Hyperliquid’s recent surge has captured traders’ attention, as strong buy pressure and consistent buybacks continue to fuel its momentum. The HYPE token has reclaimed key resistance levels with impressive conviction, while rising on-chain activity and bullish technical signals. 🦄✨

Momentum Builds as Hyperliquid Tests Key Resistance

Hyperliquid continues to display strong momentum, confirming a clean breakout from its previous descending wedge. The price has reclaimed the $46 to $47 region and is now pressing against the 0.618 Fibonacci confluence near $50.7, which aligns with horizontal resistance. The MACD indicator has flipped bullish, showing expanding momentum and rising histogram bars, a sign of renewed buying pressure. 📈💥

A sustained breakout above $50.7 would likely open the door toward the next resistance at $60, marking a potential retest of the all-time high. As long as the structure maintains higher lows above $44 to $45, the broader trend remains decisively bullish, with the next impulse wave likely forming in the days ahead. 🚀🌌

On-Chain Catalysts Reinforce the Bullish Momentum

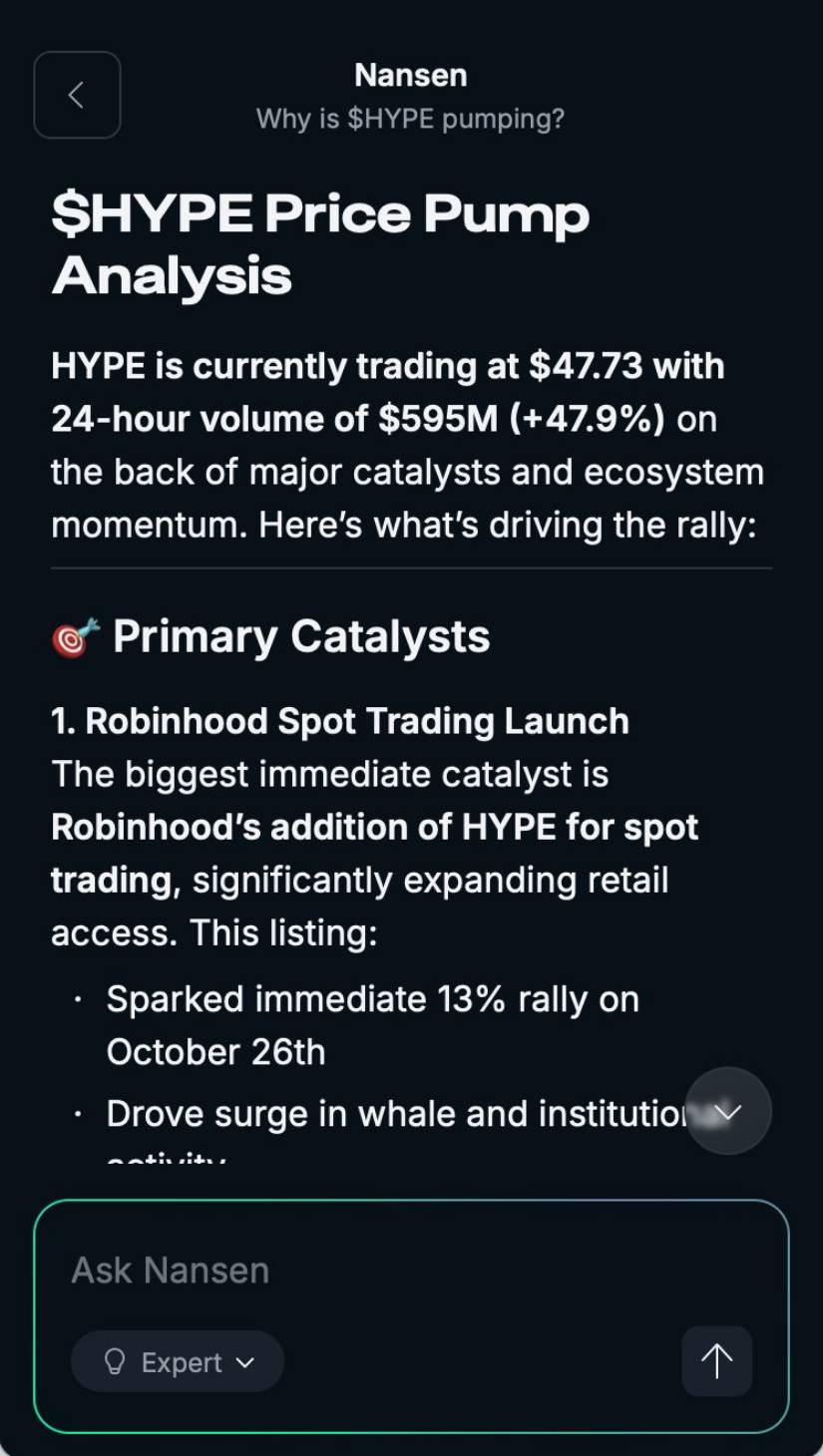

Nansen’s data reinforces Hyperliquid’s rally from a structural perspective. The asset’s Robinhood listing and HIP-3 upgrade have combined to create a surge in both retail and institutional demand. Over $595 million in daily trading volume has been recorded, highlighting significant inflow strength as shorts continue to close while whales maintain long exposure. 🐋💰

These developments illustrate that smart money remains engaged, and despite partial profit-taking, net accumulation persists. The combination of exchange listings, protocol upgrades, and liquidity expansion reflects an ecosystem-wide strengthening, suggesting Hyperliquid’s recent pump is backed by fundamental growth rather than speculative spikes. 🧠🚀

Retracements Could Offer Opportunities for Reload

StefanB’s technical setup presents two ideal reload zones for Hyperliquid near $40.26 and $33.40, with the latter aligning with previous breakout support. The broader structure continues to respect a pattern of higher lows, signaling an active accumulation phase rather than distribution. 🧭📉

If Hyperliquid breaks above $51.21, the move could accelerate sharply, potentially triggering the next leg higher. Conversely, dips into the lower bands would likely serve as accumulation opportunities, especially if volume stabilizes around those zones. 🌀💸

Consistent Buybacks Strengthen Long-Term Valuation

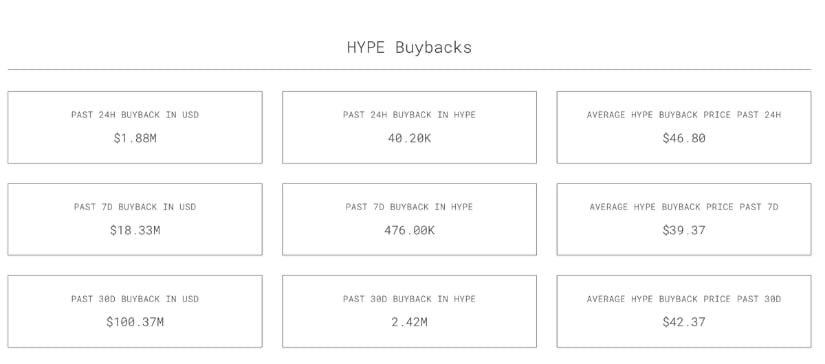

Tobias Reisner’s data confirms $1.8 million in buybacks over the past 24 hours and more than $100 million over the past 30 days, marking one of the most aggressive repurchase programs in the sector. The average buyback price sits around $46.80, showing strong institutional conviction even at current elevated levels. 🧱💼

Buybacks serve as a direct supply reduction mechanism, supporting price stability and reinforcing long-term investor confidence. Such consistent repurchases often act as an underlying price floor, making Hyperliquid’s market structure more resilient against volatility. If this pace continues, the cumulative supply reduction could meaningfully enhance Hyperliquid price prediction. 🛡️📈

Final Thoughts: Hyperliquid’s Structure Remains Firmly Bullish

Across both technical and on-chain dimensions, Hyperliquid’s setup remains robust. Rising volume, healthy MACD signals, strategic buybacks, and ecosystem upgrades are all converging to strengthen market confidence. 🤖📊

While minor pullbacks towards $40 to $44 may occur, these are more likely to serve as reloading points rather than breakdown signals. A decisive breakout above $50.7 would confirm bullish continuation, setting the stage for a Hyperliquid price prediction targeting the $60 mark. 🏁🏁

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Elden Ring Nightreign stats reveal FromSoftware survivorship bias, suggesting its “most deadly” world bosses had their numbers padded by bruised loot goblins

2025-10-28 17:19