Markets

What to know:

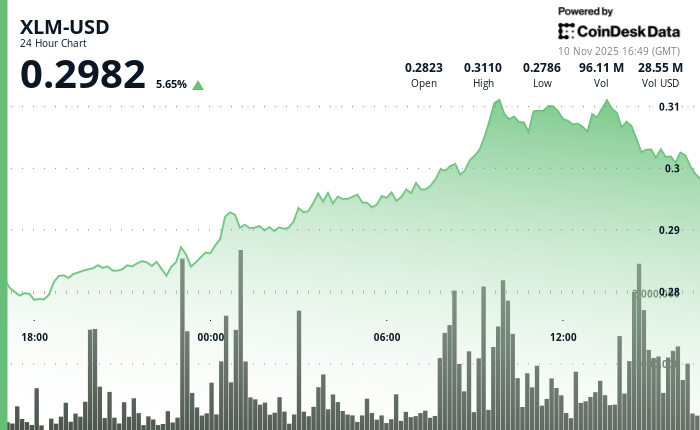

- XLM climbed 3.62% to $0.3004, with trading volume 18.90% above 30-day averages

- The token outperformed the crypto market by 4.86%, inching toward a major relative strength threshold

- Experts are abuzz about the seven-year symmetrical triangle pattern that’s oh-so-close to breaking out

On Tuesday, Stellar’s XLM token-ever the drama queen-rose 3.62% to $0.3004, making a showy break above key resistance. The volume? Well, it soared nearly 19% above its 30-day average, as if to announce to the world, “I’m here to stay!” This move put XLM ahead of the broader crypto market by 4.86%, nudging it closer to the 5% relative strength threshold. That magic number, of course, is often the harbinger of a breakout that leaves us all holding our breath.

The frenzy of activity started during European hours, naturally, because who doesn’t love a good market drama while sipping coffee? Volume hit a peak of 68.52 million shares-78% higher than its 24-hour moving average. That moment, oh that sweet moment, confirmed a clean breakout above the $0.3020 resistance. XLM then decided to play it cool, consolidating between $0.3020 and $0.3100 like a cat that’s caught a mouse but is savoring the moment. Support found a cozy home at $0.3058, almost like it was meant to be.

Now, if you’re wondering, “Is this the start of something truly wild?”-the answer might just be yes. Analysts are keeping a hawk-eyed gaze as XLM flirts with the upper boundary of a seven-year symmetrical triangle pattern. Aksel Kibar, the Chartered Market Technician (who sounds like a name straight out of a spy movie), is predicting a breakout that could see XLM soaring towards $1.52-a staggering 446% rise if this long-term consolidation finally bursts forth. To think, we’ve all been waiting since 2018!

For traders, the real question is whether XLM can keep up the momentum above resistance. The surge in institutional interest at the $0.3020 mark, coupled with steady buying on pullbacks, signals that demand is not just a passing flirtation. When combined with the fact that XLM has consistently outperformed the broader market, the signs are pointing to a bullish phase that may just stick around-who knew crypto could be this reliable?

Key Technical Levels Signal Momentum Shift for XLM

Support/Resistance: Primary support established at $0.3058 with multiple successful tests; resistance formed at $0.3118 session high with consolidation between $0.3020-$0.3100

Volume Analysis: Peak activity of 68.52M shares (78% above 24-hour SMA) occurred at 09:00, validating breakout through $0.3020 resistance level

Chart Patterns: Double-wave rally pattern emerged with ascending trend showing higher lows at $0.2790, $0.2845, and $0.2915 across 11.6% total range

Targets & Risk/Reward: Immediate resistance zone at $0.3045-$0.3050 with longer-term triangle breakout target at $1.52 representing 446% upside potential if seven-year pattern resolves higher

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- The Worst Black A-List Hollywood Actors

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

2025-11-10 20:00