It is with the utmost shock that the crypto world was rocked in November, as Bitcoin‘s price tumbled by 20%, leaving in its wake a staggering loss of over $1 trillion. Having soared to an unparalleled height above $125,000 in the month prior, the price descended sharply to around $81,000, before making a slight recovery to $87,236. A most dramatic turn of events, indeed.

Now, many a curious trader, much like a nervous debutante at her first ball, wonders: “Has Bitcoin at long last found its floor?” The reputable CryptoQuant, well known in these circles, has put forth an opinion-though whether it shall prove true remains to be seen.

The Whales Took Their Leave, and Bitcoin Was Left to Fend for Itself

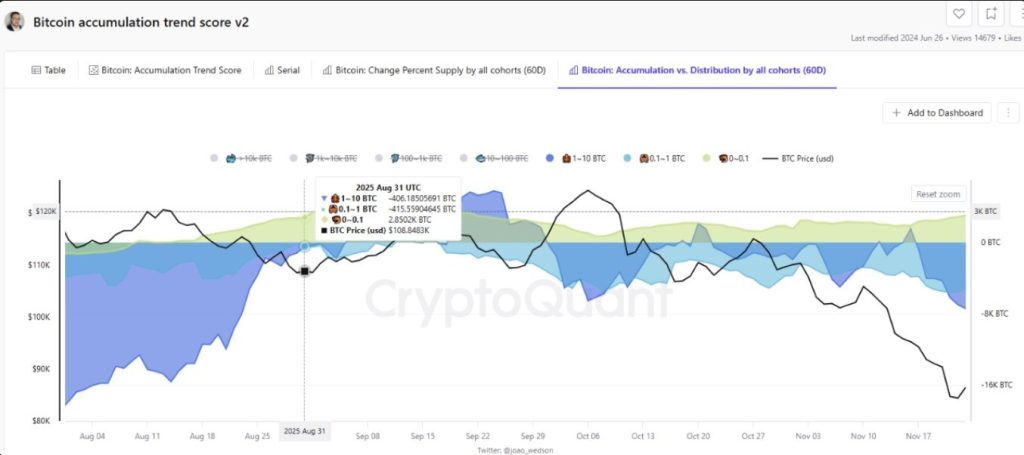

According to CryptoQuant’s analysis, this recent crash was not a mere panic reaction, but rather a curious confluence of whale activity, retail pressure, and a veritable massacre in the futures market. For weeks before the crash, those holding considerable sums-wallets containing 1,000-10,000 BTC-gradually relinquished their holdings, likely smiling all the while at the profits they locked in from Bitcoin’s towering highs.

To add to the spectacle, retail investors, those more modest folk, also chose to part with their holdings during the correction, thereby adding to the downward pressure. It is quite a marvel, really, how even the smaller wallets of under 10 BTC, and those with up to 1,000 BTC, joined in the sell-off, as if they too could not resist the lure of taking profits while the taking was good.

Thus, when both the mighty whales and the humble retail investors took their profits and retreated to safer shores, Bitcoin found itself without the sturdy support it once had. The market was left to its own devices-without the reassuring presence of buyers to keep it afloat. Alas, the poor thing!

The Only Support Came From the Middle-Tier Holders

Amidst this scene of panic and retreat, there were still a few brave souls-those with holdings between 10-100 BTC, and 100-1,000 BTC-who displayed a modicum of fortitude and continued buying through the correction. These mid-sized holders, though valiant, could not halt the descent entirely. For their influence, however steady, was but a whisper compared to the thunderous roar of the whales’ departure.

The Futures Market: A Wild Ride to the Bottom

As CryptoQuant points out, the real catastrophe came from the futures market. Over the course of thirteen days, long positions were obliterated at an alarming rate, causing Bitcoin’s descent from a healthy $106,000 to a rather pitiful $81,000. What might have been a mere correction thus became a full-fledged crash, as forced selling created a most unfortunate chain reaction.

So, Is This the Bottom? Not Quite Yet!

After briefly touching the ominous $81K, Bitcoin, in a most courageous display of life, managed to rebound to $87K within two days. This recovery, though modest, could be the first hopeful sign of a local bottom forming. However, as any sensible person would attest, a true reversal cannot occur until the whales-those with holdings between 1,000-10,000 BTC-cease their selling spree. Until that day, any recovery remains but a fragile hope, one easily dashed by a sudden change in the market’s mood.

In short, while Bitcoin may be nearing a bottom, the next chapter in this tale depends entirely upon the whims and fancies of the whales in the days to come. The suspense is unbearable! 😬

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- TV Shows With International Remakes

- 8 Board Games That We Can’t Wait to Play in 2026

- All the Movies Coming to Paramount+ in January 2026

2025-11-25 15:29