The crypto market waddled into Wednesday like a penguin in a tuxedo-dapper but visibly nervous-as traders tiptoed around the FOMC decision and Powell’s impending press conference. Total market cap lounged near $3.82 trillion, with Bitcoin lounging at $112,900 and Ethereum nervously tapping its foot near $4,000. 🕵️♂️

Liquidity, meanwhile, was as thin as a butler’s patience at a tea party, while a $15 trillion earnings circus from Microsoft, Alphabet, Meta, Boeing, and Caterpillar threatened to upend the entire crypto teacup. 🤹♂️

TL;DR

- XRP could mimic HBAR’s ETF joyride 🚀 and rocket past $4.

- Ethereum’s Fusaka shindig 🎉 nears Dec 3.

- Sequans dumps 💸 $111M in Bitcoin to Coinbase pre-FOMC.

- Big Tech earnings + Powell = evening chaos. 🎭

XRP: ETF math points to $4.20

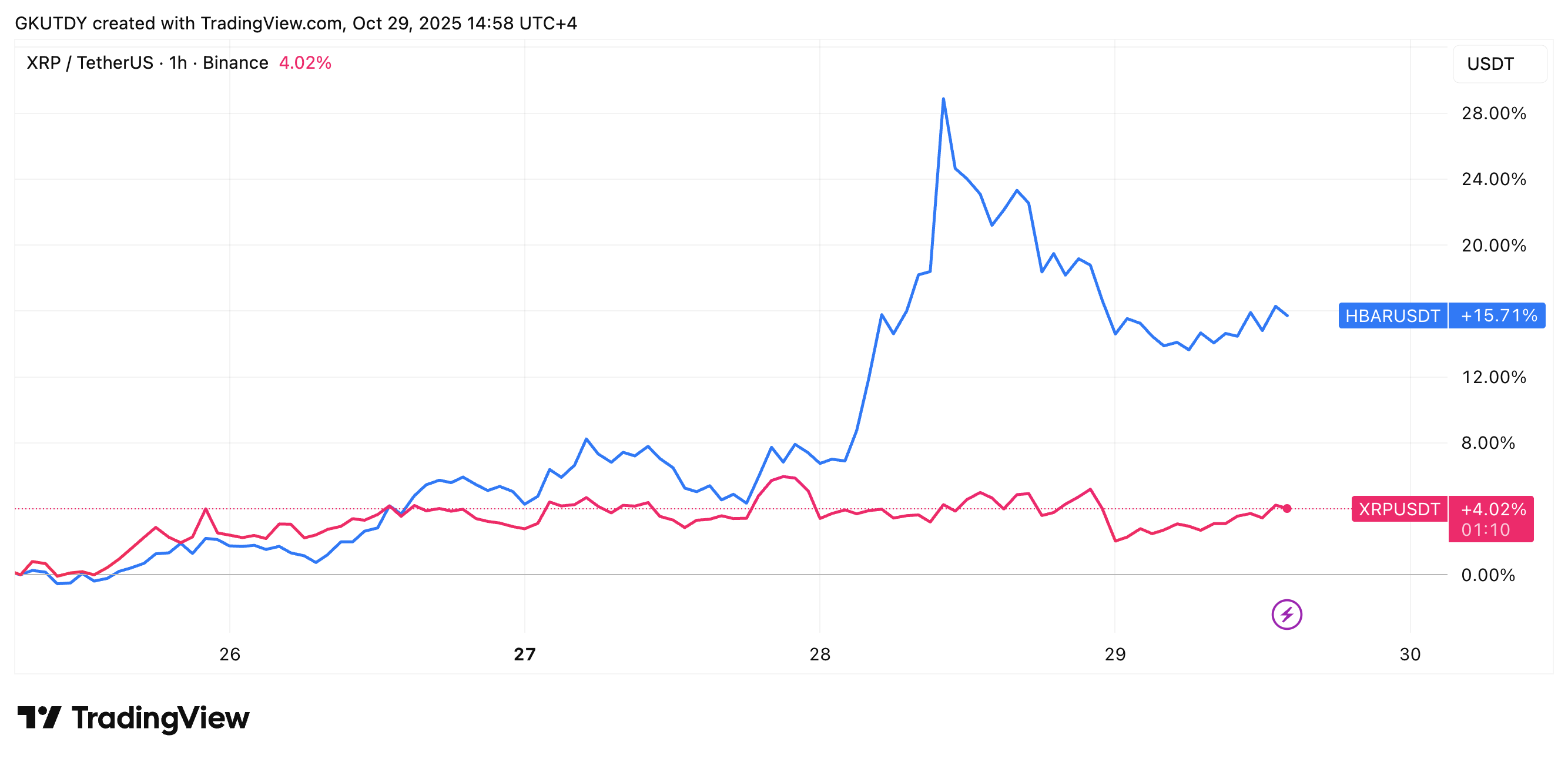

XRP lounges near $2.65, playing coy after a modest overnight flirtation. But the real gossip swirls around Hedera’s (HBAR) ETF approval shockwave 🌊, which hurled the coin 25.7% skyward like a champagne cork. Canary Capital’s ETF debut on NYSE saw HBAR leap from $0.1775 to $0.2052-on 182% volume growth, no less. 🍾

If XRP hijacks HBAR’s playbook, its $2.62 price tag could balloon to $3.29, casually strolling past $3 and eyeing $3.50-$4.20 like a cat eyeing a laser pointer. With Grayscale et al. waiting for SEC nods, traders are betting HBAR’s rally was a dry run for XRP’s institutional fireworks. 🧨

The $2.60 support band holds firm, but technical indicators whisper of $2.80-$3 retests. Break below $2.58, though, and the party’s over-unless you’re a bear with a penchant for schadenfreude. 🦘

Ethereum: Fusaka hard fork nears

Ethereum lingers just below $4,000 after two dramatic tumbles, waiting for a catalyst sharper than a vicar’s wit. Enter the Fusaka hard fork, scheduled for Dec 3 like a well-timed soufflé. 🧑🍳

The Hoodi testnet just aced its dress rehearsal, following Holesky and Sepolia’s performances. Fusaka’s upgrades? A smorgasbord of blockchain bling:

- EIP-7594 (PeerDAS): Data validation light, for validators who’ve had enough of heavy lifting. 🔧

- EIP-7825 / EIP-7935: Gas limit boosts and efficiency tweaks. 🚀

- Blob-expansion, security polish, and L2 throughput prep. 🛠️

This fork aims to cement Ethereum’s reign as the L2 settlement layer. With DeFi TVL creeping upward and gas fees back to mid-2024 levels, developers call Fusaka the “glue” for the next scaling chapter. Short term, ETH must hold $3,950 or risk a slide to $3,850. But the fork narrative’s got downside armor. 🛡️

Bitcoin: $111 million treasury sale raises red flag

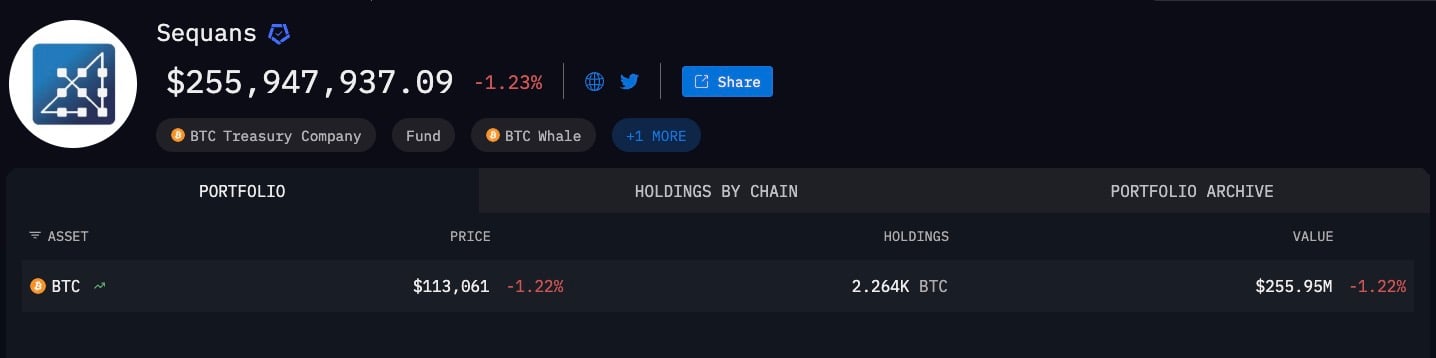

Bitcoin, after a brief $112K panic, lounges at $112,900 while Sequans Communications nonchalantly ships 970 BTC ($111M) to Coinbase. 🚚

This is Sequans’ first major BTC move since amassing 3,234 BTC (now $255M). Ranked 29th among corporate BTC holders, they’re no Strategy (640K BTC) or Tesla (11.5K BTC), but the timing screams “pre-emptive footloose maneuver.” 🕺

Corporate whales squirming before FOMC? Spooky. Resistance hovers at $113.5K, with $115K a fortress. Drop below $112K, and $110.8K becomes the new “hot single’s” chorus. 🎶

Evening outlook

The evening promises a collision of macroeconomic dread and corporate theater. FOMC’s verdict, Powell’s sermon, and Big Tech earnings will wallop risk assets like a piñata at a toddler’s birthday. 🎉

- Bitcoin: Hold $112K or face the abyss. Reclaim $113.5K for salvation. 🛐

- Ethereum: Guard $3,950. Breach $4,050? Cue $4,200 confetti. 🎊

- XRP: ETF buzz keeps $2.80-$3.00 on the menu. HBAR’s precedent? A GPS to $4. 🗺️

By Wall Street’s close, we’ll know if Powell’s scowl killed crypto’s buzz or ETF dreams and earnings lit the fuse. Today’s a binary firecracker, and the market’s perched on the fuse. 🎆

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2025-10-29 15:11