In the grand theater of markets, where fortunes rise and fall with the whims of the crowd, a curious spectacle unfolds. Behold, the mighty Bitcoin, its volatility clinging like a stubborn guest at a party long past its prime, while the S&P 500’s VIX, that fickle barometer of fear, retreats with the grace of a pardoned criminal. 🕰️

What to know:

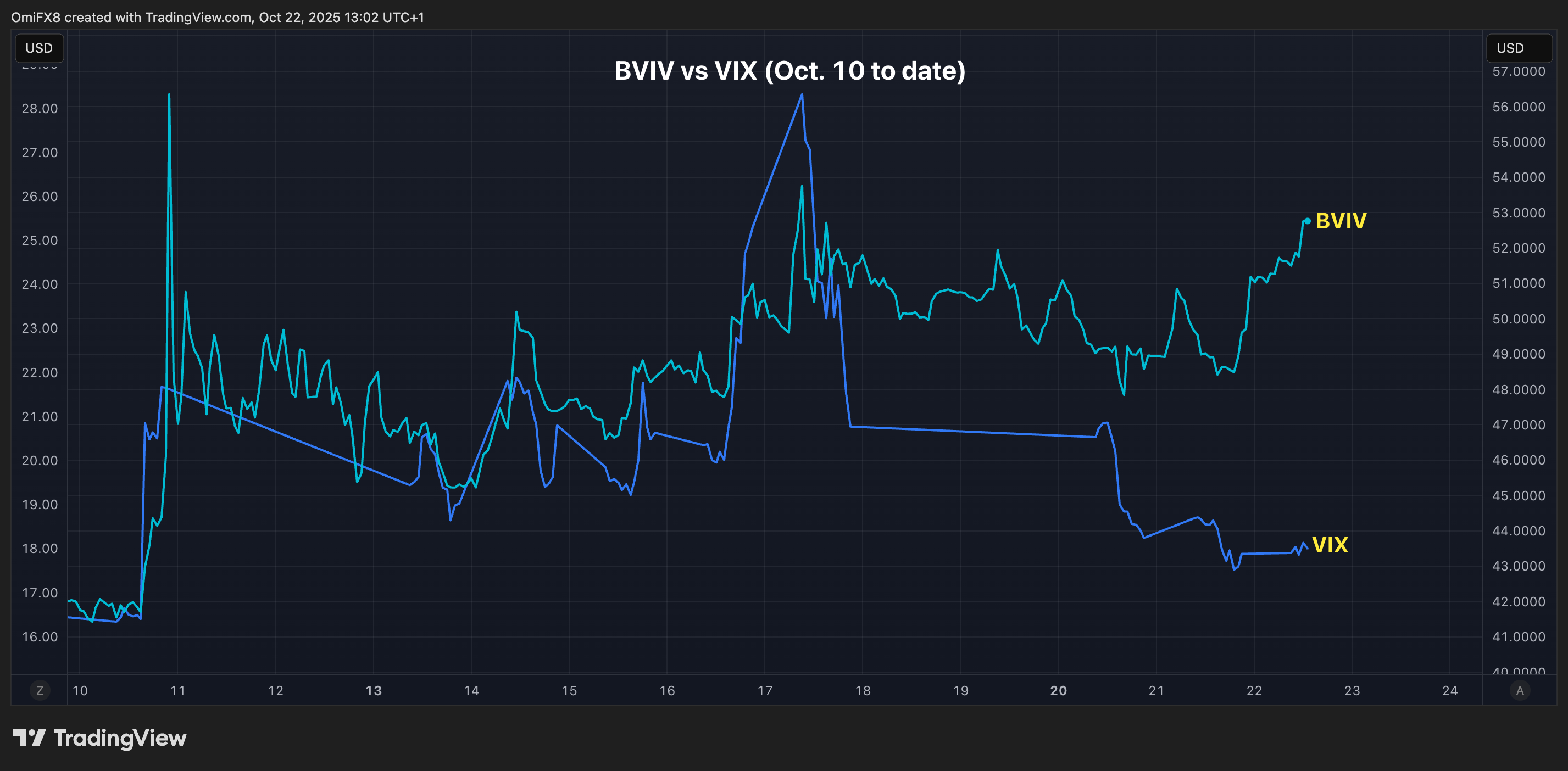

- BTC‘s 30-day implied volatility remains elevated, a relic of the October 10th crash, when the world briefly remembered it was mortal. 😱

- The S&P 500 VIX, meanwhile, has reversed its spike, as if nothing happened. How convenient. 🙄

- BTC’s divergence stems from the pricing of new risks, such as auto-deleveraging and liquidity issues-because nothing says “stability” like a system that eats its own tail. 🐍

Ah, Bitcoin, that enfant terrible of finance, whose volatility index clings to its highs like a miser to his gold. Meanwhile, the S&P 500’s VIX, Wall Street’s primary fear gauge, has calmed itself, as if the world had not just witnessed a market tantrum of epic proportions. How quaint. 🌪️

Observers, those wise sages of hindsight, attribute Bitcoin’s sticky volatility to concerns around auto-deleveraging and poor market liquidity. Because, of course, nothing soothes the soul like the prospect of your profitable positions being sacrificed to the gods of solvency. 🛐

The Oct. 10 Vol Spike and Stickiness in BTC

On that fateful day, when President Donald Trump announced tariffs on China, the markets panicked as if the sky were falling. Stocks and cryptocurrencies tumbled, and Bitcoin’s price fell from $122,000 to $104,000. Its annualized 30-day implied volatility surged from 40% to 60%, a spike that has since stabilized above 50%. Meanwhile, the VIX, that fickle creature, has fallen back below 20%, as if October 10th were but a bad dream. 😴

The index, represented by Volmex Finance’s BVIV, stands as a monument to the market’s enduring anxiety, while the VIX erases its spike with the ease of a politician changing stances. How predictable. 🎭

ADL Risks

The divergence, we are told, is due to traders pricing new risks in the crypto market. Yoann Turpin, co-founder of the crypto market-making firm Wintermute, explains: “Bitcoin volatility was subdued earlier, characterized by regular premium selling as market participants sought to generate yield. It has now become clear that new risks and market dynamics-such as ADL (auto-deleveraging)-were underestimated and are now being fully priced in.” Because nothing says “innovation” like a system that cannibalizes itself. 🦖

Auto-deleveraging, that final act of desperation, is triggered when an exchange’s insurance funds and liquidation procedures prove insufficient. The system then reduces or closes profitable opposing positions to maintain solvency, effectively socializing losses. How socialist of it! 🤑

During the October 10th crash, several exchanges, including the decentralized giant Hyperliquid, activated ADL to force-close leveraged short bets. The crash etched ADL risks into investors’ psyche, a reminder that in the crypto world, even profits are not safe. 🪦

Turpin expects volatility to remain elevated only if BTC rallies to new highs or lows outside the $100,000-$125,000 range. Because, of course, stability is for the weak. 💪

Liquidity Issues

Liquidity, that elusive siren of the markets, refers to the ease with which digital assets can be bought or sold without causing significant price changes. When liquidity is high, the market is stable; when it dries up, even small orders can cause wild swings. The October 10th panic, partly catalyzed by Binance‘s infrastructure breakdown, has left liquidity thin, setting the stage for a new high-volatility regime. 🌊

Jimmy Yang, co-founder of Orbit Markets, notes: “With many spot liquidity providers hurt during the crash, market depth has thinned, leaving prices more prone to large swings.” Because nothing says “trust” like a market that can be moved by a sneeze. 🤧

Griffin Ardern, head of BloFin Research and Options, blames tightening fiat liquidity conditions in offshore markets for elevated BTC volatility. “The Hong Kong dollar’s overnight lending rate has returned to its pre-May level, while the DXY has risen. This is a clear sign of tight liquidity, which often triggers volatility.” Because, of course, the offshore market is where the real action is. 🌍

And so, we are left with a market that is both fragile and resilient, a testament to human greed and fear. Bitcoin’s volatility remains sticky, a reminder that in the world of finance, the only constant is change. Or, as the great Tolstoy might say, “All markets are great because they are simple, and all are terrible because they are complicated.” 🧐

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-10-22 16:22