The S&P 500 index, that venerable benchmark of financial prosperity, finds itself at the very summit of its historical heights. As one might expect, the Vanguard S&P 500 Index ETF (VOO) follows closely in its lofty path, tracing the contours of the market with impeccable precision. And yet, dear reader, while the idea of investing in such a distinguished vehicle may appear most agreeable, a discerning investor might find a more strategic alternative should they pause to consider the valuations of the moment.

Indeed, while the S&P 500 stands at its zenith, there exists a certain charm in contemplating a more modestly-priced approach, as evidenced by another Vanguard offering. Let us now investigate this further, and examine what might prove to be a more sagacious decision for your investment portfolio.

On the Matter of Beginnings

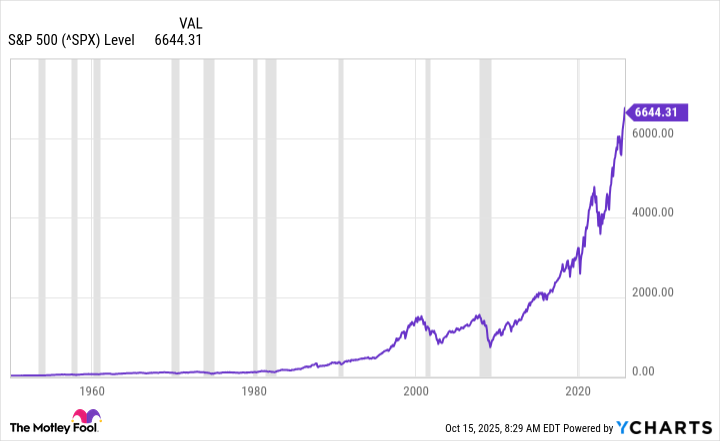

It is, as all wise investors know, the first step that is often the most elusive, yet also the most critical. For those who have not yet ventured into the world of markets, a sum of $1,000, though modest, provides the perfect opportunity to take the plunge. The obvious course for most would be to purchase an index fund, and for those of a conventional nature, the S&P 500 Index ETF would seem to be a most suitable companion. And why not? The market, ever resilient, has seen itself recover from even the most grievous of declines, always to rise again to greater heights.

Indeed, this particular fund, with its minuscule expense ratio of 0.03%, offers a most cost-effective means of gaining exposure to the broad swathe of the market. One might pause and ask, “Why, then, pay more for an identical result?” The chart below speaks to the quiet, unyielding progress of the market, with its regular, undeterred ascent even in the wake of tumultuous bear markets.

With $1,000-or indeed any sum-devoted to this course, one might not regret the simplicity and constancy of the strategy. Though, of course, one must be prepared to endure the inevitable discomforts of market fluctuations in the short term. Yet, history, that most diligent tutor, assures us that with patience, such sacrifices are often rewarded handsomely.

However, should the notion of purchasing into a market so expensive cause you some hesitation, I would advise you to consider a somewhat more conservative, and perhaps more prudent, alternative. The Vanguard Value ETF (VTV), which brings with it the promise of superior valuations, may well present a more sensible path.

The Case for Value

What, then, would a $1,000 investment in the Vanguard Value ETF yield? One might find oneself the owner of approximately five shares of this humble yet dependable fund, which, in turn, provides ownership in a collection of large, stable U.S. companies whose valuations are most certainly more appealing than the current overbought market. In a world where the S&P 500 has reached such heights, this is not a small matter.

To make this clearer, allow me to provide some figures. The Vanguard Growth ETF (VUG)-which, like an overzealous beau, has a tendency to overestimate its worth-boasts an average price-to-earnings (P/E) ratio of around 40. Certainly not a figure to endear itself to those seeking value. In comparison, the S&P 500 ETF, though not without merit, holds a P/E of 29, indicating that, while perhaps not as extravagant, it too is a bit rich for many tastes. The Vanguard Value ETF, on the other hand, enjoys a P/E ratio of just under 21-still not “cheap” in the strictest sense, but decidedly more reasonable in comparison to its peers.

Moreover, let us examine the price-to-book-value (P/B) ratio, where the contrast is even more striking. The Vanguard Growth ETF displays a P/B ratio of 12.5, an amount so elevated it may cause a discerning investor to blanch. In comparison, the Vanguard S&P 500 ETF sits at a more moderate 5.2, and the Vanguard Value ETF, in keeping with its name, registers a most agreeable 2.8. While it would be most premature to suggest that the Value ETF will protect one from the market’s occasional tempests, it certainly offers a certain sense of security when compared to the high-flying growth stocks that often soar into dangerously lofty altitudes.

A Sound Approach to Investment

To summarize, the first, and perhaps most consequential, decision an investor must make is to begin investing at all. Once this initial step is taken, the most prudent course is to remain steadfast in the pursuit, regardless of the market’s inevitable fluctuations. However, for those who have already set sail on this journey, it may be worth considering a more thoughtful allocation of funds.

If your initial sum is but $1,000, one might suggest a division of that amount between the S&P 500 Index ETF and the Value ETF, thus providing exposure to both the broader market and those more undervalued stocks that may offer protection when times grow less favourable. For the more experienced investor, the addition of the Value ETF to an existing portfolio could well serve as a means of diversifying away from the more extravagant growth stocks which currently lead the market into its dizzying heights.

In conclusion, while the S&P 500 ETF remains a solid, reliable choice, the Value ETF may, in truth, prove to be the more sensible investment at this particular juncture-offering not only promise of future returns but a sense of calm and prudence amid the ever-fluctuating tides of the market. 🌱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2025-10-19 14:03