Ah, the mighty Bitcoin, dancing its digital jig-one day soaring higher than a kite at a banker’s picnic, the next tumbling faster than a clumsy toff at a garden party. As it wriggles and jigs after its weekend alcopop, the market sentiment is flickering brighter than Uncle Basil’s trousers on a sunny day. Yet, despite this cheerful swaying, the ghost of bearishness lurks like a mischievous butler waiting to pounce-especially after that splendid October 10 liquidation boogie.

Hold Your Hats-The Big Fish Are Waiting Below $90,000

Right now, Bitcoin’s hanging about over the $100,000 mark-quite the feat, considering it’s had more crashes than an overcrowded dance floor at a June garden fete. Down over 10% from its £126,000 peak in early October, it’s still got enough bravado to make a hacker blush.

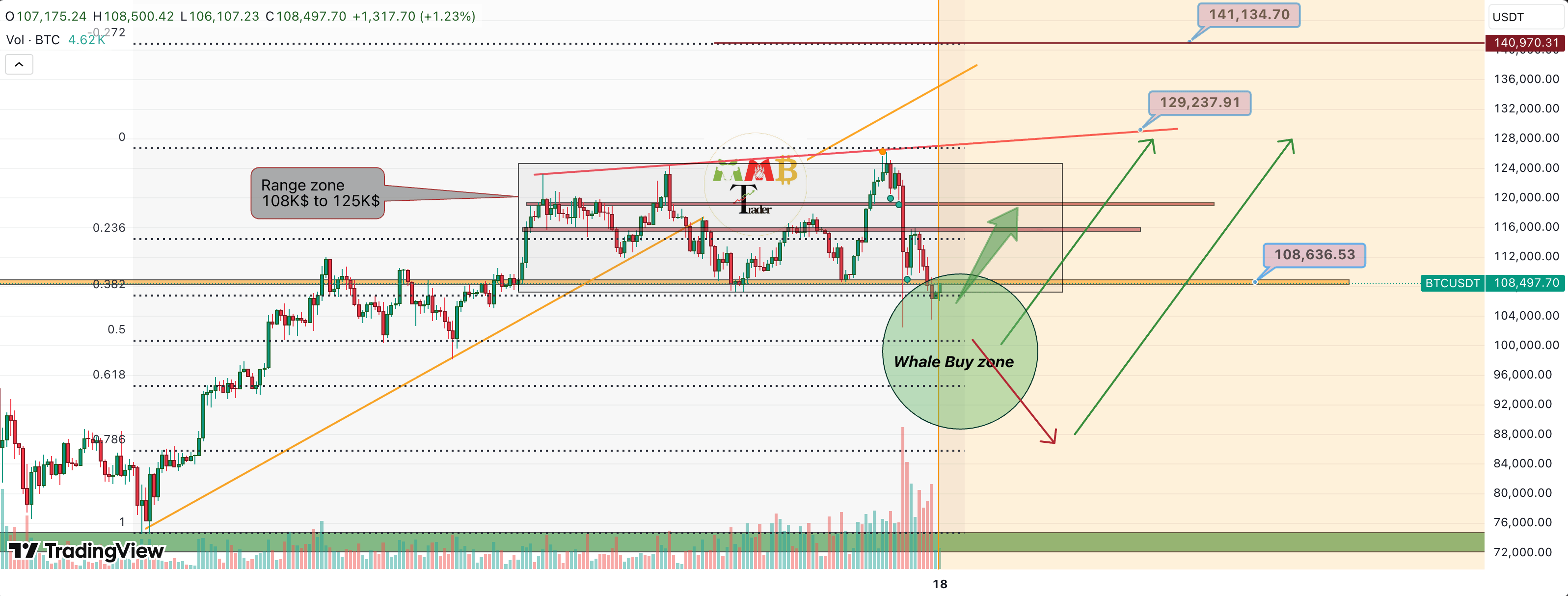

Enter Mr. MMBTrader-an oracle of obfuscation-who’s wagging a finger and whispering, “Hold your horses, dear investors! Now’s not the time to buy. Nope, save your shillings for when the whales-those enormous, finned financiers-decide to make a splash again.”

According to him, the ‘Whale Buy Zone’ is lurking below $90,000-perhaps as low as $87,000-where these aquatic titans are prone to swoop in, snout first, and scoop up a treasure trove of cheap coins. Why? Because when Bitcoin dips to fib levels like 0.38 and 0.5, it’s historically been time for a rebound-probably with a bit of whale-licking momentum to get things going.

Meanwhile, the rookie traders, the new lads and lasses, are expected to panic more than a cat in a room full of rocking chairs, selling off their holdings at a loss of 15% to 40%. But once these faint-hearted folks bail, the price will climb, climbing like a miser’s nose, to that glorious $130,000 to $140,000 range, where FOMO-the frothing frenzy of the unwise-kicks in again.

And so, the cycle spins, like a top at a garden fête, with the fresh converts rushing in and the wise old hands lounging in the shade, already smiling at their profits. Truly, investing in crypto is more about patience than a game of musical chairs with a blindfold on.

Keep Your Wits About You, Old Bean

In the midst of all this hullabaloo, Mr. MMBTrader-who’s about as steady as a barometer in a hurricane-suggests sticking to your own game plan. Mix in a dash of good old-fashioned risk management and the courage of a man who’s never heard of sleep, and you’re halfway there. The crypto seas are more unpredictable than Grandpapa’s piano lessons, so set stop-losses and take-profit levels like a seasoned captain plotting her course.

And remember-resist the urge to do a Lassie and panic sell every time the headlines scream bloody murder. Keep the head cool, the eyes clear, and approach each trade like a gentleman at a shooting party: calm, collected, and with your finger off the trigger unless absolutely necessary.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Banks & Shadows: A 2026 Outlook

2025-10-20 11:30