Hold onto your hats, folks! 🎩💥 Options trading for the Bitwise Solana Staking ETF (BSOL) is officially LIVE as of Nov. 11, just two short weeks after the spot ETF made its grand entrance on Oct. 28. This latest development means institutional investors can now go all-out with hedging strategies and complex trades on Solana (because who doesn’t love a little extra risk, right?). 🧐

Now, what does this mean for the market? Well, the numbers don’t lie. The Solana token is strutting around at a cool $156.3 with a 5.6% volatility over the last 24 hours. It’s got a market cap of $86.35 billion, and an impressive $6.00 billion in 24-hour trading volume. Looks like Solana’s ready for the big leagues! 🤑

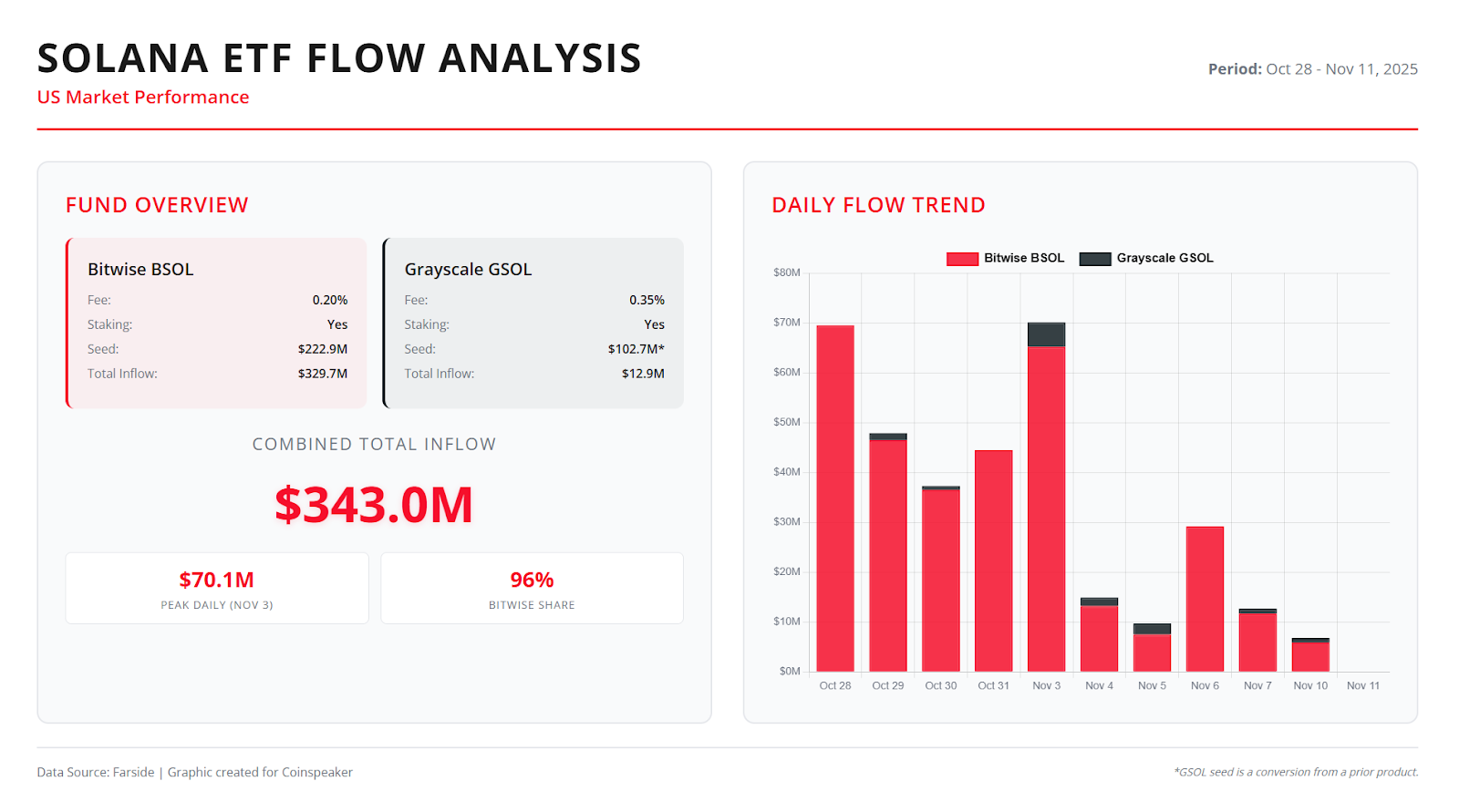

Coinspeaker Solana ETF Flow Analysis | Source: Farside

Bitwise’s bigwigs, President Teddy Fusaro and CEO Hunter Horsley, made it official with X posts on the same day. They even included Bloomberg terminal screenshots, showing active call and put contracts in all their glory. As if we needed more proof this is a major player. 📈

Milestone today –

Options are now live and trading on $BSOL, the Bitwise Solana Staking ETF.

Bridges are opening to investment professionals.

– Hunter Horsley (@HHorsley) November 11, 2025

The options come with all sorts of fun expiration dates-Nov. 21, 2025, Dec. 19, 2025, Feb. 20, 2026, and May 15, 2026-so take your pick and buckle up! 🚀 As of Nov. 10, BSOL had 22.4 million shares outstanding. That’s a whole lotta Solana on the table, friends.

Now, here’s the juicy part: BSOL is sitting pretty with $497.2 million in assets under management and 22.7 million shares, making it the largest Solana ETF in the US. For comparison, Farside Investors only has $329.7 million, so BSOL is definitely dominating. It’s even snatched up about 98% of total Solana ETF inflows during its first trading stretch-taking a bite out of Grayscale’s GSOL like a true crypto king. 👑

ETF Structure and Launch

The ETF made its debut on Oct. 28 on NYSE Arca, with a modest 0.20% management fee (totally waived on the first $1 billion in assets through Jan. 28, 2026 – lucky them!). BSOL stakes 100% of its Solana holdings, earning a solid 7.20% net staking reward rate. Those rewards get reinvested right back into the fund, because why not make more money on top of money, right? 💸

The Trust operates as a grantor trust for tax purposes (yes, it’s a legal thing), meaning the income and expenses flow directly through to shareholders. So, if you’re in the game, you get a piece of the pie. 🍰

Authorized Participants can create or redeem shares in blocks of 10,000 units (that’s a lot of Solana!) either through Solana transfers or cash settlements. As for competition, Grayscale’s GSOL is still in the race, but the Solana ETF market saw $150 million in inflows across all products by Oct. 31. So yeah, things are heating up! 🔥

BSOL’s options launch is lightning fast compared to other crypto ETFs. Take Ethereum’s options for example-they launched about 15 months after the spot ETF debuted. Slow and steady, or fast and furious? It’s clear BSOL chose the latter. 🏎️💨

Market Activity

The Solana ecosystem is buzzing with activity, thanks to all these institutional product launches. DEX volumes crossed $5 billion in early November, with network metrics showing growth in transaction volume and user engagement. Looks like Solana is making some serious noise in the crypto world. 📊

Institutional investors are getting more comfortable with Solana, especially through these new regulated products. With options now live, portfolio managers have the risk management tools they need to make those big moves. Delaware Trust Company is playing trustee, and Coinbase Custody Trust Co. is holding down the digital asset custodian duties. Because, you know, trust is important in the wild world of crypto. 😏

Bitwise, not content with just one successful crypto fund, is managing multiple ETPs-including Bitcoin and Ethereum-now even approved for retail investors in the UK. If you want exposure to the biggest digital assets around, they’ve got you covered. 🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- USD RUB PREDICTION

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- 8 Board Games That We Can’t Wait to Play in 2026

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

2025-11-12 01:33