What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

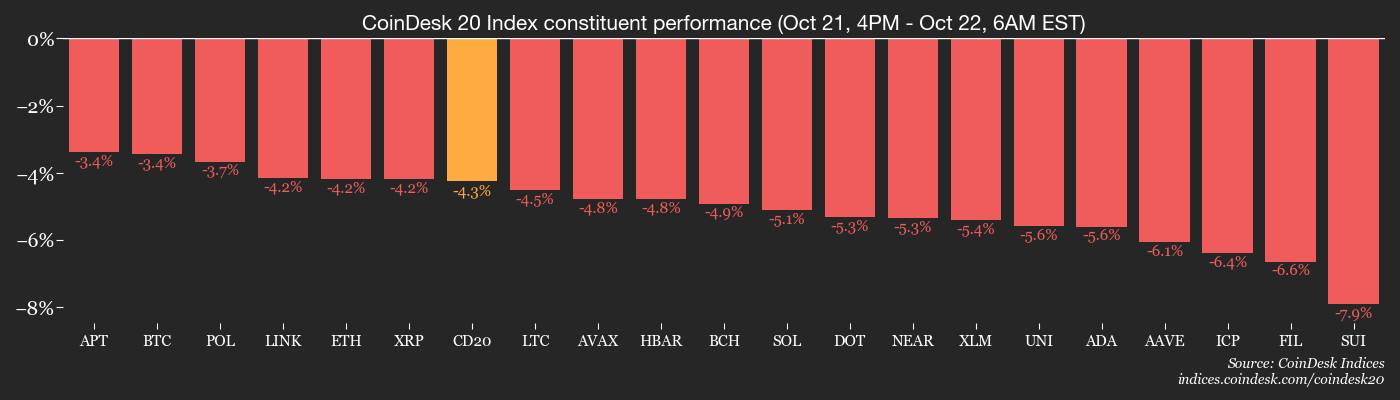

Well, shucks, the crypto market’s been acting like a squirrel on a caffeine binge-all twitchy and unpredictable. Bitcoin’s little Tuesday tango to $114,000 was about as lasting as a snowball in Hades, and the altcoins followed suit like lemmings off a cliff. The CoinDesk 20 Index is sitting there, twiddling its thumbs, while gold’s rally hit the brakes faster than a mule seeing a cactus. 🤠

Meanwhile, $600 million in crypto futures bets got liquidated faster than a politician’s promise. CryptoQuant calls it a “three-sigma event”-fancy talk for “holy moly, that’s a lot of volatility!” 🌪️

Open interest in bitcoin options is higher than a kite in a tornado, and implied volatility indices are through the roof. Alex Kuptsikevich, the FxPro chief market analyst, says this ain’t exactly a picnic for crypto investors. 🧺

But hey, the Crypto Fear & Greed index is at 25-that’s “buy when everyone’s scared” territory, or maybe just a prelude to a bigger sell-off. Who knows? 🤷♂️

In other news, Japan’s new PM Sanae Takaichi is cooking up an economic stimulus stew bigger than last year’s. Arthur Hayes thinks this’ll give BTC a kick in the pants. 🍲

FalconX is gobbling up 21Shares like a kid with a candy bar, and Asia’s stock exchanges are giving digital assets the side-eye. 🍬

Traditional markets? Dollar’s holding steady, gold’s taking a nap, and the Nikkei’s just chilling. Stay alert, folks! 🦉

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 2 of 2: Zebu Live (London)

- Day 1 of 2: London Blockchain Conference

Token Talk

By Oliver Knight

- Zcash (ZEC) is the belle of the ball, up 9.2% in 24 hours and a whopping 461% in the past month. That’s what happens when shielded tokens get all the attention-27.5% of the supply is now hidden away like a pirate’s treasure. 🏴☠️

- Shielding? That’s crypto-speak for “nobody’s business but yours.” And with less supply floating around, demand’s gone through the roof. 🚀

- Meanwhile, ASTER’s in the gutter, and plasma tokens are yesterday’s news. ZEC’s the only one dancing in this crypto hoedown. 💃

Derivatives Positioning

- ZEC futures open interest is up 22%-that’s $303 million in bets. ENA, BCH, HYPE, ADA, AVAX, and BTC are tagging along for the ride. 🎢

- LINK, XPL, and PUMP? Not so much. Investors are running scared like cats in a thunderstorm. 🐱⛈️

- Funding rates are near zero-derivatives market’s as balanced as a tightrope walker. 🪜

- Sell orders are piling up around $111K for BTC on Binance, and CME’s ether futures hit a record 2.43 million ETH. BTC’s lagging, though-institutions prefer ETH these days. 🤔

- Deribit’s seeing short strangles and call overwriting in BTC, while ETH’s all about put spreads and calendar spreads. Wintermute’s got their eye on it. 🕵️♂️

Market Movements

- BTC: Down 2.59% at $108,002.87 (24hrs: -0.51%) 💰

- ETH: Down 3% at $3,838.34 (24hrs: -0.98%) 🦄

- CoinDesk 20: Down 3.3% at 3,549.42 (24hrs: -0.78%) 📉

- DXY: Unchanged at 99.01 🧮

- Gold: Down 0.7% at $4,080.50 🏅

- Nikkei 225: Closed unchanged at 49,307.79 📈

Bitcoin Stats

- BTC Dominance: 59.75% (unchanged) 👑

- Hashrate: 1,107 EH/s (7-day avg) 💻

- Total fees: 2.95 BTC / $324,895 💸

Technical Analysis

- BTC’s 30-day implied volatility indices are higher than a kite in a hurricane. Buckle up, buttercup! 🎢

Crypto Equities

- Coinbase (COIN): Down 1.5% at $338.62 (-2.02% pre-market) 📉

- Galaxy Digital (GLXY): Up 8.1% at $42.86 (-5.27% pre-market) 🚀

ETF Flows

Spot BTC ETFs

- Daily net flows: $477.2 million 💰

- Cumulative net flows: $61.94 billion 🤑

Spot ETH ETFs

- Daily net flows: $141.7 million 💵

- Cumulative net flows: $14.61 billion 🧲

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-10-22 15:08