HBAR price plummets 16% weekly but stubbornly clings to life post-breakdown, sparking whispers of a “bear trap” so insidious it could make a Wall Street broker question their life choices.

This is the kind of market chaos where even the most stoic algorithm starts humming show tunes. The HBAR breakdown? Yes, it happened. But now we’re in a situation so precarious it makes a tightrope walker on a windsock look confident. Crowded short positions? More like a zoo for desperate traders, all waiting for the price to do a backflip and crush their portfolios. 🐘💥

HBAR’s Breakdown and Potential for a Bear Trap Rebound

Behold, the RSI-a mystical indicator that tells us whether HBAR is “oversold” (read: crying in crypto) or “overbought” (read: dreaming of retirement). The chart? A Picasso of confusion. HBAR broke below the neckline like a toddler abandoning a sandcastle, but the follow-through? Weaker than a jelly donut. Meanwhile, the RSI is doing a cosmic dance between “panic” and “meh.” If this isn’t a bear trap, what is? 🐾📉

Related Reading: HBAR Market Cap Surges Past $8.3B Amid Strong On-Chain Growth | Live Bitcoin News

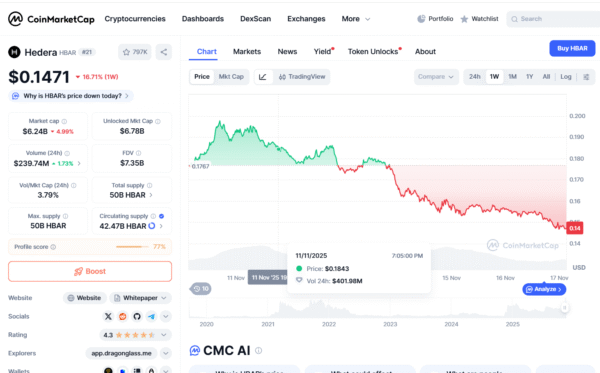

Hedera (HBAR) has plummeted 16% in a week, completing a head-and-shoulders pattern so dramatic it deserves its own Netflix docuseries. Yet, here we are: 24 hours of price paralysis, the kind of stagnation that makes a sloth look like Usain Bolt. Analysts are now speculating a “bear trap” so cunning it could probably get a PhD in deception. And let’s not forget the token’s breach of a key support level-because nothing says “confidence” like falling through a floor. 🏗️💸

As of November 16, 2025, HBAR is trading at $0.14957, having briefly flirted with $0.16 before retreating like a ghost afraid of sunlight. Institutions are reportedly selling at resistance levels like they’re burning down a casino. Some analysts predict a late-November rally to $0.22-because why not? The range of $0.16 to $0.30 for 2025? A gamble fueled by caffeine, hubris, and the faint hope that enterprises will one day stop being… enterprises. 🚀

Recent Price History and Factors Creating Uncertainty

HBAR’s recent price history is less a chart and more a modern art masterpiece. On November 14, 2025, it followed Bitcoin’s lead like a puppy chasing a laser pointer, crashing through a support level that had stood guard for weeks. The previous day? A 3.5% drop, because why hold back when you can drop 3.5% on a Tuesday? And yet, despite $68 million in institutional ETF inflows, the price remains flatter than a pancake in a tornado. 🥞🌪️

The head-and-shoulders pattern? Bearish as a bear in a bear trap. Yet here we are, stuck in a limbo of sideways action, where even the most optimistic short-seller is starting to sweat. Short positions are so crowded, it’s like a mosh pit at a ballet. And if the price reverses? Prepare for a domino effect of liquidations so brutal it’ll make a stockbroker cry into their artisanal coffee. ☕😭

But wait! There’s buying interest. Or so the tokens flowing to exchanges claim. Is this a sign of hope, or just a last-ditch Hail Mary from a market that’s lost its mind? Only time will tell. And perhaps a few more cups of coffee. ☕

Long-term optimism persists, because humans are irrational creatures who believe in things like “unique technology” and “growing ecosystems.” Some analysts still see HBAR’s future as bright-citing its “innovative consensus algorithms” and “enterprise adoption” as if those are things that matter. In the grand cosmic joke of crypto, this is what passes for logic. 🌌

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

2025-11-17 10:33