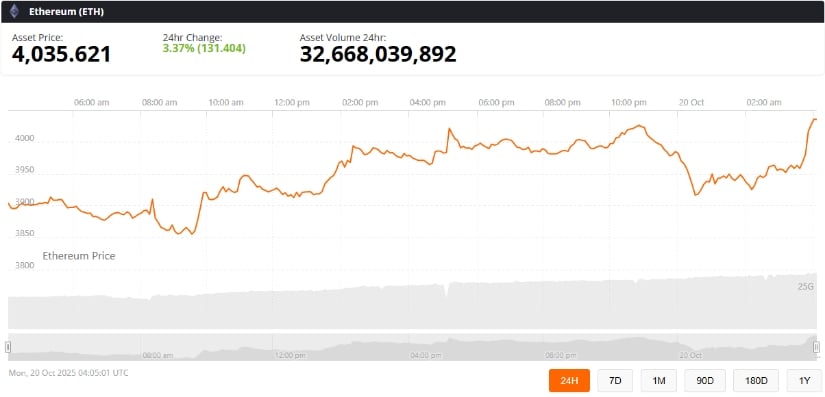

After what feels like an eternity of market doldrums, Ethereum is showing signs of life. Traders, having spent months licking their wounds from the last big crash, are starting to get that excited glint in their eyes again. The reason? A decline in open interest and the formation of a bullish pennant, which is the cryptic equivalent of a “watch this space” sign. It’s like that moment when you’re watching a movie, and the music starts building-something big is coming. Maybe Ethereum is about to hit that next major uptrend phase? 🤞

Ethereum’s Open Interest Reset Points to Healthier Market Structure

Ethereum (ETH) seems to have caught its second wind after a prolonged period of market speculation. According to on-chain data, Ethereum’s open interest (OI)-the amount of money tied up in speculative futures contracts-has plummeted. We’re talking a 37% drop, from a peak of $30 billion to a humble $19 billion. But here’s the kicker: while OI is down, ETH price has only fallen about 20% from its $4,000 high. Talk about a healthy correction, right? 🏋️♂️

Crypto analyst @TedPillows described this trend as “very bullish,” noting that less speculation means room for ETH to soar-maybe up to $5,500 or even $6,000-without causing a major market freak-out. And no one wants another crypto meltdown, trust me.

The drop in OI means the wild speculators have likely been shaken out, leaving the more stable spot buyers and long-term holders at the wheel. Historically, these kinds of resets have preceded some serious Ethereum rallies-50%, 100% price bumps. So yeah, the vibes are good right now. ✨

Technical Outlook: A 2017-Style Bullish Pennant Formation

If you’ve been around the crypto scene long enough, you know a bullish pennant when you see one. Ethereum’s monthly chart is currently drawing one, and it’s looking suspiciously like the setup we saw in 2017 before that wild breakout. Technical analyst Merlijn The Trader is calling this “the most explosive setup since 2017.” And let’s be real, if cycles didn’t repeat themselves, we’d all be living in a utopia, right? (Spoiler: we’re not.)

This pennant, formed by the converging trendlines since Ethereum’s 2021 peak, looks an awful lot like the consolidation that came before the 2017 breakout-when ETH surged from a mere $10 to a whopping $1,400. If the pattern holds, analysts are cautiously whispering about a potential upside target of $8,000. But, you know, no pressure. 😉

Ethereum’s current price hover around $3,900 to $4,100 seems to line up with key technical levels we’ve seen during previous cycle reversals. But here’s the catch: ETH needs to break above $4,200 for the bullish case to gain more traction. For now, it’s like trying to push through a party’s velvet rope-someone’s gotta let you in.

Cycle Patterns Reinforce Long-Term Bullish Structure

Ah, the beauty of market cycles. The key to understanding Ethereum’s long-term prospects is remembering its past cycles. According to analyst @EtherNasyonaL, Ethereum revisits major demand zones before it goes parabolic. In other words, it’s like that friend who says they’re “just getting started” when they’re already half a bottle of wine deep. Ethereum’s current demand zone? Somewhere between $2,000 and $3,000. That’s right-Ethereum might be gearing up for another mind-blowing, rocket-like rally. Buckle up. 🚀

The pattern looks strikingly similar to previous cycles, so the bullish thesis is looking solid. Plus, there’s strong institutional interest, with some projecting up to $2-3 billion in ETF inflows by Q4 2025. Ethereum’s still in its early stages of a potential monster rally. Fingers crossed we don’t hit a pothole along the way. 🙄

Looking Ahead: A Clean Slate for Ethereum’s Next Major Move

All signs are pointing to a potential macro breakout for Ethereum. With a drop in open interest and the formation of a textbook pennant, Ethereum is building a solid foundation for some serious price action. It’s like the crypto version of “get ready for the real show.”

With reduced speculation, stronger institutional backing, and favorable cycle alignment, Ethereum could very well be heading for the $8,000 mark. But, of course, it’s all up to whether the market can keep the momentum going. Let’s hope ETH doesn’t pull a Houdini and disappear into the ether. ✨

As traders anxiously watch, Ethereum remains the focus of bullish speculation. For long-term holders, this is not a moment of panic, but rather an opportunity to sit back and let the crypto winds do their thing. Good luck out there, folks.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-20 23:35