Behold the spectacle of stock splits, those grand rituals of the market, where numbers are rearranged like pebbles in a child’s sandbox. Once, such events stirred the masses; now, they merely amuse the idle observer. The modern investor, armed with fractional shares, no longer needs these charades to partake in the game. Yet companies persist in splitting their stocks, as if such arithmetic could somehow democratize access to wealth-a noble pretense, perhaps, but one that masks the deeper truth: the price of a share is but a number, and the soul of a company lies not in its digits but in its deeds.

When a corporation announces a split, the stock price often dances upward, as though the act of division could multiply value. Investors, those creatures of habit and hope, rally to the spectacle, mistaking the rearrangement of shares for a testament of strength. Yet what is this but a mirror held up to human folly? A split does not alter the company’s essence; it merely shuffles the deck of ownership, leaving the house of cards intact. The management, in their declarations of bullish intent, speak with the confidence of orators, yet their words are but echoes of the crowd’s own delusions.

Microsoft, that colossus of the digital age, has not split its stock since 2003. Two decades is a long time to wait for a gesture that means nothing and everything. In the intervening years, the world has changed, and so too has the company. Its stock now trades at a price that would have been inconceivable in its youth, a fact that some might interpret as a sign of impending division. But let us not confuse arithmetic with strategy. Microsoft’s silence on the matter is not a mystery-it is a testament to the company’s unshaken belief in its own grandeur, or perhaps a quiet acknowledgment that the old tools of theater have lost their luster.

A Legacy of Division

In the days of yore, between 1987 and 1999, Microsoft split its stock with the regularity of a clockwork mechanism. Eight times did it divide, each act a small revolution in the annals of corporate finance. These were the days when fractional shares were but a dream, and a low stock price was a lifeline for the common investor. Yet even then, the true value of a company was not measured in the number of shares one could hold, but in the substance of its offerings. The splits were not acts of generosity but of necessity, a means to keep the gates of participation open in an era when wealth was more rigidly stratified.

Today, the need for such gestures is diminished. Fractional shares have democratized access, and international markets, though less accommodating, are not without their own avenues of entry. Yet another force looms: the humble stock option. A contract for 100 shares of Microsoft today would cost $48,000-a sum that even the most enterprising employee might hesitate to accept. A 10-for-1 split would bring this down to $4,800, a price that whispers of possibility rather than impossibility. But is this not just another mask for the company’s own vanity? To reduce the cost of compensation is to lower the barrier to entry, but it is also to acknowledge that the value of one’s labor has been measured in currency, not in contribution.

Whether a split is imminent, I cannot say. The passage of time alone does not dictate such decisions, nor does the whimsy of market enthusiasts. Yet there are more compelling reasons to consider Microsoft’s stock-not as a relic of tradition, but as a participant in the great unfolding drama of the digital age.

A Machine of Growth

In its fiscal 2026 first quarter, Microsoft’s revenue swelled by 18% to $77.7 billion. This is a figure that defies the logic of size, for how can a behemoth of such scale continue to grow with such vigor? The answer lies in the cloud, that nebulous realm where data is both commodity and currency. Here, Microsoft’s cloud computing division saw revenue rise 28% to $30.9 billion, a triumph fueled by the artificial intelligence boom. The world, it seems, is eager to outsource its technological ambitions to providers who can shoulder the burden of infrastructure. Yet one must ask: is this progress, or merely the outsourcing of our own inadequacies? The cloud, for all its promise, is but a mirror of our collective reliance on convenience over competence.

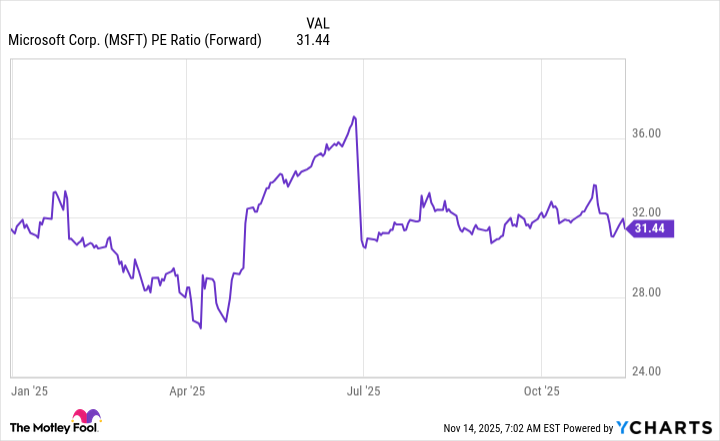

Operating income, that most vaunted of metrics, rose even faster than revenue-by 24% year over year. Efficiency, they call it. But efficiency in what? In the art of extracting value from an ever more dependent world? Microsoft’s management speaks of growth as though it were a natural law, yet the company’s stock trades at 31 times forward earnings, a multiple that suggests both optimism and hubris. The market, in its infinite wisdom, has priced in a future of perpetual expansion, but what happens when the tide turns? When the AI fever wanes and the clouds recede, will Microsoft’s fortress remain unshaken, or will it crumble beneath the weight of its own expectations?

There is risk, of course. A sell-off looms on the horizon, should the market’s appetite for AI-related investments wane. But Microsoft, with its vast resources and storied leadership, may yet weather the storm. The company is a marvel of modern industry, but it is not infallible. To invest in it is to wager on the continued relevance of its vision, and on the enduring faith of those who have placed their trust in its hands. Whether this faith is justified, only time will tell. Until then, we observe, we question, and we wait. 🤔

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Sega Dreamcast’s Best 8 Games Ranked

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Ethereum’s Affair With Binance Blossoms: A $960M Romance? 🤑❓

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

2025-11-22 22:33