Well, I say, old bean, what a dashed peculiar start to the week! While Bitcoin ETFs were busy tripping over their own digital feet, Ether ETFs staged a jolly recovery, and Solana products? Oh, they’re positively strutting like a peacock at a garden party. 🦚 A sharp divergence, indeed, and not a cricket match in sight!

Bitcoin ETFs Take a Tumble: $151 Million Down the Drain, Egad! 😱

The market, my dear fellow, opened with a narrative as familiar as Jeeves’s impeccable manners: uncertainty swirling around Bitcoin ETFs, renewed optimism lifting Ether, and Solana riding a wave of demand so strong it could carry a chap across the Atlantic. 🌊 Each asset class played its part with the clarity of a Wodehouse plot-though one suspects even Bertie Wooster could’ve seen this coming.

After a brief reprieve on Friday (a mere blip, like Aunt Agatha’s approval of one’s latest scheme), Bitcoin ETFs fell back into outflows on Monday, Nov. 24, with a $151.08 million retreat. Blackrock’s IBIT, the old scoundrel, posted a whopping $149.13 million exit, effectively dictating the market’s direction like a domineering uncle at a family dinner. 🍷

ARK & 21Shares’ ARKB shed $11.65 million, and Bitwise’s BITB slipped by $5.79 million-poor chaps, left holding the digital bag. Fidelity’s FBTC brought in $15.49 million, but it was like trying to bail out the Titanic with a teacup. ☕ Trading activity remained robust at $5.44 billion, while net assets dropped to $116.20 billion, reflecting the renewed outflow pressure. What ho, indeed!

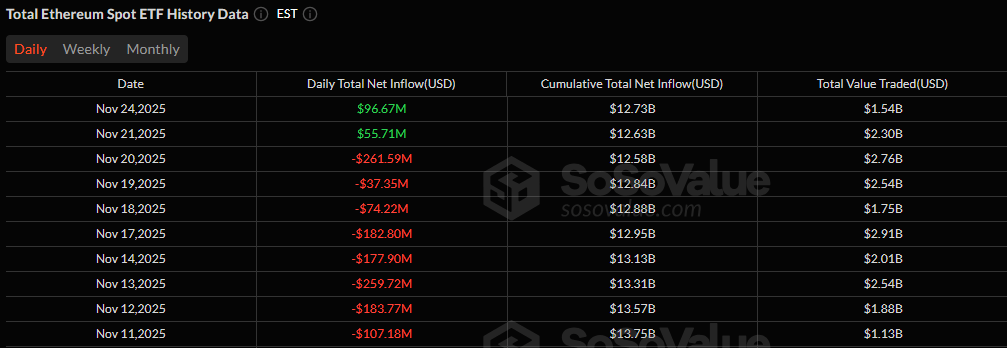

Ah, Ether ETFs! A sharp recovery from last week’s weakness, delivering a solid $96.99 million net inflow. Blackrock’s ETHA brought in a commanding $92.61 million, lifting sentiment like a well-timed quip at a dull party. Grayscale’s Ether Mini Trust added $9.81 million, and 21Shares’ TETH chipped in $742,320. Bitwise’s ETHW and Fidelity’s FETH tried to rain on the parade with modest outflows, but they were about as effective as a wet firework. 🎆

Solana ETFs, meanwhile, delivered another corker of a day, securing $57.99 million in inflows and extending their multi-week streak of green. Bitwise’s BSOL led the charge with $39.47 million, while Fidelity’s FSOL, Grayscale’s GSOL, and Vaneck’s VSOL followed suit. 21Shares’ TSOL rounded out the group with a steady $970,540 inflow. Net assets surged to $843.81 million-another milestone for the plucky Solana ETF segment. 🏆

Bohdan Opryshko, co-founder and COO of Everstake, chimed in with a spot of wisdom: Institutional and retail segments are treating Solana as a yield-generating asset rather than a speculative trade.

Quite the endorsement, what? 🧐

Staking yield, old sport, has become the primary driver of allocation. Who knew Solana could be the Jeeves to the market’s Bertie Wooster? 🤵

As the week begins, the contrast is as unmistakable as Gussie Fink-Nottle’s obsession with newts: Bitcoin stumbles, Ether rebounds, and Solana continues to shine. What a show, eh? 🎭

FAQ📊

- Why did Bitcoin ETFs start the week with losses?

Bitcoin ETFs saw a $151 million outflow, largely thanks to Blackrock’s IBIT behaving like a chap who’s lost his wallet at the club. 🧳 - What fueled the strong rebound in Ether ETFs?

Ether ETFs surged with nearly $97 million in inflows, led by Blackrock’s ETHA-the life and soul of the party, one might say. 🎈 - Why are Solana ETFs continuing to climb?

Solana ETFs extended their streak with $58 million, highlighting investor confidence as solid as a Wooster family fortune. 💼 - What does this divergence mean for the market?

The split in flows shows investors rotating away from Bitcoin toward faster-growing assets like Ether and Solana. A bit like swapping a horse and cart for a Rolls-Royce, eh? 🚗

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-11-25 18:28