Ah, Bitcoin, that fickle darling of the digital realm, has tumbled below the $100,000 threshold, a fall as dramatic as a socialite’s scandal at high tea. Cryptoquant, those purveyors of doom and gloom, whisper that this descent mirrors the prelude to the 2022 bear market-a spectacle so dire, it makes a Wildean tragedy look like a comedy of errors. 🌪️✨

Bitcoin’s Price Action: A Farce in Financial Finery

According to Cryptoquant’s latest missive, their Bull Score Index has plummeted to zero-a number as devoid of life as a society hostess’s heart. This, they declare, signals an “extremely bearish” posture, a phrase so dreary it could only be uttered by a man in a velvet smoking jacket, sipping absinthe. 🦹♂️💔

The analysis, as florid as a Wildean monologue, highlights that Bitcoin now trades below its 365-day moving average of $102,000. This, my dear reader, is not merely a technical level but a psychological precipice-the last bastion before the abyss of the 2022 downturn. Oh, the humanity! 📉🌀

Cryptoquant’s researchers, with all the gravitas of a Greek chorus, warn that failing to reclaim this moving average could “trigger a much larger correction.” The 365-day MA, once the “ultimate support” of bull cycles, has now become a noose around the necks of long-term traders. How deliciously ironic! 🎭⚰️

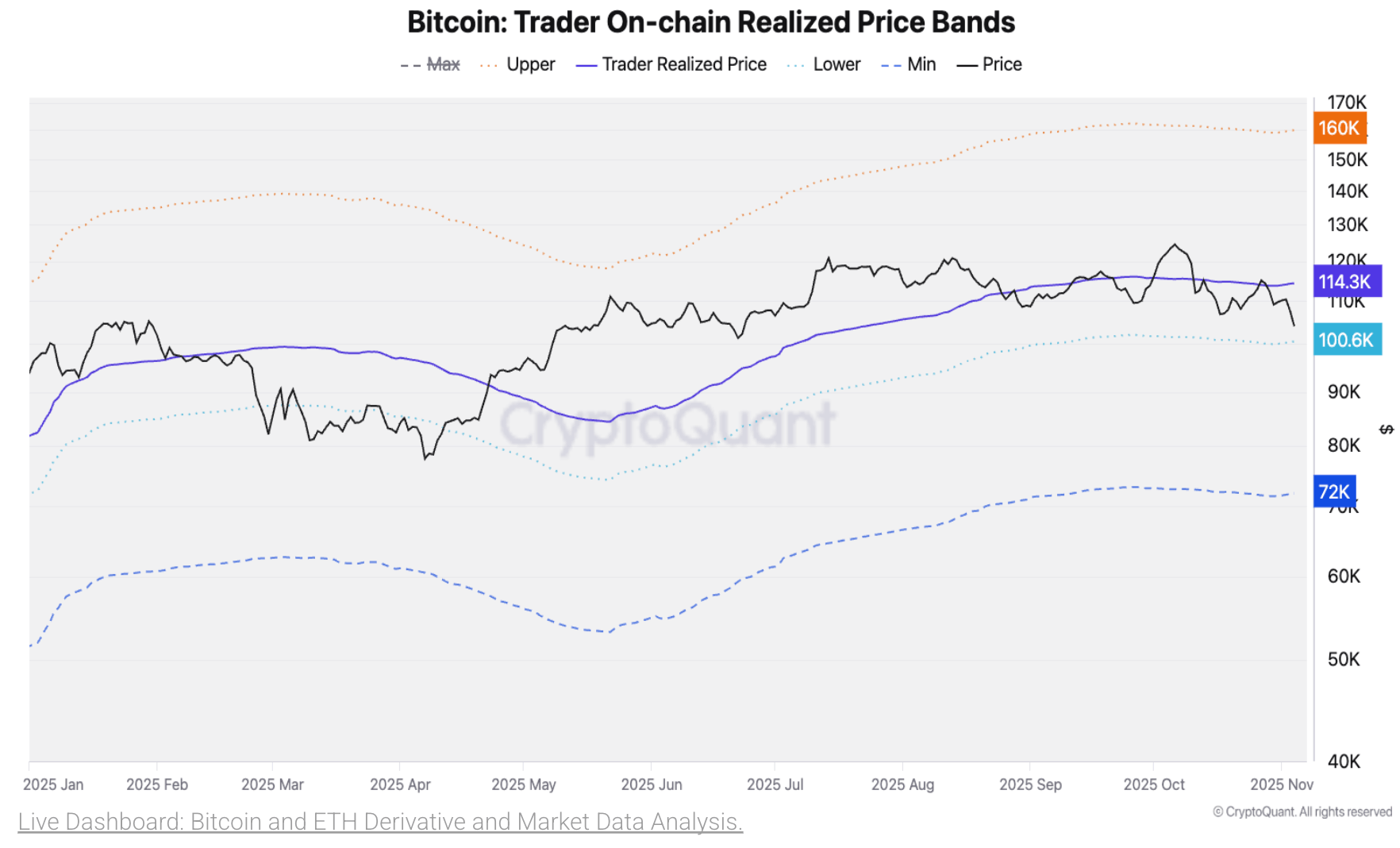

But wait, there’s more! Cryptoquant’s onchain data points to the Traders’ Onchain Realized Price Bands as another harbinger of doom. Analysts predict Bitcoin could drift toward $72,000-the minimum price band-within one to two months if prices do not recover. Oh, the horror! The lower band, historically a support level, may crumble like a house of cards in a tempest. 🌪️🃏

And let us not forget the network valuation framework based on Metcalfe’s law, which identifies an additional support zone near $91,000. This “2x Metcalfe Value band” level, they say, once anchored price activity between November 2024 and May 2025. How quaint! 📊🔮

Cryptoquant’s researchers, with all the subtlety of a sledgehammer, emphasize that these converging signals-from technical indicators to onchain metrics-suggest Bitcoin’s current weakness is not isolated but reflects broad structural softness in the market’s fundamentals. Over the past 24 hours, BTC has been rangebound between $99,192 to $104,044-a dance as tedious as a society ball. 💃🕺

FAQ

- What does Cryptoquant’s Bull Score Index indicate?

It reflects overall market momentum and has dropped to zero, showing an extremely bearish outlook-a prognosis as bleak as a rainy day in London. ☔🐻 - Why is the 365-day moving average significant?

Cryptoquant identifies it as Bitcoin’s ultimate support line; falling below it previously marked the start of the 2022 bear market. A line in the sand, if you will, but one that has been spectacularly crossed. 🚫⚔️ - What price supports are analysts watching next?

Cryptoquant highlights $91,000 as network support and $72,000 as the potential next level if selling continues. Oh, the suspense! Will it hold, or will it crumble like a poorly baked soufflé? 🥧💥

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-11-08 20:33