Once the darling of the market, The Trade Desk (TTD) has seen its stock tumble from a lofty $142 to a more modest figure, leaving many to ponder whether this is a misstep or a masterstroke in disguise. A company that flourished during the pandemic, rode the inflation wave, and basked in the glow of 2023’s relative calm, now finds itself in a peculiar position-its shares having lost 65% of their value. A curious turn of events, one might say.

Indeed, the stock’s trajectory was nothing short of meteoric, soaring from $27 in 2020 to its peak in December 2024. At its zenith, it was valued at 134 times free cash flow and a staggering 227 times earnings. Such numbers are the stuff of dreams, though they often come with the caveat that the sky is the limit-until it isn’t.

But the market, that fickle paramour, turned its back on The Trade Desk with alarming speed. A single underwhelming revenue report sent the stock spiraling, losing 34% in a week and continuing its descent. Today, it hovers 65% below its December high-a bittersweet reminder that even the most promising ventures can falter.

Yet, I find myself intrigued. A stock that has fallen so far, and so swiftly, often presents an opportunity. Let us not be hasty in judgment; sometimes, the most compelling stories unfold in the shadows.

What Went Awry?

Let us not mince words: The Trade Desk’s challenges are real. Sales growth, once a relentless march forward, has slowed, and the reasons are as predictable as they are disheartening. First, the political ad boom of 2024, a temporary boon, has faded. Comparing last year’s 26% growth to this year’s projected 20% is akin to measuring a sprint against a marathon-both are commendable, but the context is vastly different.

Second, The Trade Desk’s reliance on a handful of behemoths-McDonald’s, Pepsi, IKEA, Disney-has proven a double-edged sword. These titans, while loyal, are also vulnerable to the tariff tempests that swirl across the globe. Their budgets, strained by these tensions, have inevitably impacted The Trade Desk’s coffers.

A Fight for Survival

Yet, The Trade Desk is not one to surrender gracefully. The company has adopted a pragmatic approach, embracing flexible short-term deals while forging long-term alliances. These joint business plans (JBPs), though not without their complexities, offer a glimpse into a future where commitment is rewarded with premium pricing. As CEO Jeff Green aptly noted, “In volatile environments, programmatic advertising has historically proven its mettle.” A sentiment as elegant as it is astute.

“In volatile environments, these things have historically accelerated the move to programmatic precisely because it comes with control, agility, and performance. And when advertisers become more deliberate and performance-driven, programmatic is at its very best.”

A Delicate Balance

The Trade Desk’s strategy is a masterclass in balance-flexibility for the present, ambition for the future. By offering tailored solutions to price-sensitive clients while nurturing deeper relationships with key players, it aims to navigate the choppy waters of the current market. “The number of live JBPs is at an all-time high,” Green remarked, a statement that hints at resilience rather than resignation.

Such a combination, though fraught with challenges, is not without its charms. It is a dance of pragmatism and vision, one that may yet yield dividends.

Numbers That Speak Volumes

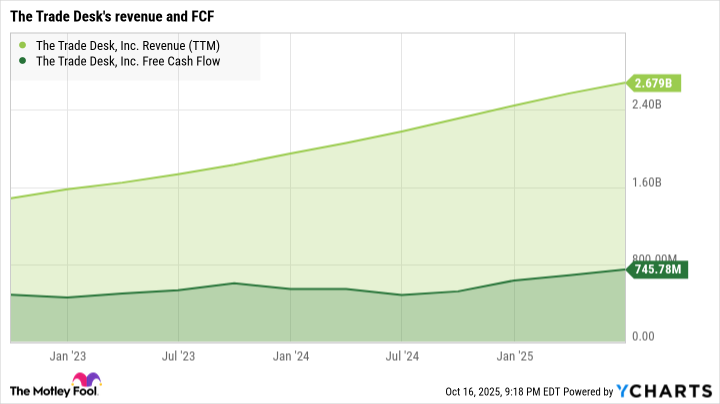

Despite the turbulence, The Trade Desk remains a formidable force. With $746 million in free cash flow over the past four quarters and revenues of $2.68 billion, it is clear that the company is not without resources. Its 2025 growth targets of 20%, while modest compared to past feats, are still impressive given the economic climate.

In the grand scheme of things, The Trade Desk’s current valuation ratios are a whisper of its former self. A stock that once commanded exorbitant multiples now trades at a fraction of that price-a fact that may not be lost on the more discerning investor.

So, while the market may have grown weary of The Trade Desk’s antics, I remain cautiously optimistic. After all, what is life without a little drama? 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

2025-10-19 15:52