It is a truth universally acknowledged, among those who seek the quiet dignity of income-generating investments, that a dividend-paying stock in possession of a good character must be in want of growth. Yet while many investors fix their attentions solely on the immediate allure of yield-much as a society might judge a suitor by his initial address-few pause to consider the subtler virtues of consistent dividend advancement. It is within this rarefied circle of equities, those that have elevated their payouts with unerring regularity for half a century or more, that one discovers Parker-Hannifin-a name perhaps less celebrated than its peers, yet one whose fidelity to shareholders rivals the most steadfast of literary heroes.

Before unveiling the merits of this particular gentleman of industry, let us first consider the broader class of Dividend Kings. In the grand ballroom of the S&P 500, where many stocks perform their lively quadrilles of fluctuating payouts, only a select few maintain the decorum of unbroken dividend increases for fifty years or more. Among these, Parker-Hannifin distinguishes itself not merely by longevity, but by the quiet excellence of its 69-year streak-a record that places it in the upper echelon of financial propriety.

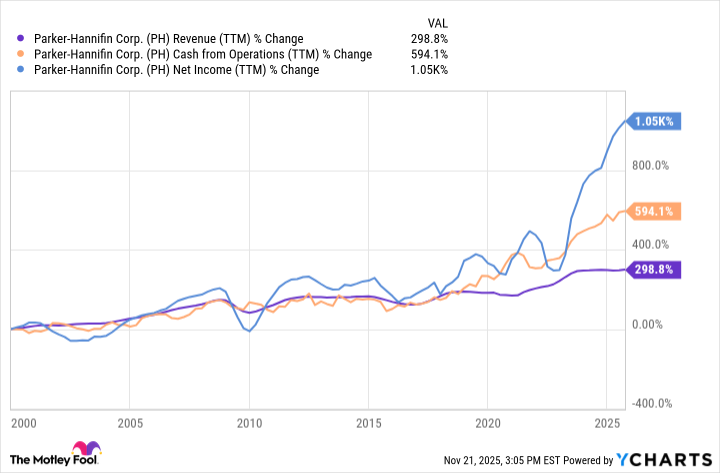

One might reasonably inquire: What advantage does such persistence confer? Consider the following: an investment in Parker-Hannifin at the dawn of the millennium, with dividends reinvested, would today command a return of 3,600%. This surpasses even the most ambitious expectations of its contemporaries, much as Mr. Darcy’s character ultimately outshines the more ostentatious displays of his peers.

An Ode to Compounded Virtue

The tale of Parker-Hannifin is not merely one of dividend increments, but of strategic mastery in the realm of motion and control technologies-a field as vital to modern industry as propriety is to a well-regulated society. With annual sales of $19 billion, the firm’s dominion extends across hydraulics, filtration, and climate control, serving clients in aerospace, defense, and beyond. Its clientele, two-thirds of whom engage with four or more of its offerings, exhibit a loyalty akin to that of well-bred families bound by generations of mutual regard.

Such interwoven commitments ensure a resilience not unlike the bonds of matrimony-tested by time, yet strengthened thereby. The firm’s recent acquisition of Filtration Group, a transaction of £9.25 billion, further entrenches its position in the aftermarket-a sphere of high margins and recurring revenue. One might liken this to a judicious marriage settlement, securing both present comfort and future prosperity.

The Calculations of a Prudent Steward

At the close of its fiscal year in June 2025, Parker-Hannifin’s backlog stood at a record £11 billion, with aerospace orders alone exceeding £7.4 billion. Its cash flow, increased by 12% to £3.8 billion, speaks to a management as attentive to liquidity as Mr. Bingley’s sisters are to the state of their pianoforte. Guidance for fiscal 2026 anticipates 4% to 7% sales growth, with aerospace and defense-accounting for 35% of revenues-poised to grow by nearly 9.5% organically.

Aftermarket: The Jewel in the Crown

Yet it is the aftermarket segment that most captivates the discerning observer. Comprising 51% of fiscal 2025 sales, this division’s high-margin, recurring revenue model resembles the steady income of a well-managed estate. The Filtration Group acquisition, with 85% of its sales derived from aftermarket channels, ensures that Parker-Hannifin’s future shall be as secure as a heroine’s happy union.

A Final Reflection

Some may dismiss Parker-Hannifin’s current yield of less than 1% as wanting in immediate gratification, much as a hasty reader might overlook Elizabeth Bennet’s charms for her lack of immediate fortune. Yet herein lies the subtlety of true worth: a dividend growth rate that, over decades, may transform modest beginnings into a legacy of both income and appreciation. In an age of speculative excess, Parker-Hannifin remains a testament to the virtues of patience, prudence, and the quiet confidence of a well-ordered enterprise. 📈

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-11-24 04:23