In the shadow of the AI tempest, Michael Burry’s Scion Asset Management, that paragon of contrarian thought, casts his gaze upon the towering edifices of Palantir and Nvidia, their peaks trembling under the weight of his bearish options. 🧠🔥

Wall Street Déjà Vu: Trading Veteran Michael Burry’s Scion Bets Against AI Mania

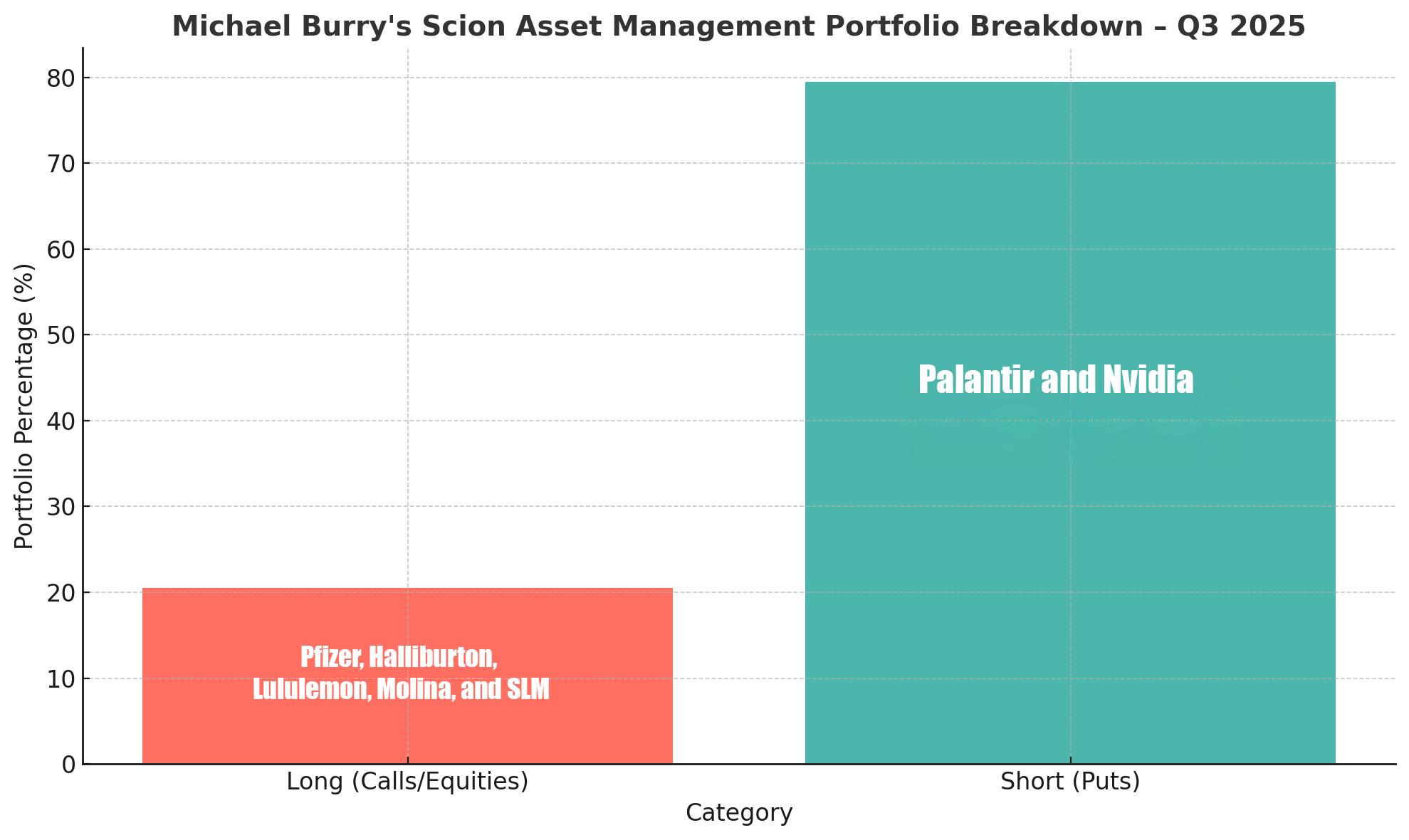

The latest 13F, a document as revealing as a confessional, unveils a portfolio steeped in paradox-bearish gambles on AI’s gilded idols, while new bullish ventures bloom in the realms of health care and energy. A classic Burry, one might say, a man who, like a prophet in the desert, scorns the crowd’s fervor and dares to wager on the abyss. 😏

Burry, that sardonic sage of finance, is no stranger to the art of seeing what others cannot. His 2008 premonition, immortalized in “The Big Short,” now echoes in his latest moves-a symphony of puts on Palantir and Nvidia, as if he’s whispering, “The bubble, my dear reader, is not yet burst, but the clock ticks louder.” 🕰️

With a portfolio so tightly woven, it’s not mere speculation-it’s a declaration. The 5 million Palantir puts and 1 million Nvidia puts are not just numbers; they’re the stiletto of a man who believes the market’s fever will one day break. Yet, even as he bets against the tide, he sows seeds of hope in Pfizer and Halliburton, a duality as perplexing as the human soul. 🧩

These calls, like flickers of light in a storm, promise upside if the pipelines flow and the drills sing. Yet, Scion’s doubling down on Lululemon and SLM Corporation feels like a gamble on the American consumer’s resilience-a fragile hope, perhaps, but one that fuels the fire of speculation. 🏋️♂️

The exits, too, are telling. Chinese e-commerce and U.S. health insurers are cast aside, as if fleeing a plague. A strategic retreat, or a confession that even the sharpest minds can be blinded by the glare of global chaos? 🌍

The house view? A call to avoid the storm of policy and geopolitics, to seek solace in the clarity of U.S. markets. But can one truly escape the tempest? The portfolio, a chessboard of concentrated bets, is a testament to Burry’s belief that volatility is not a foe, but a companion. 🎭

Geographically, the filing reads like a map of retreat and advance-China’s risks discarded, U.S. opportunities seized. A mirror to the investor’s soul, seeking value where others see only noise. 🗺️

Yet, the question lingers: Is Burry the prophet, or the fool? For in markets driven by narrative, even the wisest can be undone. The puts may wither, or the payoff may be grand. A gamble, as all bets are, but one that echoes the eternal human struggle: to foresee, to bet, and to hope. 🤞

What Changed in Q3-and Why It Matters

- AI on notice: Palantir and Nvidia puts dominate, signaling an expectation that euphoric multiples eventually meet math. 🧮

- Health care tilt: Pfizer calls and a fresh Molina stake show a bias toward defensible cash flows and policy-linked demand. 💊

- Energy as a hedge: Halliburton calls nod to cyclical upside if global supply tightens or capex rises. ⛽

- Consumer/credit picks: Lululemon doubled, SLM added-targeted U.S. names over broad beta. 👕

The Bottom Line

Scion’s concentrated structure amplifies both risk and reward. It’s a portfolio that reads like a thesis, not a market basket-bearish where the hype is loudest, constructive where cash flows and cycles still have room to breathe. But will the market heed the warnings of a man who once saw the fall of empires? 🧠

And while Burry’s contrarian instincts made him a household name, his track record since then has been mixed. Some of his macro wagers-like past short positions on Tesla and broad market indexes-fizzled before paying off, leaving critics to argue that his timing can be early enough to hurt. 😅

With AI stocks still posting strong earnings and institutional inflows, his current puts could misfire if enthusiasm and profits hold. In markets driven as much by narrative as by numbers, even the man who once shorted the housing bubble isn’t immune to being right too soon-or just plain wrong. 🧠💥

FAQ ❓

- Where is the focus of Scion’s new bets? Primarily U.S. sectors-health care, energy services, and select consumer names-after trimming China exposure. 🏢

- What makes this filing notable for North American investors? The portfolio concentrates 80% in AI-related puts while adding U.S. call exposure in Pfizer and Halliburton. 💰

- How many core equity positions remain in the U.S. book? Three: Lululemon, Molina Healthcare and SLM Corporation. 👕

- Why did Scion exit Chinese e-commerce and U.S. health insurers? The filing points to geopolitical and regulatory headwinds and a pivot toward cleaner U.S. catalysts. 🌍

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-11-05 03:59