Ah, the grand prophecy of our age! Standard Chartered CEO Bill Winters, with the solemnity of a Dostoevskian character, has declared that every transaction shall one day bow to the almighty blockchain. A “complete rewiring” of global finance, he calls it. How poetic. 🤔

All Hail the Blockchain Overlord

As reported by CNBC, Winters, at a Hong Kong FinTech Week panel, waxed lyrical about the future of finance and Hong Kong’s role in this digital utopia. “Our belief, which I think is shared by the leadership of Hong Kong,” he said, “is that pretty much all transactions will settle on blockchains eventually, and that all money will be digital.” Oh joyous day! 💸

The world marches on, with tokenization leading the charge. Even SWIFT, the payments giant, is hopping on the blockchain bandwagon, as announced in September. Tokenization, the digital cloning of assets, has become the darling of financial innovation. Hong Kong, ever the eager participant, tested this wizardry last year, with Standard Chartered playing its part.

Standard Chartered, a British bank with global ambitions (including Hong Kong), has been expanding its digital assets empire. Earlier this year, it became the first of its kind to launch a spot Bitcoin and Ethereum trading desk for institutional clients. Now, that’s progress. Or madness. Who knows? 🤷♂️

Not to be left behind, the bank has also teamed up with Animoca Brands and Hong Kong Telecom (HKT) to secure a stablecoin license from the Hong Kong Monetary Authority (HKMA). Stablecoins, the blockchain’s answer to fiat currencies, are set to rise. Winter’s vision? A tokenized Hong Kong Dollar (HKD). Because why not?

But wait, there’s more! Winters warns, “Think about what that means: a complete rewiring of the financial system.” Indeed, a rewiring that could either light up the world or fry it. Only time will tell. 📈💥

Bitcoin’s Rollercoaster Ride Continues

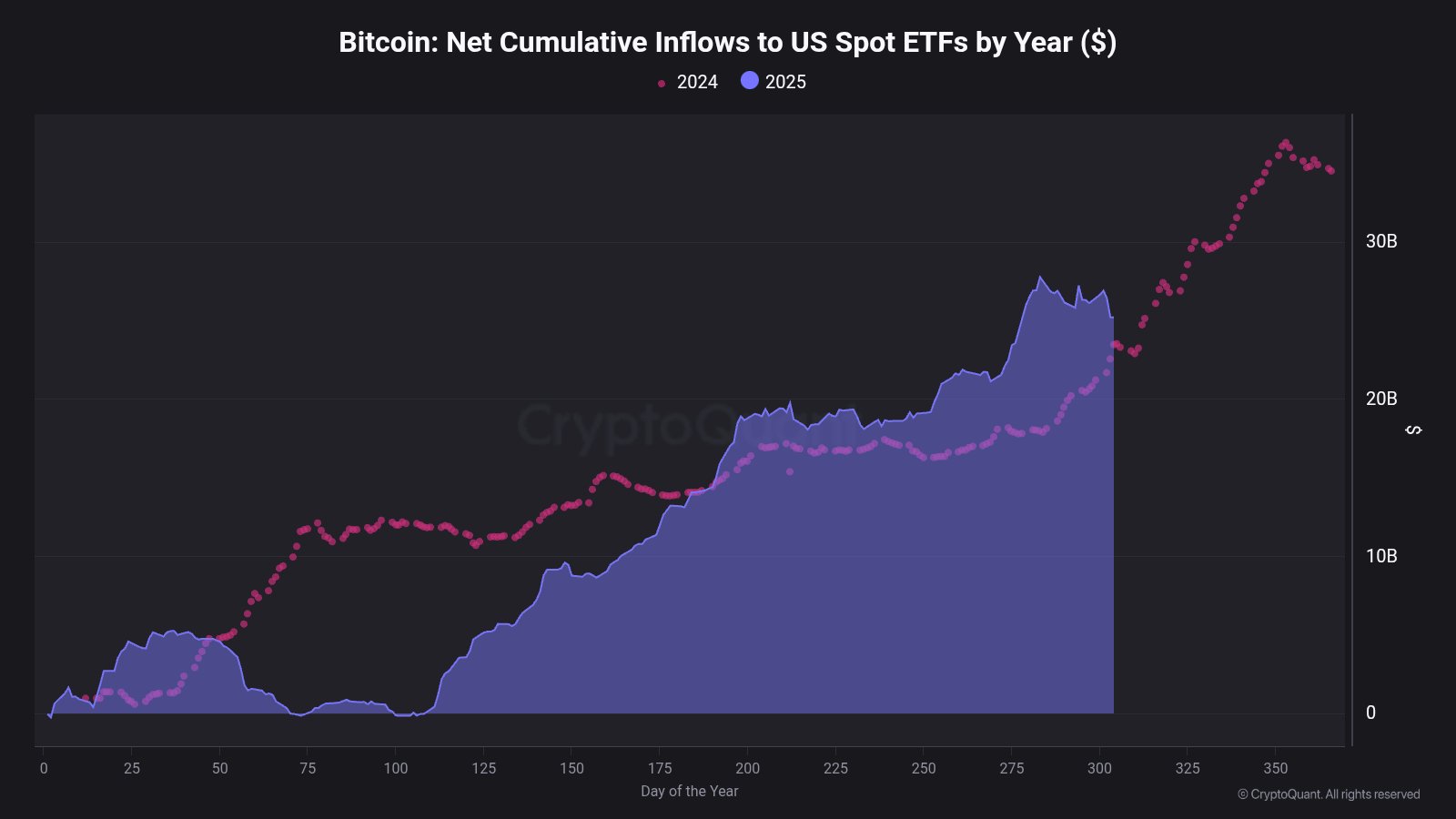

Speaking of frying, Bitcoin has taken a 3% hit in the past day, dropping back to the $107,500 mark. Here’s a visual treat for those who enjoy watching cryptocurrencies plummet:

Despite this bearish stumble, Bitcoin still reigns supreme in 2024, thanks to spot exchange-traded fund (ETF) inflows. As CryptoQuant analyst Maartunn pointed out on Twitter, 2025 is already outpacing 2024 in year-to-date inflows. 🚀

At this point last year, US Bitcoin spot ETFs registered around $22.5 billion in cumulative inflows. The same metric for 2025? A whopping $25.18 billion. Now that’s what I call inflation. 💰

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

2025-11-04 09:24