In the vast, unforgiving tundra of the financial markets, Bitcoin, once the stalwart colossus of digital currency, has stumbled. Its descent into the mid-$90,000s has ignited a cacophony of debate: are we witnessing the dawn of a bear market, or merely a dramatic interlude in an enduring ascent? The analysts, like soothsayers in a Soviet-era queue, converge on the same battleground levels, yet their interpretations diverge as sharply as a Gulag fence. 🌪️

Has the Bitcoin Bear Market Clawed Its Way In?

Macro swing-trader “The Great Mattsby” (@matthughes13), a man who sees patterns where others see chaos, insists that Bitcoin is merely retracing its steps, like a drunkard on a familiar path. “Back in 2024,” he reminds us, “BTC consolidated for 7 months in the $70k-$50k zone before breaking out.” Ah, the sweet nostalgia of past glories! 🥂

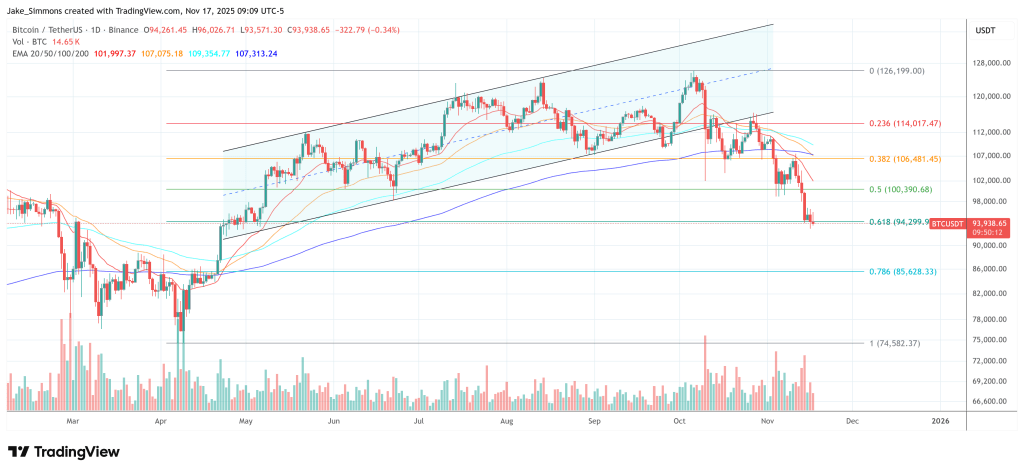

With the precision of a KGB archivist, he employs monthly Fibonacci retracements from the March 2024 high to the November 2022 low. Bitcoin, he notes, once kissed the 0.618 retracement at $51,518, “even wicked below, then bounced.” Now, on a fresh set of fibs drawn from the October 2025 top to the August 2024 low, that same level sits at $96,975. The price, like a reluctant conscript, trades slightly below it, echoing the 2024 wick. 🕷️

With two weeks left in November, Mattsby, ever the optimist, stresses that the close matters more than the intramonth volatility: “If BTC holds this $96-$97k zone for a monthly candle close in November, this could mirror last year’s setup: a couple more months retesting this zone, then a run to new all-time highs would be possible.” Hope, it seems, is the last refuge of the crypto trader. 🌈

But on the weekly timeframe, market analyst Rekt Capital is less sanguine. For him, the 50-week exponential moving average has been the backbone of this cycle’s bullish structure. “Bear Markets confirm when the bullish structures that supported continued bullish momentum start to fail,” he writes, with the gravity of a party apparatchik. His chart shows the current weekly candle pushing decisively below the 50-week EMA, which has previously acted as support. He sees “a high probability the Weekly Candle Closes below the 50-week EMA,” adding that the reaction in the coming weeks will be “macro trend-defining.” 🌋

The key question, in his view: “Can BTC produce enough upside in the coming weeks to invalidate this Weekly Close below the 50 EMA and reclaim the EMA as support?” One can almost hear the drums of uncertainty beating in the distance. 🥁

What Bitcoin On-Chain Data Whispers

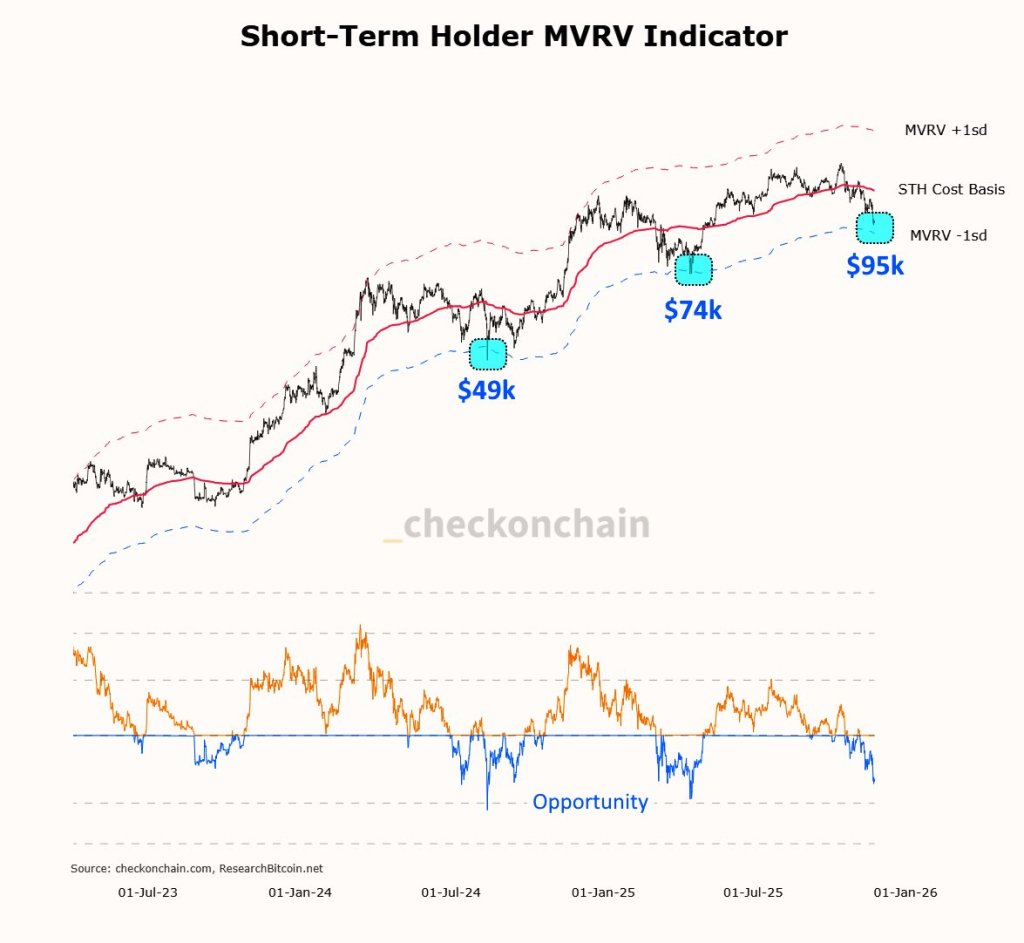

On-chain data, like a dissident’s pamphlet, tells a different tale. Analyst Frank (@FrankAFetter) shares Checkonchain’s Short-Term Holder MVRV chart, which tracks the profitability of recent buyers relative to their cost basis with standard-deviation bands. Bitcoin’s latest flush has driven the metric to the lower, negative-one-standard-deviation band, a zone previously tagged near $49,000 and $74,000 before meaningful bounces. Frank’s approach is as straightforward as a hammer and sickle: “I’m a buyer of standard deviation moves to the downside; they don’t come often, but they tend to be excellent opportunities.” 🛠️

CryptoQuant founder Ki Young Ju, meanwhile, focuses on who is selling this dip. He characterizes the move as internal rotation among long-term players rather than broad distribution: “This dip is just long-term holders rotating among themselves. Old Bitcoiners are selling to tradfi players, who will also hold for the long run.” Ah, the circle of crypto life! 🦁

He recalls that his earlier top call was driven by “OG whales … dumping hard,” but argues that the landscape has shifted: “ETFs, MSTR, and other new channels kept injecting fresh liquidity. Onchain inflows are still strong. This dip is basically OG whales dragging the market.” Looking ahead, he points to “sovereign funds, pension funds, multi-asset funds, and corporate treasuries” as building even larger, persistent liquidity channels and concludes: “The cycle theory is dead until these liquidity channels stop running.” Notably, Ki Young Ju correctly predicted in March this year that Bitcoin could see a “6-12 months of bearish or sideways price action.” 🧙♂️

In short, the technical picture has clearly weakened, with the 50-week EMA and the $96,000-$97,000 monthly Fibonacci zone now acting as critical lines in the sand. If Bitcoin can reclaim the weekly EMA and secure a monthly close above that 0.618 retracement, the case for this being a deep but standard consolidation remains credible. A sustained failure at these levels, by contrast, would lend significant weight to the bear-market argument. For now, the verdict hinges on how the next few weekly and monthly candles close, not on the intraday noise. 🕯️

At press time, BTC traded at $93,938, a number as arbitrary as a five-year plan. 📉

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Celebs Who Fake Apologies After Getting Caught in Lies

- 20 Must-See European Movies That Will Leave You Breathless

- 2 Hot AI Stocks You Should Consider Selling Right Now

2025-11-18 05:21