The S&P 500 sank like a stone in a hurricane, flirting with bear market territory like a drunk man at a funeral. But here we are, watching the index bounce back with the resilience of a cockroach in a nuclear meltdown. Some corporations followed suit-Alphabet and Walmart, the two dividend darlings, turned their ships around with the grace of a drunken sailor dodging a bullet.

These two stocks? They’re not just rebounding-they’re doing a backflip over a minefield. And the best part? You can still jump on the train, provided you don’t trip over your own feet. Here’s the lowdown, straight from the front lines of the financial apocalypse.

1. Alphabet

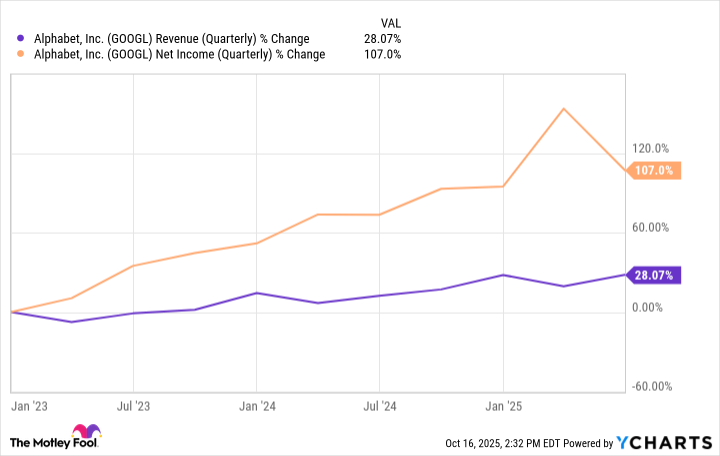

Alphabet spent the first half of the year flailing like a fish out of water, battling market volatility and a parade of company-specific nightmares. But then-BOOM-shares took off like a rocket fueled by moonshine and quantum physics, climbing 58% in six months. The antitrust lawsuit? A specter banished by the ghost of Jeff Bezos. The tech giant’s ad business? Still the king of the hill, even as AI chatbots try to steal its crown.

Yes, tariffs are the tax man with a crowbar, but Alphabet’s ad empire is built on sand, not brick. Its cloud computing? Growing faster than a teenager in a gym. And let’s not forget the autonomous vehicles-because nothing says “future-proof” like a self-driving pizza delivery robot. Oh, and the dividend? A brand-new toy for investors, but one that’s already sparking joy in the pockets of the brave.

Alphabet’s AI overviews and search modes? A mad scientist’s dream, but one that’s already paying dividends. The company’s dominance in search? A death grip on the ad business, unshakable as a drunk man’s grip on a whiskey bottle.

Its cloud division? A rocket ship with no brakes. And the dividend? A shiny new penny in a world of rusted coins. Reinvest it, and you’ll be laughing all the way to the bank-assuming the bank hasn’t been taken over by robots yet.

2. Walmart

Walmart’s shares took a nosedive earlier this year, hitting rock bottom on April 8 like a sad clown at a funeral. But since then? A 29% rebound, because nothing says “resilience” like a discount retailer with 5,200 locations. It’s a fortress of consumerism, with 90% of Americans within 10 miles. That’s not a statistic-that’s a weapon.

Tariffs? A tax man with a crowbar, but Walmart’s got a bigger stick. Its warehouses and Sam’s Club? A membership model so tight, it’s like a secret society for bargain hunters. Consumers may be tightening their belts, but when they need to spend? Walmart’s the only game in town, offering everything from cat food to quantum physics at prices that make your wallet weep with joy.

WMT“>[stock-chart symbol=”NYSE:WMT” f_id=”206096″ language=”en”]

Walmart’s survival? A testament to its adaptability. While other retailers crumbled like wet paper, Walmart evolved. It’s the ultimate survivor, a company that’s learned to dance with the future without losing its step. And the dividend? A 53-year streak of raises, making it a Dividend King for the ages.

So here we are, staring into the abyss of the market, and these two stocks? They’re not just surviving-they’re thriving. A trader’s dream, a gambler’s prayer, and a reminder that even in chaos, there’s always a way to make money. Just don’t forget to check the toilet paper supply before the apocalypse hits.

🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-20 17:37