In the grand cosmic lottery of investing, most people win the scratch ticket only to find it’s just a participation trophy (and the ticket was printed on recycled toilet paper). The real trick, of course, is to survive the entire game while pretending you understand the rules. Which brings us to the eternal conundrum: how to invest during a recession without accidentally funding a dystopian overlords’ tax cut. The answer, according to 30 years of market data and a suspiciously cheerful Bloomberg analyst, is to embrace consumer staples. Or, as the universe might call them, “the last things to go before the lights go out.”

Recessions are the economic equivalent of a surprise pop quiz written in hieroglyphs. Everyone scrambles for the exit, clutching their portfolios like talismans. But here’s the twist: some investors have discovered a magical ETF that allegedly outperforms in these scenarios. Whether this is a miracle or a statistical fluke remains to be seen, especially since the universe has a well-documented aversion to consistency.

How to Play Defense (or Pretend You’re Not Losing)

For those with a “long-term horizon” (a euphemism for “hope”), the solution is to diversify into defensive sectors. These are the industries that, in theory, keep humming while the rest of the economy plays musical chairs. Consumer staples, for instance, are the financial world’s version of a warm blanket-except the blanket might catch fire if you stare at it too long.

Consumer staples are the companies that produce the things humans can’t quite bring themselves to stop buying, even when their wallets are as flat as a corporate quarterly report. Toothpaste, food, medicine-these are the modern-day equivalents of cave paintings. According to Bloomberg and iFAST, this sector has historically outperformed during recessions, which is impressive given that the universe seems to specialize in upending expectations. For example, in the 12 months before and after recessions since 1990, consumer staples averaged 14% and 10% returns respectively. One wonders if this is due to the products or the sheer determination of the analysts who compiled the data.

In the 12 months preceding these recessions, consumer staples generated an average return of 14%. During the 12 months following the recession’s onset, the sector generated an average return of 10%.

This ETF Has a 2.71% Yield (And a Lot of Questions)

The Consumer Staples Select Sector SPDR Fund (XLP) is the financial equivalent of a well-worn umbrella-useful in storms, but not exactly a life raft. Launched in 1998, it’s a portfolio so unassuming it could pass for a government budget. Over 31% of the fund is invested in consumer staples distribution and retail stocks, which is like saying a significant portion of your savings is tied to the idea that people will keep buying things. The top five holdings include Walmart, Costco, Procter & Gamble, Coca-Cola, and Philip Morris International. A veritable who’s who of corporations that have mastered the art of selling essentials to a species that forgets how to budget.

- Walmart 11.05%

- Costco Wholesale 9.33%

- Procter & Gamble 8.18%

- Coca-Cola 6.62%

- Philip Morris International 5.77%

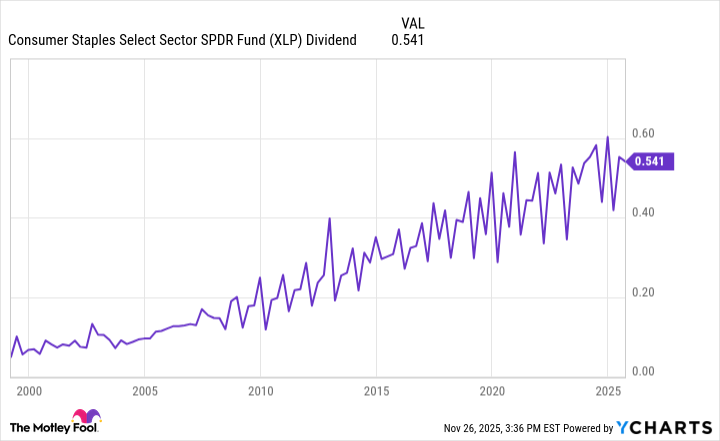

While the fund’s 2.71% yield sounds comforting, it’s worth noting that this is roughly the same return as a savings account if inflation were a benevolent deity. The fund’s 25-year dividend track record is commendable, but one must ask: is this a sign of resilience or simply a lack of ambition? After all, the universe is known for its indifference to human aspirations.

Allocating capital to consumer staples is akin to building a sandcastle in a desert-possible, but not particularly practical. If you’re worried about the “frothy” market (a term that sounds suspiciously like a cocktail garnish), XLP might offer a modicum of comfort. However, relying solely on defensive sectors is like wearing a raincoat during a hurricane-eventually, the water finds you. As for the S&P 500’s concentration in AI stocks, one might argue it’s less a portfolio and more a group of investors holding hands and staring at a spreadsheet.

In conclusion, the art of investing is less about strategy and more about convincing yourself that chaos has a plan. Allocate some capital to XLP if you must, but remember: the universe is watching, and it’s laughing. 🤷

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2025-12-02 14:13