Markets: The Circus of the Digital Gold Rush 🎪

What you really need to know (or wish you didn’t):

- Bitcoin is having what we might politely call a “moment.” A big, steaming break in momentum, with onchain indicators flashing signals that send shivers down the spine-think crashes, not dances. 💃🚫

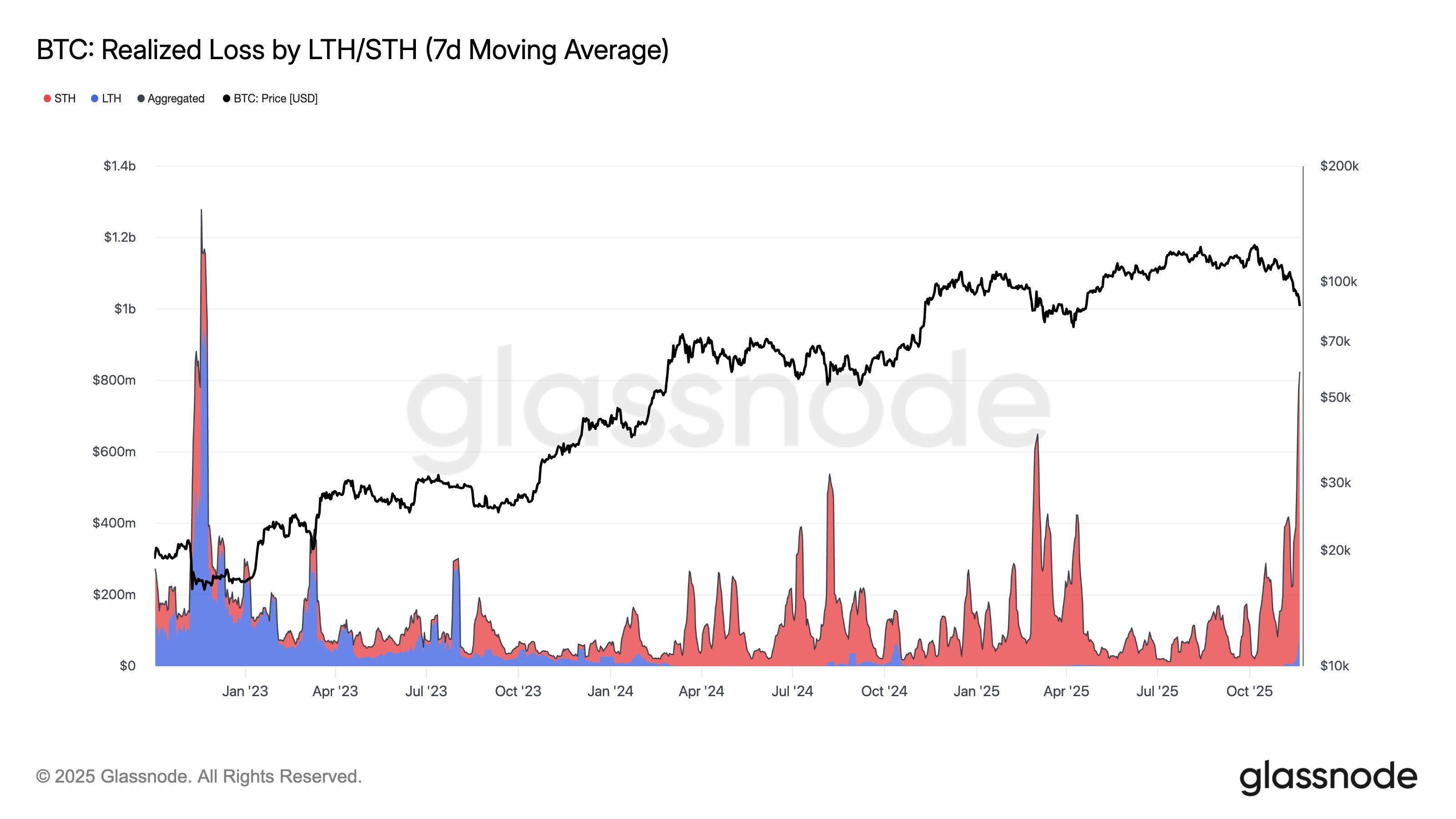

- Realized losses? Oh, they have surged like a bad joke that keeps repeating. Driven mainly by short-term holders-those brave souls who bought dip after dip-now running for cover as Bitcoin dips below its 200-day moving average, probably whispering, “Not again.” 😅

- The market, in its usual flair for drama, is edging closer to levels historically linked to short-term bottoms-like a climber inching toward the edge of a cliff-but beware, the volatility monster might just be warming up for its encore.

Bitcoin displays one of its most dramatic tantrums of the cycle, with onchain indicators sounding alarms reminiscent of the industry’s most glorious wipeouts-grab your popcorn. 🍿

Glassnode whispers that realized losses hit levels last seen in the November 2022 FTX fiasco-a moment that will be remembered, mainly because everyone lost sleep over it. This time, it’s almost all short-term holders running for their digital lives, unwinding faster than a cheap sweater.

The scale of this week’s panic is one for the history books-dollar amounts flashing in the billions daily, a spectacle that makes even the most hardened trader think, “Well, this is new.” 💰🙃

Market structure? Oh, it’s doing its best impression of a rollercoaster-trading three and a half standard deviations below its 200-day average, which is apparently rare enough to warrant a meme.

Only three times in a decade! Once during the 2018 chaos, once during the pandemic panic, and once in June 2022-because apparently, history likes to repeat itself, just with more flair.

btcusd is beyond 3.5 standard deviations from its 200dma

other occasions:

Nov 2018

Mar 2020

Jun 2022– mekhoko (@MEKhoko) November 20, 2025

This week’s antics? Spot selling soaring like a bad drone video, funding rates collapsing faster than dreams of easy money, and reluctant buyers retreating-probably to the nearest bar or virtual casino.

With Bitcoin under more pressure than a soap bubble, and fear gripping the market like a bad horror flick, the low points are seeming almost inevitable-music for the bottom-feeders, perhaps.

But hold onto your hats: without some grand macro event, this volatility isn’t going anywhere, and the rollercoaster is just getting warmed up. 🎢🤑

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- The 35 Most Underrated Actresses Today, Ranked

- AIQ: A Calculated Gamble (That Paid Off)

- Chips & Shadows: A Chronicle of Progress

2025-11-21 17:01