In the grand theater of decentralized finance, where contracts dance with chaos and wallets weep silent tears, Balancer-the once-celebrated saint of liquidity-has been unmasked as a jester clutching a bag of stolen coins. With a flourish of malicious code, an anonymous sorcerer siphoned $116 million across blockchains, transforming the platform into a farcical stage where trust curtsies to paranoia. The performance began with $70 million in losses, a modest prelude to the symphony of Ethereum conversions that followed. In one hour, Balancer’s reputation crumbled like a house of cards in a hurricane, now sharing the spotlight with DeFi’s rogues’ gallery.

According to the oracle of blockchain analytics, Lookonchain, the thief wasted no time in swapping pilfered tokens for ETH, as if conducting a midnight ballet with the market’s heartbeat. “Note that the Balancer hacker is now swapping the stolen assets for $ETH,” they intoned, like a prophet of doom. The total loot swelled to $116.6 million before the villain’s pace slowed, their targets: wrapped ETH and staked derivatives, the digital gold of the crypto age.

Note that the #Balancer hacker is now swapping the stolen assets for $ETH.

Vulnerability in Balancer V2 pools

Balancer, in a tweet that dripped with bureaucratic solemnity, admitted to a “potential exploit impacting v2 pools.” Their engineers, armed with coffee and code, vowed to investigate “with high priority.” Yet the words rang hollow, drowned out by the cacophony of panicked withdrawals and the ghostly whispers of lost funds. Investors, once believers in the gospel of decentralization, now clutched their remaining coins like talismans.

We’re aware of a potential exploit impacting Balancer v2 pools.

Our engineering and security teams are investigating with high priority.

We’ll share verified updates and next steps as soon as we have more information.

The exploit, according to on-chain sleuth Adi, was a masterclass in exploiting loopholes. “Improper authorization and callback handling allowed the attacker to bypass safeguards,” they declared, as if narrating a heist film. Balancer’s composable design, a feature once praised as a marvel of innovation, became the villain’s playground, enabling the hacker to drain assets faster than a vampire drains blood.

Preliminary data from Lookonchain revealed the thief’s haul: 6,587 WETH ($24.46M), 6,851 osETH ($26.86M), and 4,260 wstETH ($19.27M). The hacker’s on-chain portfolio, now worth $90.5 million, saw a 6.6% drop in 24 hours-not due to guilt, but the market’s own descent into despair.

StakeWise recovers stolen tokens

Amid the chaos, StakeWise emerged as a knight in chainmail, recovering 73.5% of the stolen osETH. “StakeWise DAO emergency multisig has executed a series of transactions, recovering ~5,041 osETH (~$19M) and 13,495 osGNO (~$1.7M),” they announced, as if returning a lost puppy to its owner. The funds, they promised, would be distributed pro-rata-a balm for the wounded, though the scars of betrayal lingered.

Just half an hour earlier, StakeWise DAO emergency multisig has executed a series of transactions, recovering ~5,041 osETH (~$19M) and 13,495 osGNO (~$1.7M) tokens from the Balancer exploiter.

On Ethereum mainnet, this represents 73.5% of the ~6,851 osETH stolen earlier today,…

This partial victory, however, did little to calm the markets. ETH, now trading at $3,500-a 23% plunge from Monday’s price-remained a stormy sea, its tides dictated by fear and uncertainty.

Balancer’s struggles continue

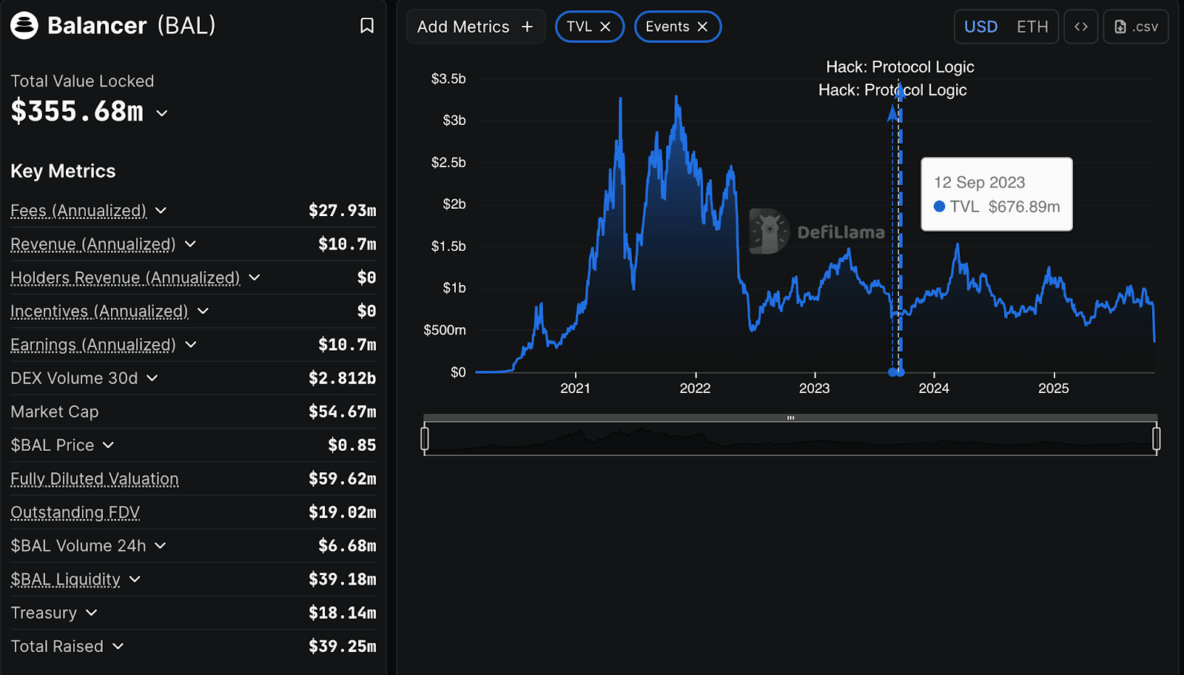

DeFiLlama’s data painted a bleak portrait: Balancer’s total value locked (TVL) had plummeted to $355.68 million, a shadow of its $3 billion peak. Yet, it persisted, handling $2.81 billion in monthly trading volume and generating $10.7 million in revenue-a phoenix rising from the ashes of its own hubris.

Crypto commentator Haseeb observed the chains’ varied responses: “Berachain halted the network; Polygon censored the hacker; Sonic froze accounts. Small ecosystems, they said, should prioritize safety over ‘code is law.’” A lesson in futility, perhaps, for a world where code is both god and sinner.

Audit gaps expose Balancer’s weakness

Security concerns loomed large. Balancer’s last major audit was in 2022, a relic in an era of relentless innovation. Its bug bounty, capped at 1,000 ETH, excluded web interface flaws-a glaring omission. Previous audits by Certora and OpenZeppelin, while thorough, proved as useful as a umbrella in a hurricane when faced with immutable contracts.

In 2022, Balancer introduced a security accelerator, offering credits and tools to projects. Yet, this exploit-like a ghost in the machine-revealed the folly of assuming past vigilance guarantees future safety. The demand for audits, once a whisper, now roared like a tempest.

Why this matters

The Balancer hack is a parable for DeFi’s fragility. For all its promises of decentralization and transparency, it remains a house of cards, where a single flaw can topple empires. The hacker’s dance across blockchains was a reminder that in this digital realm, speed is both a weapon and a curse. For Balancer, the breach is a crossroads: rebuild with honesty and steel, or fade into the annals of crypto’s cautionary tales. StakeWise’s recovery offers a glimmer of hope, but trust, once shattered, demands more than a patchwork of fixes. It requires a reimagining of what it means to be secure in a world where code is king-and kings are often blind to their own vulnerabilities.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

2025-11-04 13:06