The idea of a small-cap ETF doubling in five years reads like a capitalist parable-polished and optimistic, yet tinged with the dust of unmet promises. For decades, smaller stocks have been the forgotten stepchildren of Wall Street, their potential buried beneath the glitter of megacap empires. Yet here, in the Avantis U.S. Small Cap Value ETF, lies a flicker of hope for those who dare to look beyond the crowd.

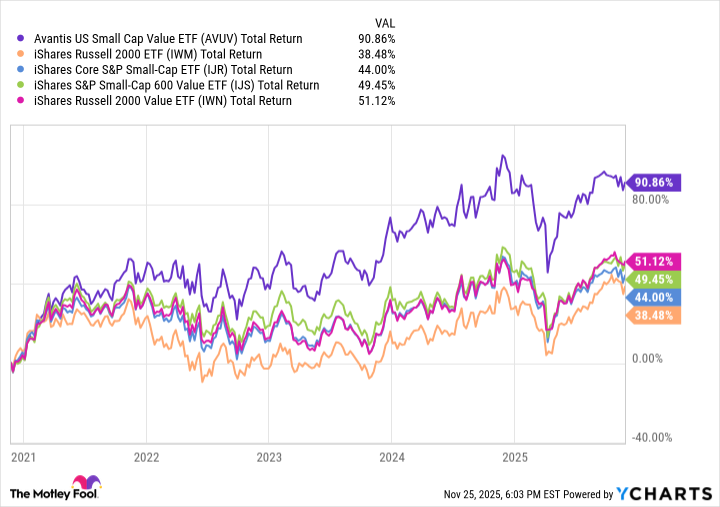

The Russell 2000 and S&P SmallCap 600 indexes, once the beating hearts of speculative fervor, have grown complacent. Over five years, they’ve coughed up paltry returns-38% and 44%, respectively-while value-oriented small-cap funds withered into obscurity. Investors, seduced by the siren song of AI-driven giants, have left the underdogs to gnaw on scraps. But in this bleak landscape, the Avantis ETF (AVUV +0.20%) has clawed its way to prominence, a testament to the quiet resilience of those who refuse to surrender to the tide.

With $19 billion in assets, Avantis is no longer a whisper in the market’s ear. At six years old, it stands as the sixth-largest small-cap ETF, a titan forged in the fires of active management. Its five-year outperformance of broader peers is not mere luck-it is the result of a philosophy rooted in pragmatism: seek stocks with profitability ratios that hum like a well-tuned engine, and shun the hollow shells of value traps. This is not the poetry of speculation; it is the gristle of survival.

While the market dances to the rhythm of AI euphoria, Avantis moves to a different beat. Its focus on return on equity and profitability is a quiet rebellion against the chaos of fleeting trends. Here, the fund’s managers are not wizards-they are the unsung laborers of capital, sifting through the rubble of neglected companies to unearth those with the grit to endure.

Stars May Be Aligning for This ETF

The past five years have been a trial by fire for small-cap value. Yet, the stars-dim as they may seem-are beginning to shift. A rotation into this asset class could ignite a renaissance, driven by a weary economy and the cyclical hunger for undervalued gems. If the U.S. emerges from its doldrums, history whispers that small caps will lead the charge, their agility a stark contrast to the lumbering giants that dominate headlines.

Moreover, the pendulum of market sentiment has swung too far toward growth. Small-cap value, long in the shadow of its more flamboyant cousin, now stands at the edge of a reversal. This is not a gamble for the faint-hearted; it is a wager on the inevitability of balance-a principle as old as the markets themselves.

Should these forces converge, the 100% gains by 2030 forecast may not be a stretch. It would be a triumph of the underdog, a reminder that even in a world of algorithms and hype, the quiet persistence of value can carve its own destiny. For the investor who sees beyond the noise, Avantis is more than an ETF-it is a mirror held up to the soul of capitalism, warts and all.

🌟

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2025-12-01 14:38