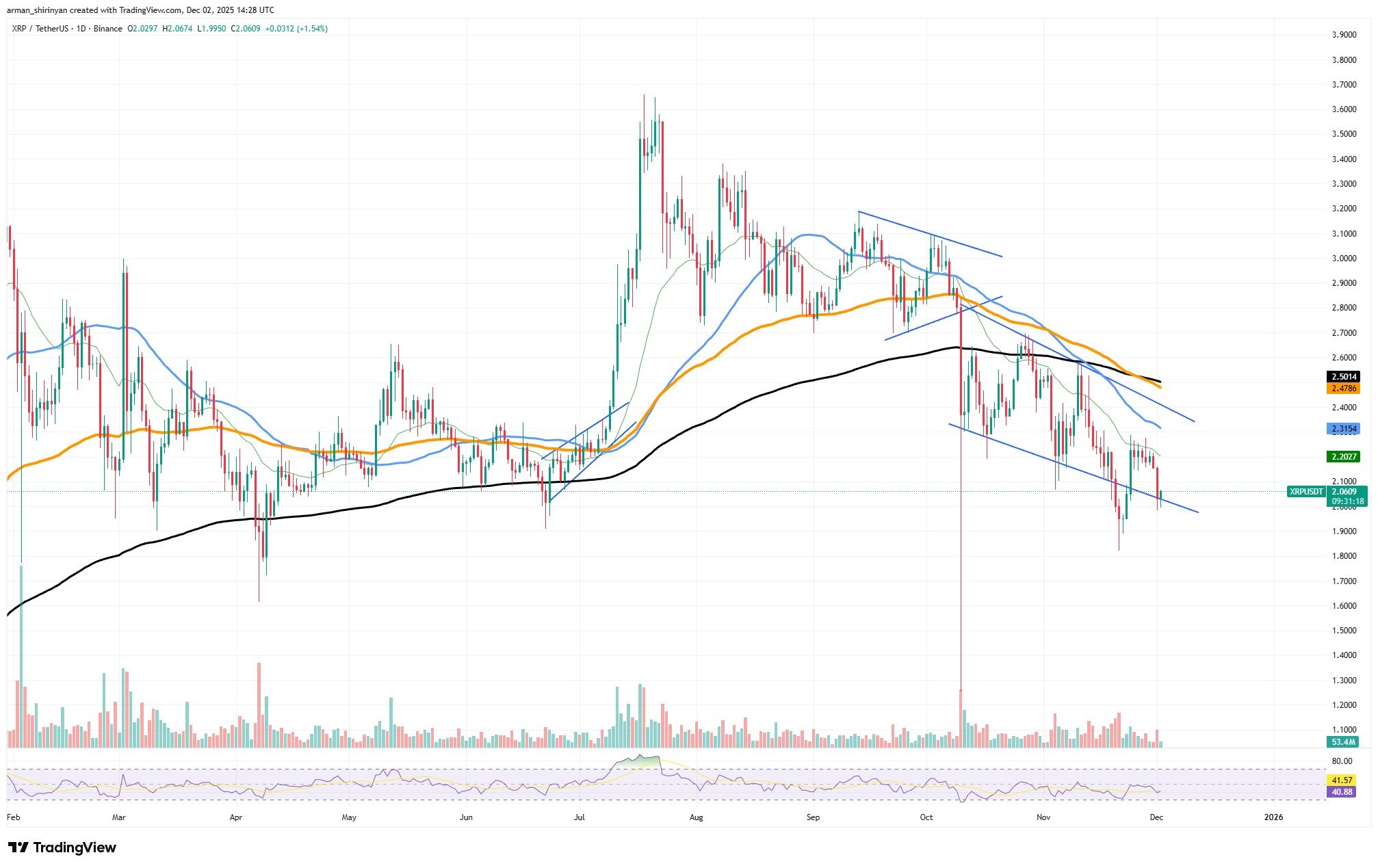

Let’s talk about XRP. It’s clinging to the $2 mark like a desperate limpet on a particularly slippery rock. The charts are telling a story, and it’s not a happy one: lower highs, lower lows, a descending channel so clean you could probably use it to measure things. Any attempt to climb out has been met with a swift and rather dismissive slap-down. It seems the sellers are thoroughly enjoying themselves.

The market isn’t “confused,” it’s just…tired. And a little bit illiquid. And pointed firmly downwards. It’s the way it’s falling, not that it’s falling, that’s unsettling. It’s retreating from those 20- and 50-day EMAs as if they were actually solid objects – which, let’s be honest, they really aren’t. Momentum? Vanished faster than free pizza at a tech conference. And green days? Pathetically undersized compared to the dramatic sell-offs. 🙄

This, my friends, is what we call “classic continuation behavior.” Not a base. Not an accumulation zone. Just…a decline. Losing $2? Well, that logically opens the door to $1.85-$1.90. And if that channel breaks again? Brace yourselves, because we’re talking about a rather unpleasant slide.

The RSI is loitering around mid-40s, which is…neither here nor there. It’s like a shrug from the market. The 200-day EMA is comfortably out of reach, and the 50/100 EMA is acting like a miniature death cross, applying pressure from above. It’s all rather bleak, isn’t it?

Historically, XRP’s rebounds come from spectacular capitulations – frantic sell-offs. Right now? Not even that. We’re just…drifting. So yes, a further decline is not just possible, it’s practically the most sensible outcome, given everything. Unless XRP pulls off some sort of last-minute miracle, don’t expect a joyous turnaround. Buyers are on strike. The chart is reflecting that with brutal honesty.

Bitcoin can recover (Maybe)

Bitcoin’s structure? Messy. Let’s be upfront about that. But not entirely hopeless. It found some buyers in the mid-$80,000s after that mid-November plunge, and a recovery was initiated. Enough to maybe, possibly, briefly nudge towards $90,000. But don’t start planning yacht purchases just yet.

The bounce is classic exhaustion near the local bottom, followed by some increasingly hopeful higher lows. Encouraging! And there’s a gap between the spot price and the 20-day EMA which is, you know, something. Also, in November, the RSI got spectacularly oversold and now it is recovering. The same might be happening now.

However – and there’s always a “however,” isn’t there? – anything above $90,000 is basically a minefield of resistance. The $92,000 to $96,000 range is crammed with the 50-day EMA, previous breakdown zones, and lingering memories of failed attempts. Unless something dramatic shifts in the broader economic climate, it’s going to be a tough nut to crack.

So, reaching $90,000 is plausible. It fits the pattern of an oversold bounce. But expecting a sustained breakout? That, my friends, is a bit optimistic, given the current market mood. Still below the 200-day EMA, still making lower highs, still lacking any serious buying enthusiasm. It’s like watching someone try to push a boulder uphill.

Dogecoin‘s stabilization risks (Don’t Get Your Hopes Up)

Dogecoin is attempting to stabilize. Bless its little heart. But declaring the end of the downtrend would be…optimistic, let’s say. The chart remains trapped within a descending structure, with every rally being sold off almost immediately. This latest move off the $0.13 to $0.14 zone feels less like a shift and more like a temporary pause.

Still below the 20, 50, and 200-day EMAs-a bearish alignment-and they’re all pointing downwards. That doesn’t resolve quickly, and tells you something. The key level to watch is $0.155 to $0.16. If buyers can’t reclaim that, any talk of a reversal is, well, pointless. Breaking it would mean the sellers are losing their grip.

But, and this is a big but, Bitcoin is the bigger fish here. Dogecoin doesn’t exactly have free rein. If Bitcoin keeps stumbling, Dogecoin will stumble too. 🐕🦺 Meme assets and everything else pretty much suffers when Bitcoin is stuck in a rut.

So, is the DOGE downtrend ending? The chart remains stubbornly silent on the matter. Expect more sideways-to-down movement unless Bitcoin stages a real recovery. Without broader market strength, DOGE will likely drift. Any short-term bounces will likely only be…bounces. Liquidity is draining fast and speculative appetite is diminishing (again). Not ideal for a meme coin.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

2025-12-03 03:24