In the dry, sun-baked plains of the cryptocurrency frontier, where fortunes rise and fall like tumbleweeds in a dust storm, a tale of woe unfolds. The on-chain scribes at CryptoQuant have etched a grim saga: the American hordes, those golden-hungry pioneers of the digital age, have been unloading their Bitcoin like a pack of disgruntled coyotes at a barn dance.

The Coinbase Premium Gap: A Red Flag in the Desert

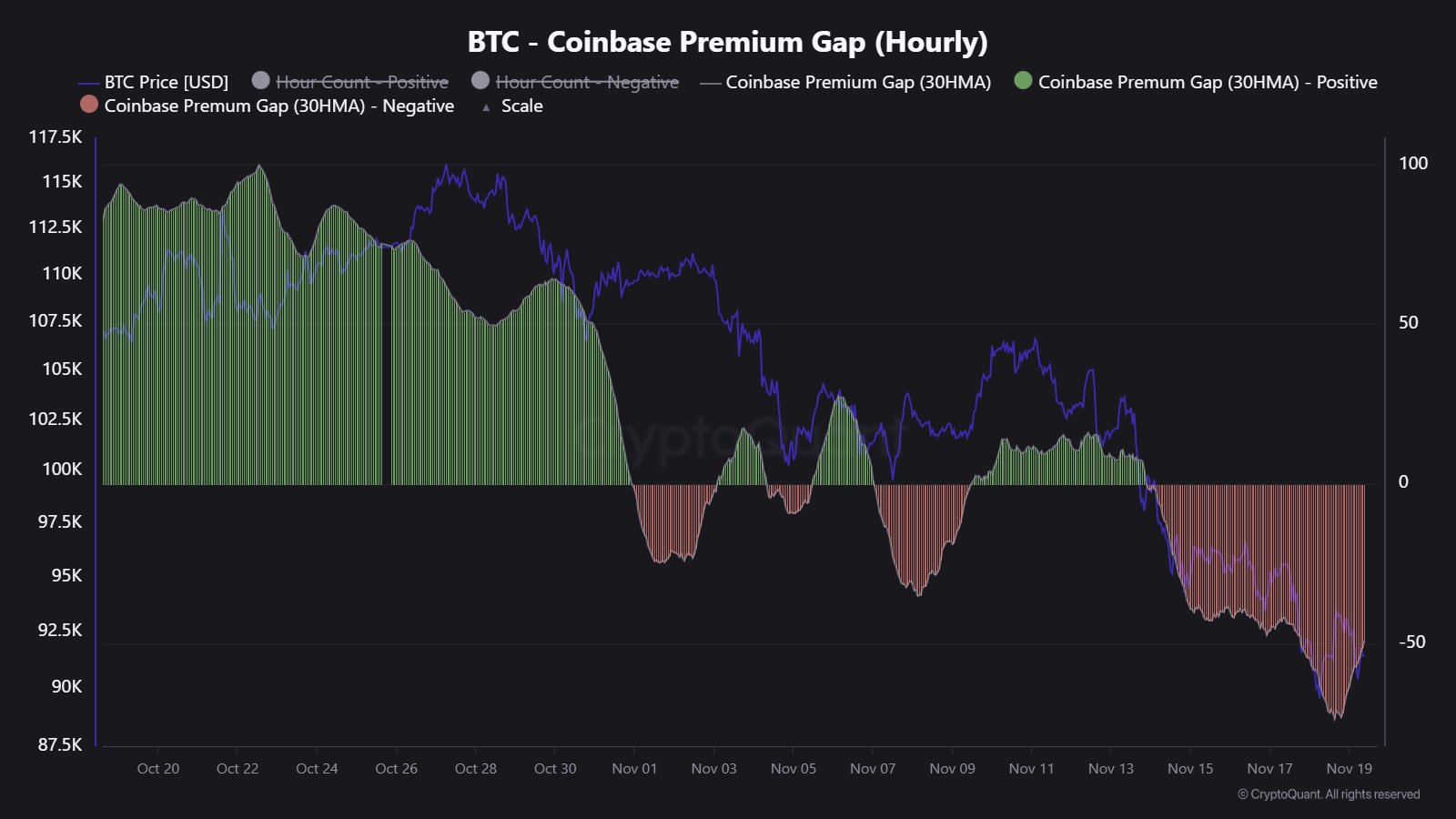

Behold the “Coinbase Premium Gap,” a curious beast that measures the chasm between the price of BTC on Coinbase (the favored watering hole of US investors) and Binance (where the global hoi polloi gather). Lately, this gap has plunged into the crimson depths, a scarlet warning that the American traders are peddling their coins faster than a tumbleweed rolls in a tornado.

“The Premium Gap hit -$90, a sign that US whales are selling their dreams of financial freedom like hotcakes at a family reunion,” quipped the scribes. Meanwhile, the rest of the world sips coffee and watches the show, sipping their espresso with the nonchalance of a cat watching a mouse trap reset.

The charts, those sacred scrolls of the crypto priesthood, reveal a truth as plain as the nose on a miner’s helmet: while Europe and Asia-Pacific trade hours hum along like a well-oiled jalopy, the American session is a howling gale of losses. It’s as if the market itself is screaming, “Y’all better bring sunscreen!”

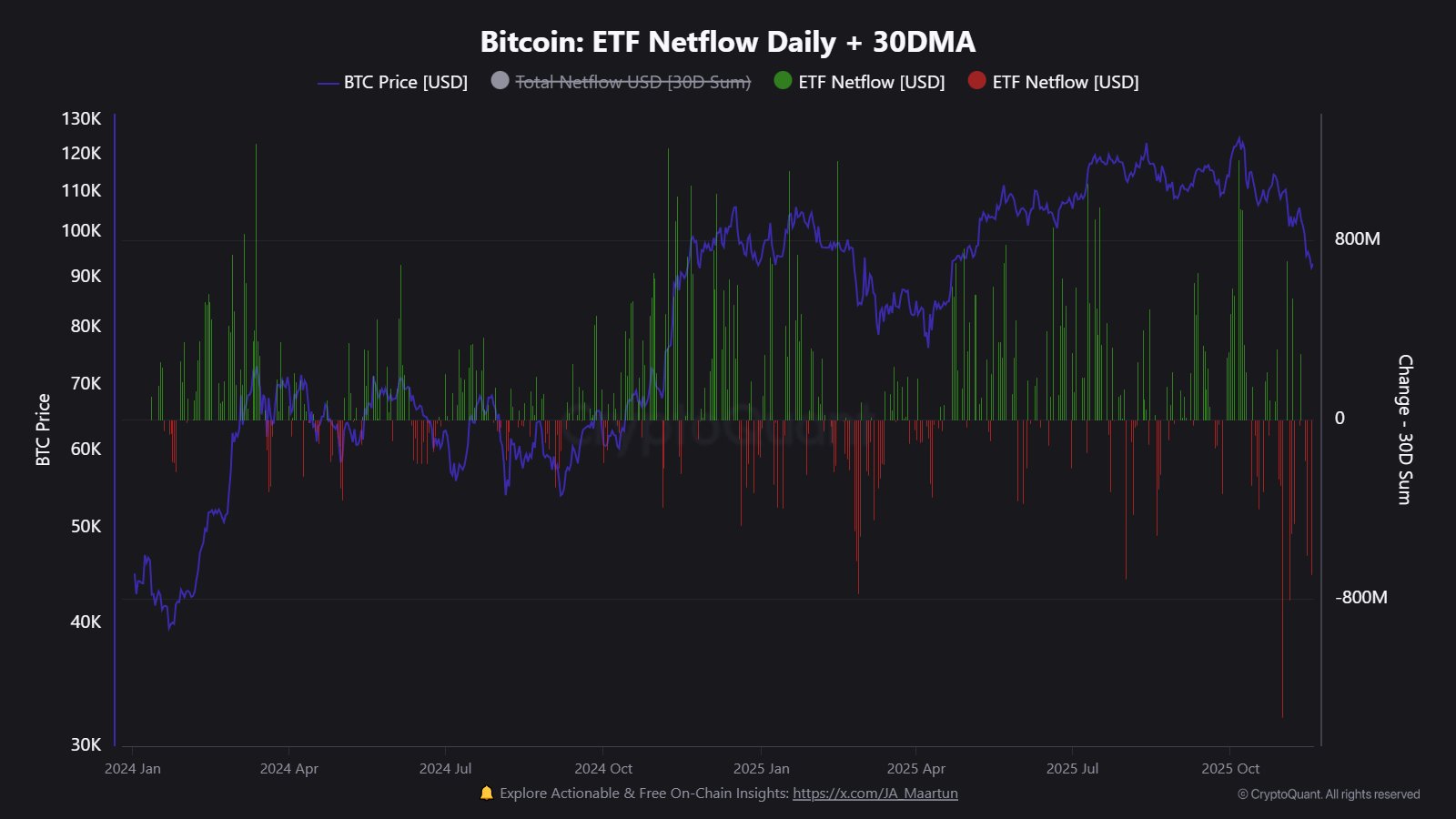

Even the noble spot ETFs, those modern-day gold-plated barns promising safe haven, have seen their flocks flee. For three weeks straight, BTC has been flowing out like water from a leaky canteen. Last year, 194,000 BTC poured in like rain after a drought. This year? A paltry 8,000 BTC exodus. “ETF outflows continue to weigh on the market,” the scribes sigh, as if lamenting the death of a dearly beloved mule.

BTC Price: A Rollercoaster in the Desert

At present, Bitcoin meanders near $92,000, a 10% drop in seven days that would make a seasoned miner weep into his coffee. The cost basis of those ETFs now hovers at $86,566, a line in the sand. Should BTC cross this threshold, the ETFs’ holdings will go “underwater,” a phrase that sounds suspiciously like a bad fishing trip.

And so, the desert winds howl, carrying whispers of uncertainty. Will the BTC caravan find its oasis? Or will the US traders’ exodus turn this digital gold rush into a ghost town? Only time-and perhaps a few more espresso shots-will tell. 🤷♂️💸

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2025-11-21 09:06