Billionaires, those modern-day alchemists of capitalism, have a curious habit: they often chase the same shiny object while pretending to disagree about which color it should be. Take David Tepper, Michael Platt, and Philippe Laffont-three hedge fund magicians who, like lemmings with a secret agenda, piled into the same AI stock this quarter. What’s the deal? Let’s investigate this financial farce with the gravity of a man who just remembered he left the oven on. 🔥

This particular stock isn’t just riding the AI gravy train-it’s building the tracks. Revenue growth? Double-digit? Triple-digit? Please, it’s more like “quadruple-digit” if you squint and ignore the math. Analysts whisper this sector could grow into a trillion-dollar pie, and our hero company-let’s call it “Nvidia” for now-is the only chef with a flamethrower and a business degree. (Spoiler: the pie is gluten-free, and it tastes like money.)

Should you follow these billionaires into the AI abyss? Well, if you’ve ever trusted a man in a suit who says “synergy,” then you’re already halfway there. But let’s not pretend this is a comedy of errors-this is a comedy of opportunity. Let’s break down the numbers, shall we?

Why Billionaires? Because They’re Just Like Us… Except Richer

Why should we care what billionaires do? Simple: they’ve spent decades playing the stock market like a piano made of money. Sure, some of them lost their shirts in the 2008 fiasco, but let’s not dwell on that. Let’s focus on the fact that Tepper, Platt, and Laffont are now holding hands with Nvidia. (Not literally, unless you count billions in assets as a form of tactile affection.)

Tepper, the man who owns the Carolina Panthers, is also a wizard with $6.4 billion in 13F securities. Platt runs BlueCrest, a fund so European it smells like espresso and existential dread. Laffont? He’s the tech bro with $35 billion and a portfolio that probably includes a Tesla and a time machine. (We’re still waiting on the patent.)

From $4 Trillion to $10 Trillion: A Journey in Three Acts

These investors recently bought shares in Nvidia, the AI chip titan that just passed $4 trillion in market cap. My prediction? By the end of the decade, it’ll be $10 trillion-or a “deca-trillion,” if you prefer. (Yes, I just invented that word. Mel Brooks would be proud.)

- Tepper boosted his Nvidia stake by 483%-because 483% is the new 100%. Now it’s 4.2% of his portfolio. That’s like saying 4.2% of your Netflix queue is just reruns of “The Crown.”

- Platt opened a position with 649,956 shares. At 3.9% of his portfolio, it’s the financial equivalent of ordering a salad in a world of steak. But hey, balance is key!

- Laffont cranked up his Nvidia holdings by 34%, now owning 5% of his portfolio. That’s like putting 5% of your wardrobe in a single color-bold, but risky if trends change.

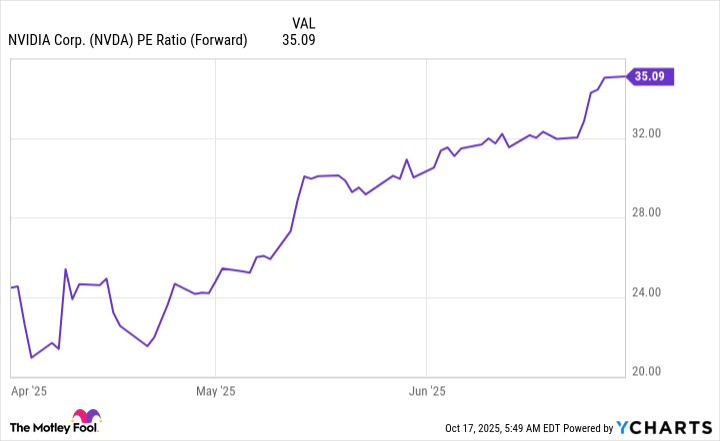

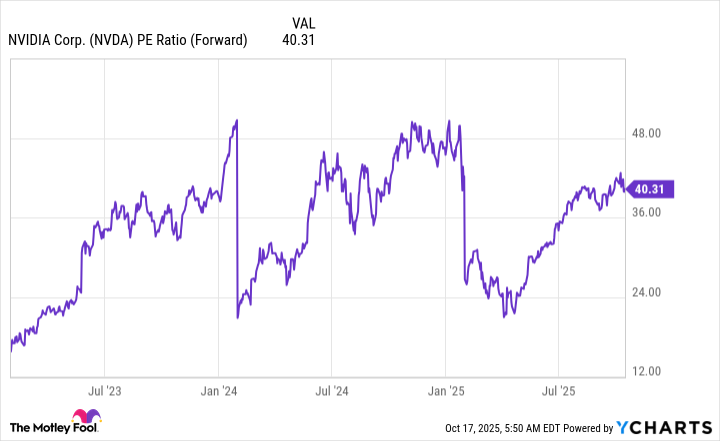

These billionaires might have snatched Nvidia during a dip-when the stock traded at 24x forward earnings. That’s the financial equivalent of finding a $50 bill in an ATM. (Spoiler: it’s not real.) Now, it’s trading at 40x, which is still cheaper than a Tesla Model S. (But not by much.)

Is This Stock for You? Or for Your Grandkids?

Should you follow the billionaires into Nvidia? Well, if you’re a cautious investor, this is like jumping off a cliff with a parachute made of bubble wrap. But if you’re an aggressive investor? It’s the financial equivalent of a standing ovation at a stand-up comedy show. Just don’t forget to diversify-your portfolio shouldn’t be a one-trick pony, even if that trick involves GPUs and AI.

Nvidia’s positioned to benefit from the AI infrastructure boom. When customers need compute power, they turn to Nvidia’s GPUs-because who needs sleep when you can train neural networks for 24 hours straight? (Spoiler: no one, but the GPUs don’t know that.)

Remember, investing is a long game. Buy and hold for five years, and you might just outlive the hype cycle. And if Nvidia hits $10 trillion? Consider this: even if you bought in at today’s price, you’d still be grinning like a Cheshire cat in 2030. (Minus the 20% tax, of course.)

So, should you follow the billionaires? Only if you’re ready to ride the AI rollercoaster in a tuxedo. And if you’re not, maybe invest in something less volatile-like a savings account. But where’s the fun in that? 😄

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-21 04:02