Ethereum, that paragon of digital virtue, finds itself once more in the throes of a fiscal quandary, as its price, in a fit of pique, has slipped beneath the sacred threshold of $3,000, leaving the altcoin in a state of existential confusion. 🧠💸

Yet, this descent has not instilled the expected dread among investors, who, in a display of misplaced optimism, have begun to hoard ETH with the fervor of a religious sect, convinced that the short-term price will stabilize like a well-timed joke. 🤯

Ethereum Holders Buy Heavily

The balance of Ethereum held on exchanges has experienced a dramatic decline this week, as if the digital coins were fleeing a spectral menace. ETH supply on trading platforms fell from 2.77 million ETH to 1.41 million ETH – a staggering 136 million ETH drop. At current prices, this represents nearly $4 billion in buying. 🧙♂️

Such a mass exodus reflects the confidence of investors, who, rather than panic, have chosen to accumulate with the diligence of a miser counting pennies. Exchange outflows, typically a harbinger of doom, here appear more akin to a well-orchestrated heist. 🕵️♂️

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📧

Macroeconomic momentum has weakened further, with a major technical indicator flashing red. Ethereum’s exponential moving averages formed a Death Cross this week – its first in more than nine months. This crossover ends the Golden Cross structure that began in July, which had supported Ethereum’s strength during the summer rally. 🩸

Historically, a Death Cross on Ethereum has paved the way for short-term consolidation or minor relief rallies, followed by renewed declines. This pattern increases the probability that ETH may trade sideways before encountering additional downward pressure. 🧨

ETH Price May See Volatility

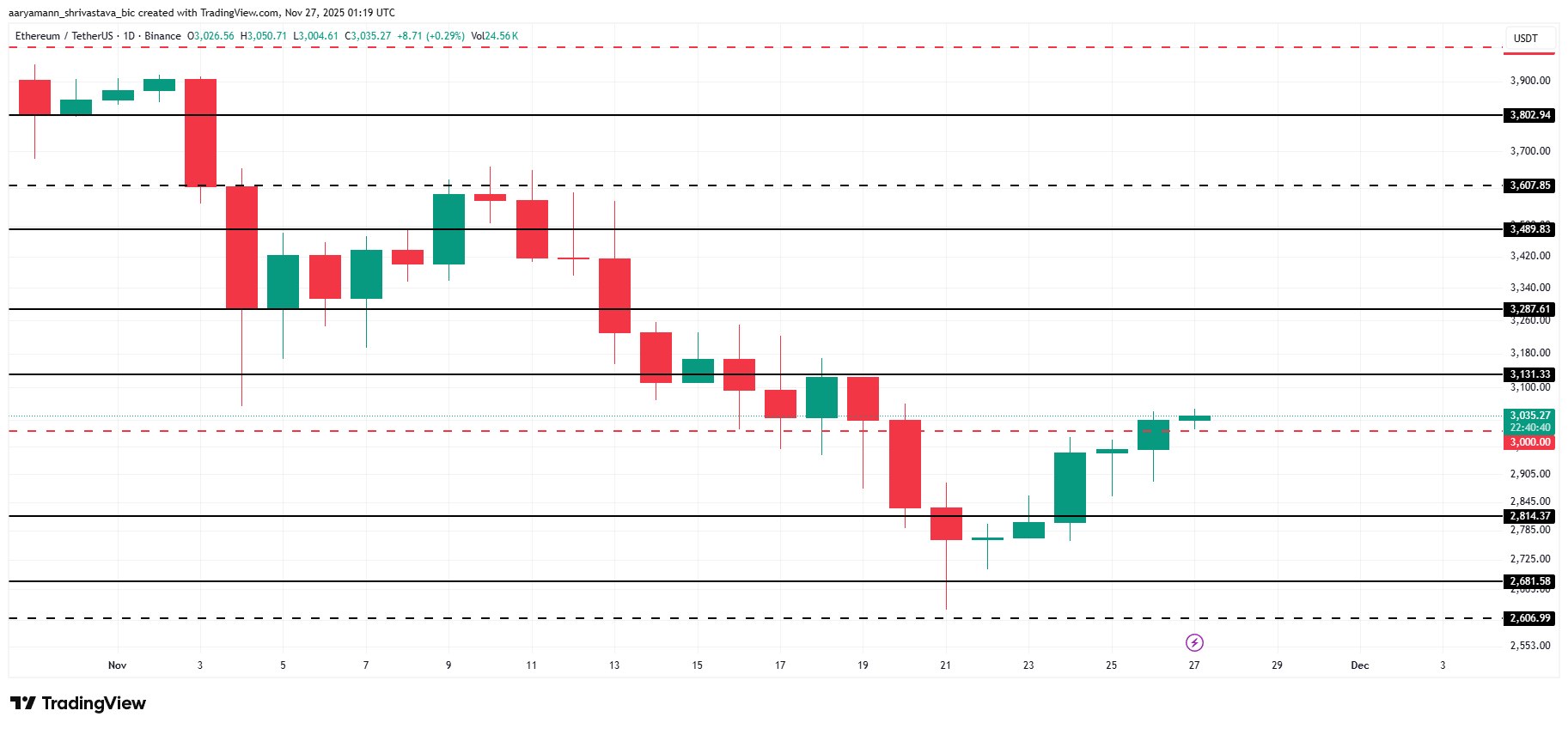

Ethereum is currently priced at $3,035, attempting to flip the crucial $3,000 resistance level. Losing this psychological threshold triggered the wave of $4 billion in buying as investors consider this to be a bottom for ETH and are accumulating to capitalize on the eventual gains. 📈

If broader conditions stabilize, ETH could regain bullish momentum. A decisive reclaim of $3,000 would open the path toward $3,131 and potentially $3,287. This would help Ethereum continue its recovery and rebuild confidence among holders. 🧭

On the other hand, if the market conditions worsen, ETH will likely consolidate under $3,000 and attempt to hold above support at $2,814 or $2,681. If market conditions worsen or investors continue to sell, Ethereum could break below $2,681 and slide toward $2,606 or lower, invalidating the bullish thesis. 📉

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-11-27 04:37