Well, lookie here! Ethereum (ETH) is still struggling to stay above $4,000, like a tired ol’ mule trying to outrun a bear. Bulls are putting up a valiant fight to take back control, but they’re still stumbling after the October 10th sell-off. That day, the market took a big ol’ nosedive, wiping out leveraged positions like it was cleaning up a messy kitchen.

Now, here we are, watching as ETH’s price wobbles and falls like a house of cards. If buyers don’t step in soon, we might see the price plummet further. Analysts are starting to get nervous. But wait-there’s more! On-chain and institutional flow data are telling a different tale. Beneath all this market chaos, the big players are loading up on ETH like it’s Black Friday and the sales are too good to pass up.

It’s a classic case of price weakness versus institutional strength. If ETH can just find its footing and break back above $4,000, we might see the bulls charge once again. But if not, well, brace yourselves for more dips and possibly a deeper correction before we get any signs of a recovery. Hold on to your hats, folks!

Bitmine Goes on a Buying Spree

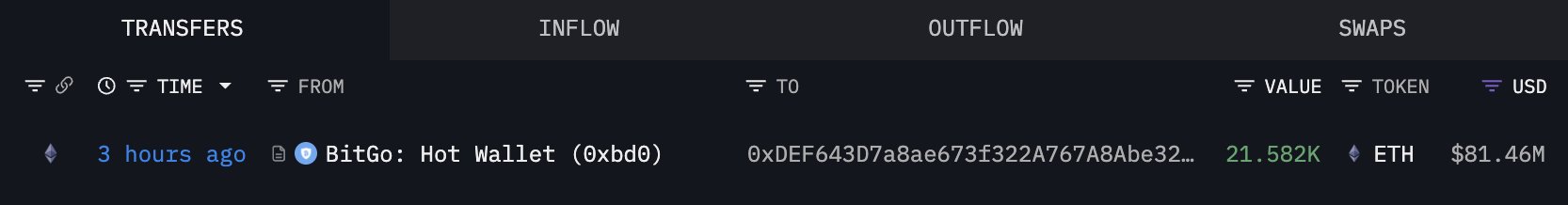

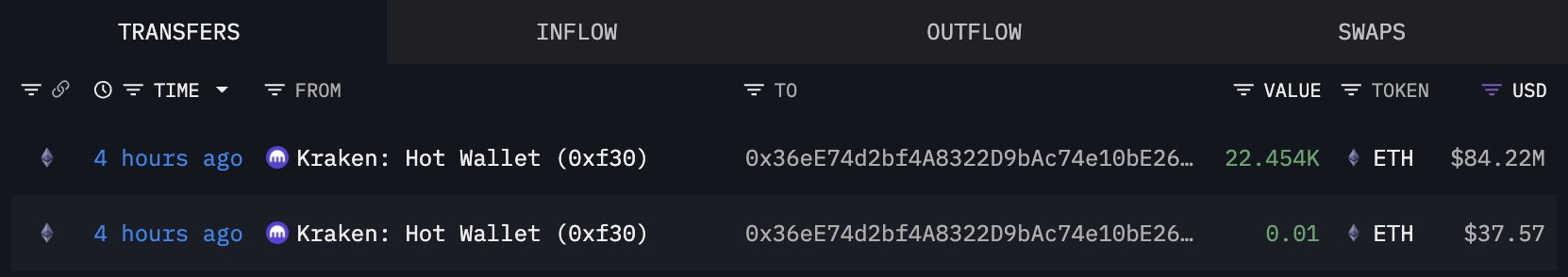

Now here’s a juicy tidbit for you: Bitmine, the institutional player, has been buying Ethereum like there’s no tomorrow. They’ve scooped up a cool 44,036 ETH during the recent market dip. That’s a whopping $166 million worth of ETH added to their stash! Looks like they’re betting big on Ethereum’s future, despite the short-term price struggles.

With this latest purchase, Bitmine now holds a grand total of about 3.16 million ETH, worth a staggering $12.15 billion. I don’t know about you, but that’s a whole lot of Ethereum! And it shows just how out of sync institutional investors are with the mood of the retail crowd. While regular traders are shaking in their boots over Ethereum’s price struggles, Bitmine and other big players are casually picking up more ETH like they’re at a yard sale. Go figure.

This is the beauty (and the madness) of the crypto market. While the price charts look all sad and pitiful, the smart money is quietly stocking up, confident that the long-term prospects are still solid. To them, dips are like a buffet-they’re just grabbing as much as they can before the next rally.

The contrast between short-term panic and long-term optimism is clear as day. With whales accumulating more ETH, exchange outflows, and rising institutional participation, it’s obvious that they’re not sweating the small stuff. They’re looking at the big picture-Ethereum’s future is as bright as a diamond in the sun.

Ethereum Faces a Tough Test

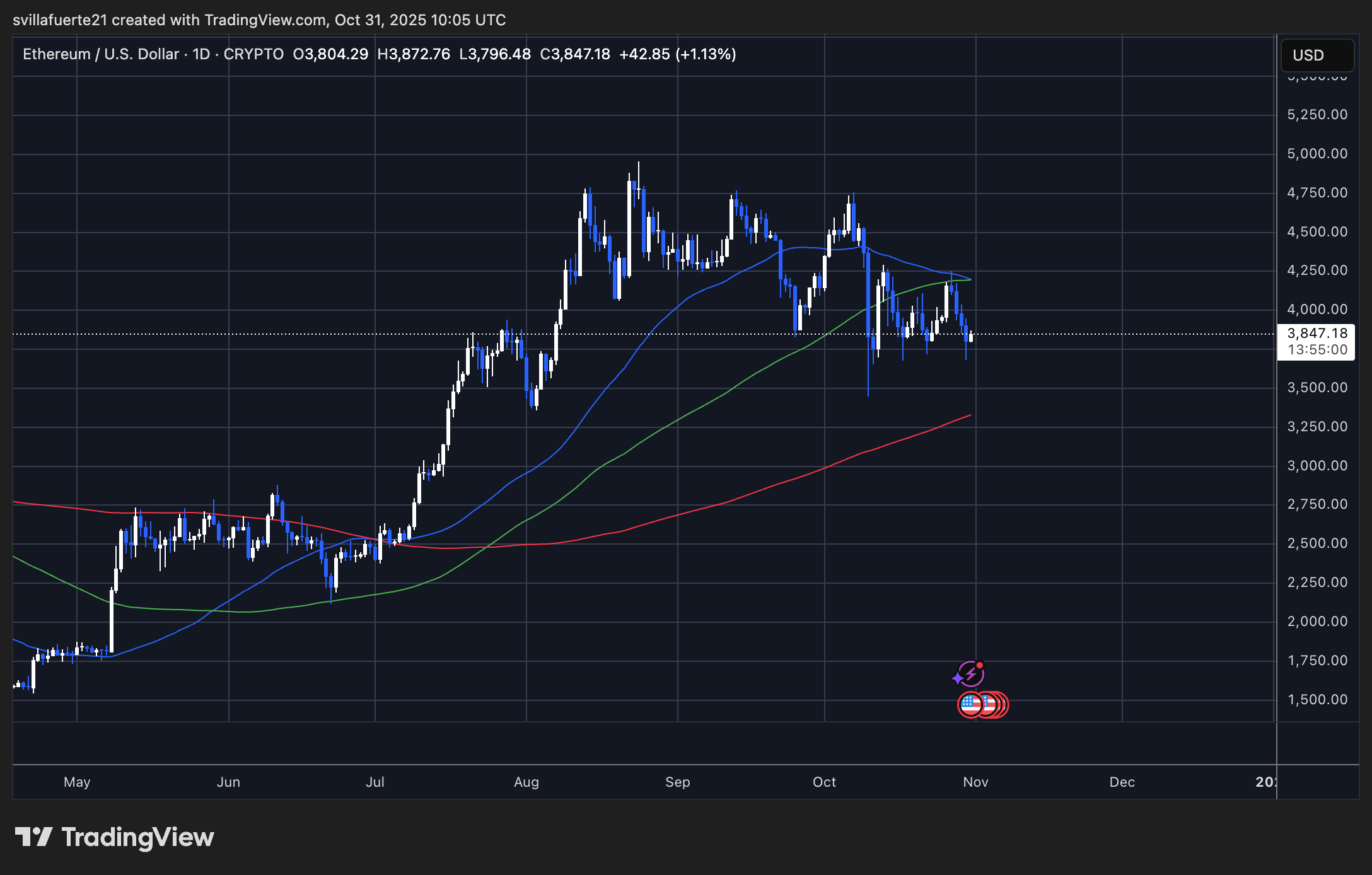

Now for the moment of truth. Ethereum is hanging around $3,847, testing some critical support levels. It tried, and failed, to stay above the $4,000 mark and got a swift rejection from the $4,200 resistance earlier this week. If you’re into technical analysis, you’ll know that it’s breaking below both the 50-day (blue) and 100-day (green) moving averages. Translation: momentum’s weak, and the bulls are sweating it out.

Now, if ETH can hold that $3,800 region, we might see some hope for a rebound. But if it loses that support? Well, next stop is $3,500, and maybe even $3,200, which would be a deeper test of its long-term strength. But hey, let’s not get ahead of ourselves. The broader bullish structure is still intact for now, even if the short-term picture is a bit grim.

For the bulls, here’s the mission: reclaim $4,000 and break through $4,150-$4,200 to reignite that bullish momentum. Until then, it looks like we’re in a consolidation phase, so don’t expect any wild price spikes. But with institutional money flowing in, Ethereum’s future is looking like it might just have a few tricks up its sleeve.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- PLURIBUS’ Best Moments Are Also Its Smallest

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2025-11-01 04:18