On October 28, 2025, REINHART PARTNERS, LLC. disclosed a purchase of 91,788 shares of Axcelis Technologies (ACLS 1.67%), valued at approximately $7.39 million. This transaction, based on the third-quarter 2025 average price, represents 0.24% of the fund’s reportable assets under management (AUM).

The fund now holds 1,610,332 shares, valued at $157.23 million, making Axcelis its largest holding at 5.1% of AUM.

What happened

A U.S. SEC filing dated October 28, 2025, revealed that REINHART PARTNERS, LLC. increased its stake in Axcelis Technologies by 91,788 shares during Q3 2025. The trade, estimated at $7.39 million, elevated the fund’s holdings to 1,610,332 shares, with a market value of $157.23 million.

What else to know

The purchase elevated Axcelis’ share of the fund’s 13F reportable AUM to 5.1%, surpassing other holdings such as IDCC ($142.36 million) and SIMO ($142.30 million). Axcelis’ stock price stood at $83.25 as of October 27, 2025-a 7.6% annual decline, underperforming the S&P 500 by 25.8 percentage points.

Company overview

| Metric | Value |

|---|---|

| Price (as of market close October 27, 2025) | $83.25 |

| Market capitalization | $2.58 billion |

| Revenue (TTM) | $896.09 million |

| Net income (TTM) | $158.49 million |

Company snapshot

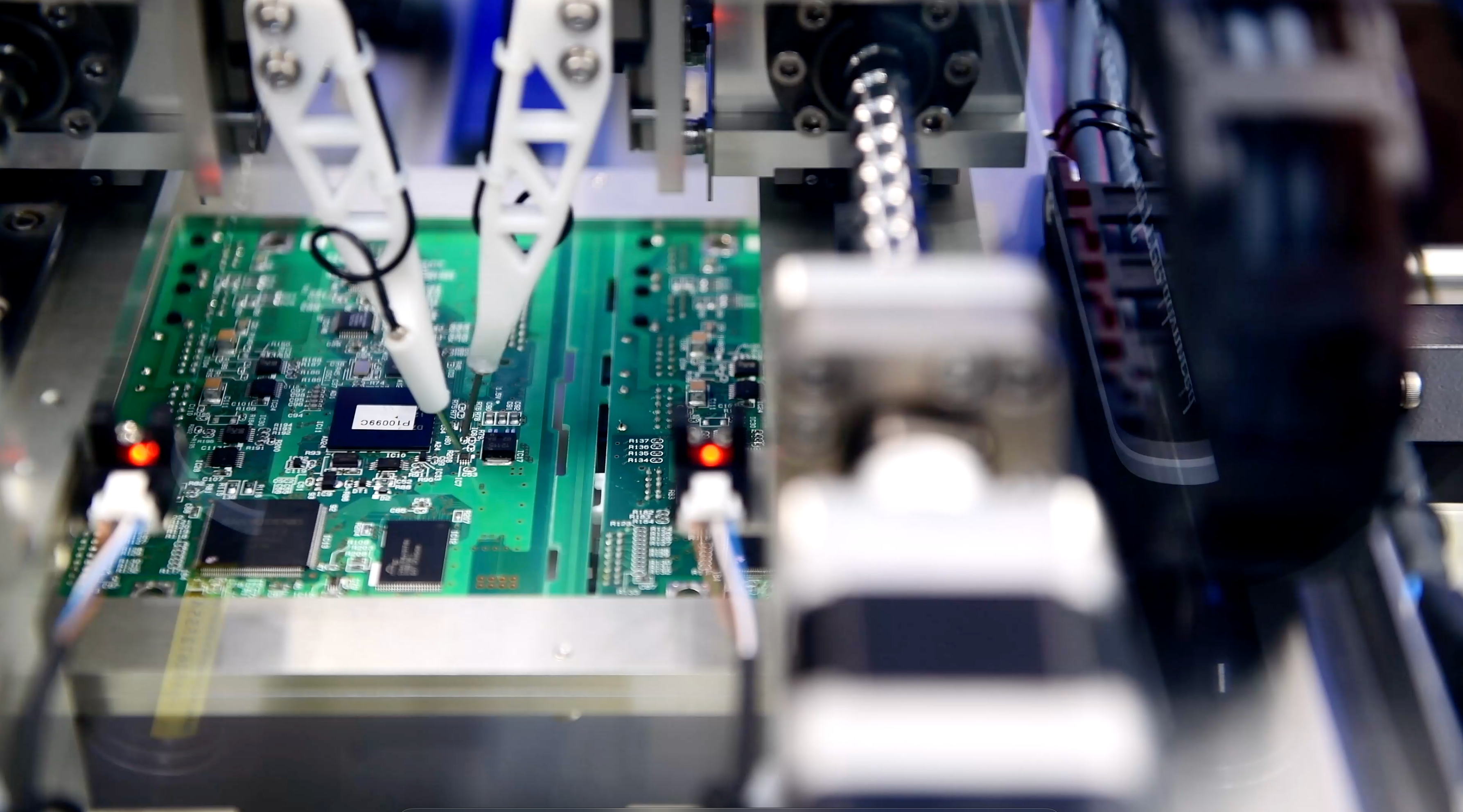

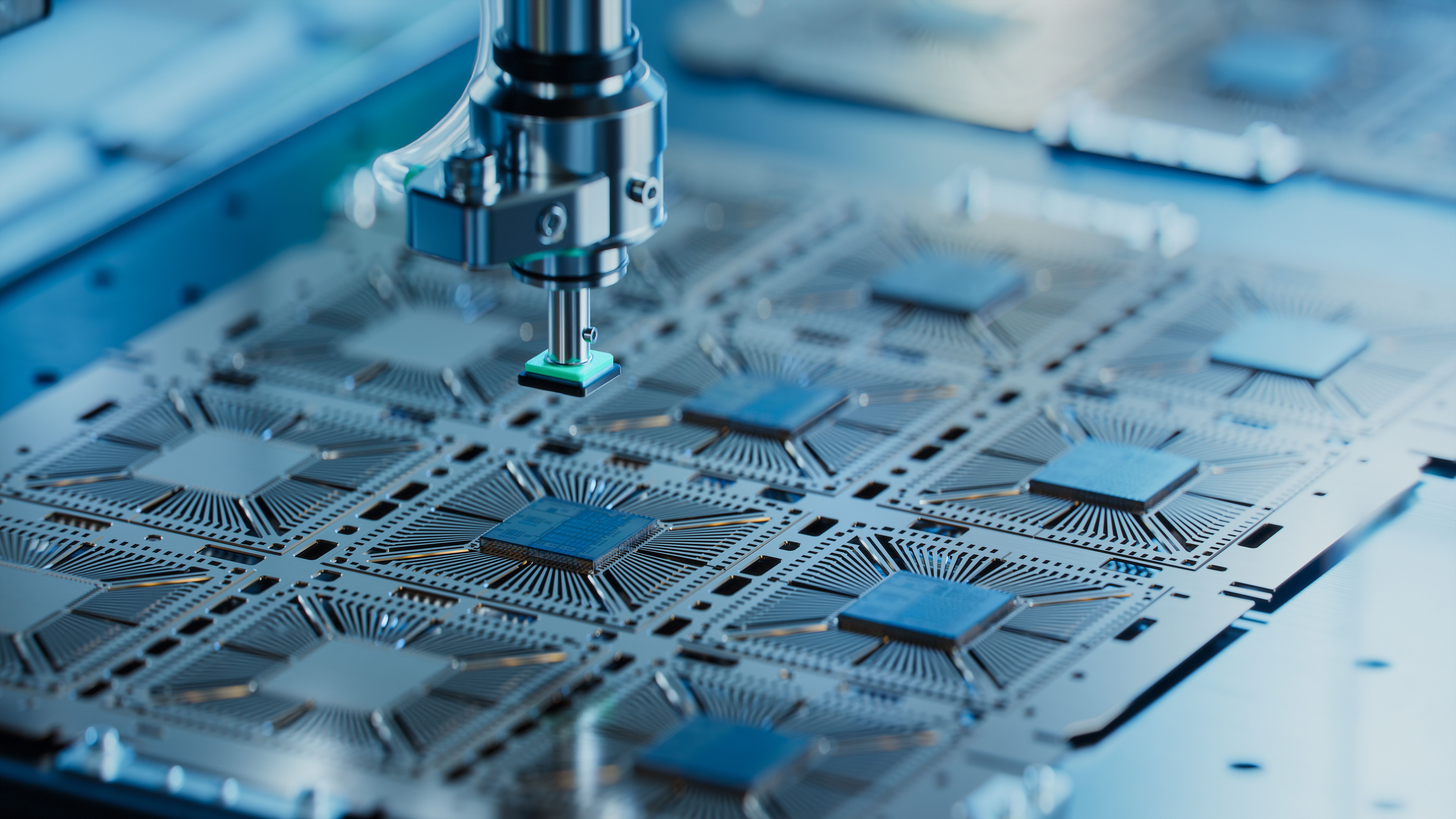

Axcelis Technologies specializes in ion implantation equipment, a critical component in semiconductor manufacturing. Its products include high-energy, high-current, and medium-current implanters, alongside aftermarket services such as maintenance, upgrades, and training.

The company derives revenue from direct equipment sales and ongoing service contracts, targeting semiconductor manufacturers globally. Its focus on a narrow technical niche-ion implantation-has established it as a reliable supplier to major industry players.

Foolish take

Investors, particularly those with long-term perspectives, often find opportunities in less visible sectors. Axcelis’ recent rise in Reinhart Partners’ portfolio suggests a belief in its long-term prospects, despite a 8% annual decline in stock value. The company’s specialization in a single, essential process within chip production-ion implantation-grants it a unique position in an industry dominated by broader equipment firms.

Its reliance on a narrow technical expertise, while limiting diversification, also creates a barrier to entry for competitors. As demand for power semiconductors grows-driven by electric vehicles and industrial applications-Axcelis may benefit from its established client base and recurring service revenue. Yet, its performance remains tethered to the cyclical nature of the semiconductor market.

Glossary

AUM: Total value of investments managed by a fund.

13F reportable AUM: Portion of a fund’s assets subject to quarterly SEC disclosure.

Post-trade stake: Holdings in a company after a transaction.

Aftermarket lifecycle services: Maintenance, upgrades, and support for equipment post-sale.

Ion implantation equipment: Tools that alter semiconductor material properties via ion bombardment.

Filing: Official document detailing financial activity.

Mission-critical: Essential to operational success.

TTM: Trailing twelve months.

Stake: Ownership interest in a company.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- Celebs Who Got Canceled for Questioning Pronoun Policies on Set

- Ethereum Flips Netflix: Crypto Drama Beats Binge-Watching! 🎬💰

- ONDO’s $840M Token Tsunami: Market Mayhem or Mermaid Magic? 🐚💥

- Games That Removed Content to Avoid Cultural Sensitivity Complaints

- Riot Platforms Sells $200M BTC: Funding AI or Desperation? 🤔

2025-10-31 05:13