KEY POINTS: 🧠💸🚀

Bitcoin has bounced back to around $115K, as if it’s just woken up from a particularly confusing nap. 🤔💸

Much of the upwards price momentum has happened not long after $160M+ worth of short liquidations. 🧨💥

Bitcoin could hit $120K and potentially surpass its $126K ATH by the end of the year according to Deepseek, marking another 4%-10% price increase over the following months. 📈🔮

Bitcoin Hyper could be the next altcoin hit thanks to its Layer-2 project, built for Bitcoin-focused DeFi integrations. 🧰🧙♂️

Bitcoin seems to be picking up after a shaky mid-October crash which saw over $19B in crypto liquidations. $BTC has pulled away from lows around $105K to a current price of $115K, and some analysts predict this is just the start of a more intense rally. 🚀💸

But what does artificial intelligence have to say? We asked Deepseek to predict the value of $BTC over the next few months following this upturn. This resulted in an interesting conversation. 🤖🧠

First off, Deepseek pointed out that this expected rally wouldn’t appear out of nowhere. Its underlying causes have already been identified by social media users. Yesterday, crypto content hub FOUR on X pointed out that $BTC is due to pump after breaking out of a consolidation zone formed by a descending triangle. 🧩📉

The $112K mark highlighted here is a key zone for $BTC shorts. After pushing over this point, the price raise for $BTC triggered $160M in short positions to be liquidated immediately. 💸💣

Over the course of October 26th, over $350M in $BTC short positions in total were cashed out, pushing the price of $BTC even higher. 💸📈

However, there’s something different about this period of $BTC activity compared to previous cycles. Deepseek also pointed out that retail investors are selling and much of the accumulation comes from existing long $BTC positions held by whales and institutions. 🐋🐟

FOUR, once again, seems to agree, with numbers to prove it. 📊📊

In the last year, retail accumulation has strictly trended downwards after a huge selloff in Q3 2024, while large investors have increased their $BTC holdings. If this trend continues, Deepseek predicts market scarcity will lead to a significant increase in the value of $BTC, potentially pushing the coin past its most recent $126K ATH on October 6. 🧠💰

While discussing the implications of $BTC’s long-term forecast, an emerging Bitcoin-focused crypto project, Bitcoin Hyper ($HYPER), could see a spike in retail interest. 🧙♂️🪙

It’s a project that’s overhauling the aging Bitcoin network with some Web3-ready capabilities, positioning itself within the Bitcoin ecosystem but giving the potential upside of a new altcoin hitting the market. Read on to see how Bitcoin Hyper could change Bitcoin in the near future. 🧰🚀

What’s the Deal with Bitcoin Hyper? 🧠🧩

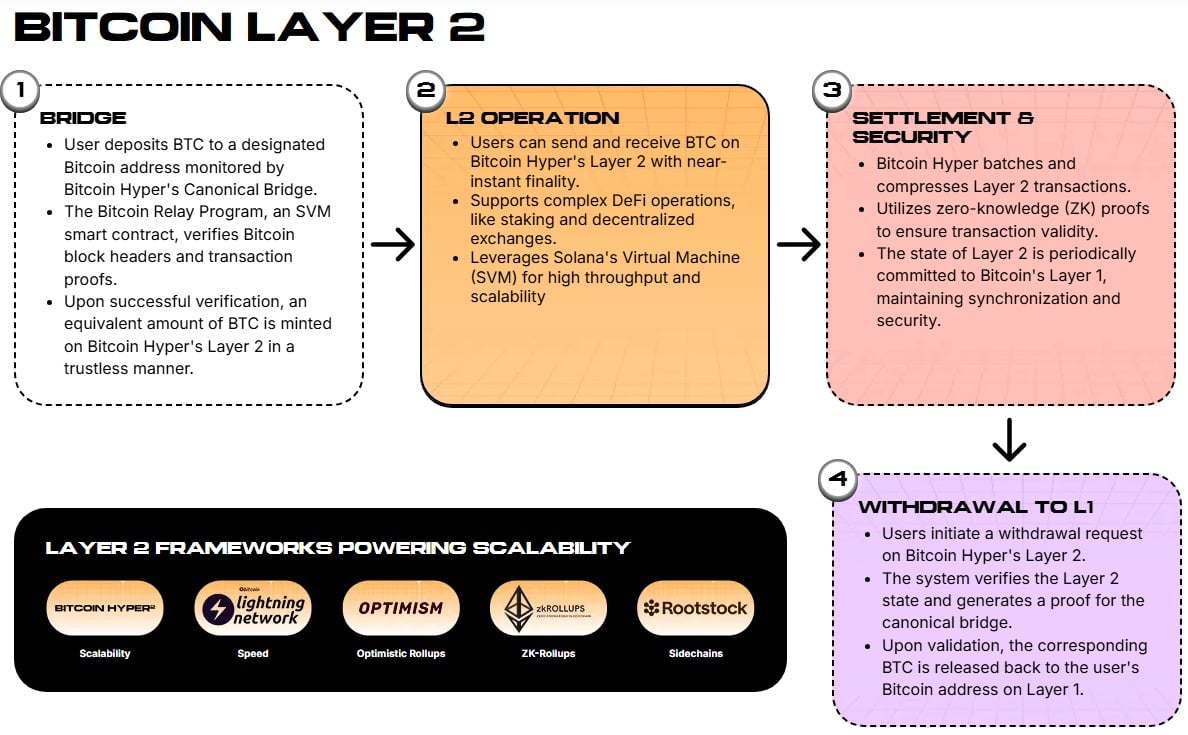

Bitcoin Hyper ($HYPER) is a new crypto presale with a daring project. It plans to add extra capabilities to the Bitcoin ecosystem with a Layer-2 (L2) solution that integrates the Solana Virtual Machine (SVM). 🧰⚡

This technology ensures Hyper’s L2 can deliver lower transaction fees and faster confirmation for $BTC holders bridging into the new network. 🚀💸

The changing landscape of Bitcoin ownership isn’t that surprising if you think about what $BTC is useful for. It’s great as a long-term store of value, yet retail crypto users are more likely to prefer Ethereum or Solana for day-to-day use. They’re faster to clear, cheaper to use, and support Web3 apps. 🧠🌐

Bitcoin Hyper’s upscaling solution could put Bitcoin on par with those blockchains, driving retail consumers back to $BTC. 🚀🧾

That’s because the integrated SVM uses Solana’s known scalability to offset congestion on the Bitcoin blockchain by offloading and recording transactions in a temporary ledger. 🧠🧩

These temporary transactions are periodically committed back to the Layer-1, keeping track of your $BTC while it’s in custody via the project’s canonical bridge. 🧠🔐

In the meantime, you can use your cross-minted wrapped $BTC ($wBTC) on Bitcoin Hyper to run dApps, lending protocols, DEX swaps, and other DeFi platforms running on Solana-style smart contracts. 🧠 decentralized finance 🧠

All you have to do is send $BTC to the Bridge address on the L1, and you’ll be sent newly-minted wrapped $BTC on the L2, where transactions clear for a fraction of the cost. 💸🚀

See our guide to buying $HYPER to learn more. 🧠🧩

Bitcoin Hyper ($HYPER): The 25M+ Crypto Presale Building It All 🧠🧩

The $HYPER token is the driving force behind this project. As the official utility token for Bitcoin Hyper’s ecosystem, it gives holders access to exclusive features, early dApps, and governance rights across the Bitcoin Hyper blockchain. 🧠 decentralized finance 🧠

When you do run those dApps, $HYPER will also reduce on-chain fees, letting you make the best of your DeFi trading and $wBTC. 💸🚀

Currently still on presale, the project has raised over $25M so far, even including major whale buys of $379.9K and $274K. 💸🐋

With a targeted token listing date sometime in Q4 2025/Q1 2026, and an optimistic $HYPER price forecast showing room for 11x potential growth, the hype is unsurprising. 🚀📈

It’s also a dynamic presale, so all this interest in $HYPER has pumped the token’s pre-market price up to $0.013175, not far away from the targeted listing price of $0.013225. 💸📈

Early buyers also get the opportunity to stake $HYPER for up to 47% in APY rewards. 🧠💰

Get $HYPER before the listing price locks in. 🚀💸

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2025-10-27 17:33