Ah, the sublime theater of bureaucracy! On a crisp October day in the year 2025, Energy Secretary Chris Wright, with a flourish worthy of a baroque courtier, dispatched a missive to the federal regulators. His demand? To truncate the interminable connection times for the grid from years to a mere 60 days. A proposal so audacious, one might suspect it was penned under the influence of a particularly potent espresso. 🌟

This, my dear reader, is no mere administrative trifle. It is a seismic shift in the way the ravenous tech behemoths-AI and Bitcoin miners-siphon the lifeblood of America’s power grid. As these titans of industry vie for the dwindling nectar of electricity, the demand surges with a ferocity unseen since the last great energy crisis. Or perhaps since the last time I tried to charge my electric toothbrush during a heatwave. 🔌

The Proposal, Unveiled with a Wink

Wright’s epistle to the Federal Energy Regulatory Commission (FERC) is a masterpiece of bureaucratic poetry. It beckons large electricity users-those with appetites exceeding 20 megawatts, enough to power a small metropolis or my uncle’s Christmas light display-to plug directly into the high-voltage veins of the grid. The plan, a veritable cornucopia of 13 principles, demands that these corporate leviathans fund their own network upgrades. In return, they are promised the sweet nectar of approval in just 60 days. A bargain, one might say, as fair as a coin toss in a hurricane. 🌪️

Wright, ever the optimist, insists this falls squarely within FERC’s purview and serves the public interest. He has graciously granted the regulators until April 30, 2026, to ponder his wisdom. One can only imagine the furrowed brows and furiously scribbled notes in the FERC offices. 📜

Why This Matters, or The Great Power Grab

America’s electricity demand is not merely growing; it is galloping, frothing at the mouth, like a stallion that has discovered Red Bull. Data centers, those silent sentinels of the digital age, guzzled 4.4% of the nation’s electricity in 2023. By 2028, they may devour between 6.7% and 12%. The numbers are as staggering as my last credit card bill after a particularly indulgent book-buying spree. 📈

From 58 terawatt-hours in 2014 to 176 in 2023, and projections soaring to 325 to 580 by 2028-driven, of course, by the insatiable maw of artificial intelligence. Wright, with a gravitas befitting a Shakespearean tragedian, declares that US electricity demand is “expected to grow at an extraordinary pace.” One might almost hear the grid whimpering in anticipation. 😱

Current rules, alas, are as cumbersome as a three-legged elephant. Companies face multi-year waits, and “phantom” data centers-those speculative mirages-clog the approval queue like a hairball in a drain. This, naturally, makes it harder for legitimate projects to proceed. A bureaucratic nightmare, if ever there was one. 👻

Bitcoin Miners: The Unlikely Beneficiaries

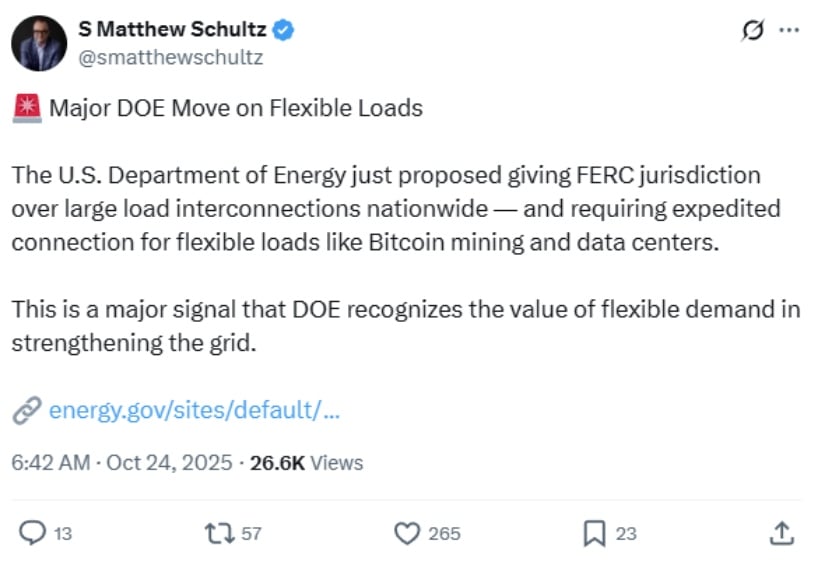

Ah, the Bitcoin miners! Those modern-day alchemists who transmute electricity into digital gold. They stand to gain the most from this regulatory reshuffling. Their operations, requiring more power than a small nation, could flourish under these new rules. S. Matthew Schultz, CEO of CleanSpark, hails the proposal as “a major signal”-a beacon of hope in a world where energy is the new currency. 💰

US Bitcoin miners already command over 5 gigawatts of power, with another 6 gigawatts in the pipeline. Direct access to transmission lines could grant them cheaper electricity, particularly in regions awash with renewable energy. A win-win, unless you’re a polar bear. 🐻❄️

Yet, the miners face their own trials. The April 2024 “halving” event slashed their rewards, forcing many to pivot toward hosting AI computing. A marriage of convenience, if ever there was one. 💍

The Trump Administration’s Crypto Crusade

This proposal is but a single note in the grand symphony of President Trump’s pro-cryptocurrency agenda. Trump, ever the showman, has declared his desire to see all remaining Bitcoin “mined, minted, and made in the USA.” An “America First” approach, as subtle as a brick through a stained-glass window. 🧱

In January 2025, he signed an executive order supporting digital assets and blockchain technology, establishing a working group to navigate the regulatory labyrinth. The administration views Bitcoin mining as both an economic boon and a means to monetize surplus power, all while stabilizing the grid. A trifecta of ambition, if not necessarily of wisdom. 🎩

Concerns and Pushback: The Naysayers’ Chorus

Not everyone is enamored with this plan. Environmental groups, those perennial Cassandras, warn of the carbon emissions from energy-intensive operations. Camden Weber of the Center for Biological Diversity accuses FERC of potentially “rubber-stamping connections in just 60 days.” A damning indictment, or perhaps just a healthy dose of skepticism. 🌍

Policymakers, too, raise their eyebrows. Does FERC truly possess the legal authority to regulate large load connections in this manner? Traditionally, such matters have been the domain of the states. A jurisdictional quagmire, as murky as a pond after a rainstorm. 🌧️

Consumer advocates fret about electricity prices. Data centers are already driving up costs in some regions. If these facilities gain priority access, might ordinary customers be left holding the bill? A question as fraught as a family gathering during an election year. 💸

And then there are the practical concerns. Can the system truly process applications in 60 days while ensuring safety and reliability? Critics warn of potential pitfalls, like a tightrope walker without a net. 🪢

A Battle for Power: AI vs. Bitcoin

The rivalry between AI companies and Bitcoin miners is as intense as a chess match between two grandmasters. Both demand vast amounts of power; both seek out cheap, clean energy sources. JPMorgan analysts predict that Bitcoin miners have a nine-month window to secure deals with AI companies before the opportunity slips away. A high-stakes game of musical chairs, if ever there was one. ♟️

Some miners are already emerging victorious. Core Scientific’s stock soared 272% after securing contracts with AI infrastructure provider CoreWeave. A strategic move, as cunning as a fox in a henhouse. 🦊

The stakes are astronomical. By 2030, US power demand from data centers could reach 84 gigawatts-up from a mere 4 gigawatts in 2024. The question lingers: Can the grid withstand this onslaught, and who will be first in line? 🌪️

The Road Ahead: A Regulatory Tightrope

Wright’s proposal sets a six-month deadline for FERC’s response. If approved, the new rules could revolutionize how large power users connect to the grid. FERC commissioners, divided in their opinions, now face a 3-2 Republican majority-a tilt that may favor the proposal’s business-friendly ethos. 🏛️

Whatever FERC decides will shape America’s future in AI and cryptocurrency mining. Will the grid become a bottleneck for innovation, or will it rise to the challenge? Only time, and perhaps a bit of bureaucratic magic, will tell. 🕰️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-25 01:52