The tech sector, with its peculiar alchemy of innovation and hubris, has long since left the rest of the market trailing in its wake. What began as a modest flirtation with software has metastasized into an obsession with artificial intelligence-a realm where the line between genius and madness is thinner than a trader’s margin call.

The so-called “Magnificent Seven” now dominate the S&P 500 like a cabal of overambitious aristocrats, their collective earnings and performance a testament to the peculiar logic of modern capitalism. One might say they have seized the reins of the benchmark with the same ruthless efficiency they apply to their quarterly reports.

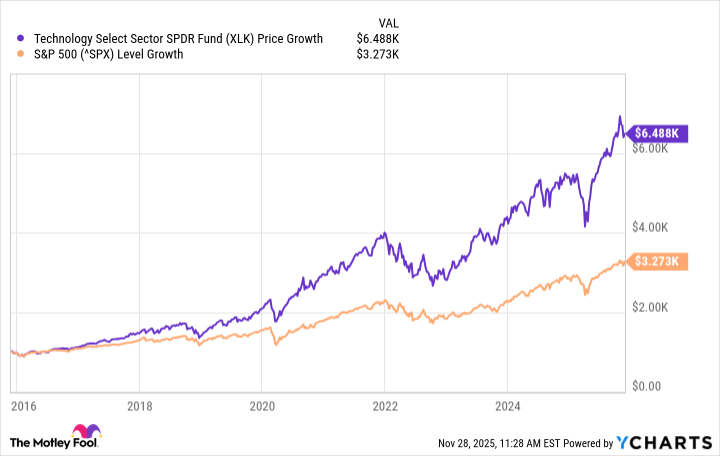

Chip manufacturers and data processors, those modern-day alchemists, have seen their shares ascend with the fervor of a cult. Valuations, that fickle specter, have grown increasingly precarious, yet the faithful persist, convinced that the upward trajectory is both eternal and divinely ordained. A $1,000 investment in the Technology Select Sector SPDR Fund (XLK +0.86%) a decade ago would now command a sum that might make even the most stoic investor pause-and wonder if they’ve been living in a parallel universe.

A Triumph of Tech Over Tradition

The XLK, that paragon of technological prowess, holds court with the likes of Nvidia, Apple, Microsoft, and Broadcom-companies whose stock prices dance to the whims of a market both fickle and feverish. It has outperformed the S&P 500 with the ruthless precision of a well-oiled machine, leaving the broader index to ponder its own irrelevance.

An investor who placed their faith in the S&P 500 a decade past would now tally a tidy $3,270, a 227% return that, while respectable, pales beside the XLK’s 545% leap to $6,500. One might conclude that the future belongs to those who gamble on the next big thing-or at least the next big ticker symbol.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2025-12-01 16:22