Nvidia (NVDA) shares have enjoyed a spectacular ascent that would make even the most seasoned bookmaker blush. Three years ago, the notion of this chipmaker surpassing Apple – then a £2.28 trillion titan – as the world’s largest company would’ve been dismissed as the fever dream of a caffeine-deprived analyst. Yet here we are: Nvidia’s market cap now stretches beyond comprehension, fueled by the AI revolution’s insatiable appetite for its silicon wares.

While none of us possess functioning time machines to invest retroactively, we can peer ahead with the benefit of modern crystal-gazing techniques. Two possible trajectories emerge from the fog, one more likely than the other. Let us dissect this with the precision of a Mayfair tailor measuring a particularly tricky pair of trousers.

The AI gravy train shows no signs of derailment

Nvidia’s graphics processing units (GPUs) have proven themselves the Swiss Army knives of computing – capable of rendering pixel-perfect explosions in video games one moment and training multimillion-parameter AI models the next. Their parallel processing prowess has made them indispensable in the AI arms race, where even the most reclusive tech oligarchs queue up to purchase these digital muskets.

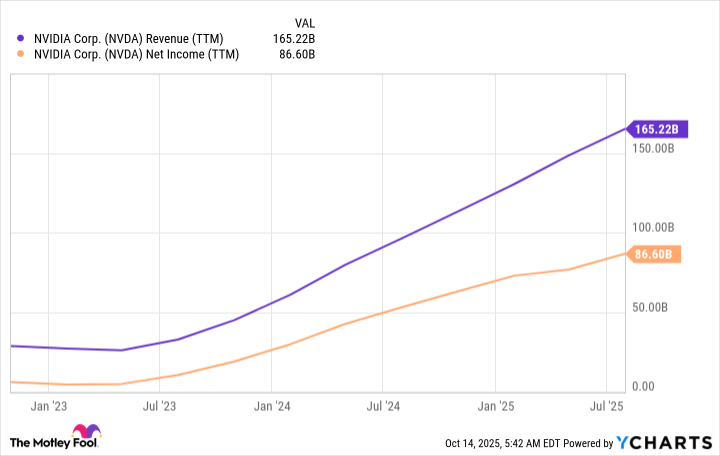

This technological indispensability has translated to financial figures that would make Scrooge McDuck spill his single-malt Scotch.

But can this vertiginous growth continue? The answer lies in the vaults of hyperscalers, who’ve committed to record data center investments through 2026. However, AMD’s recent flirtation with OpenAI has raised eyebrows in Palo Alto. While their hardware may lack Nvidia’s pedigree, it arrives with a price tag that might tempt penny-wise executives – though one suspects AMD still struggles to convince developers its chips aren’t merely “Nvidia for beginners.”

Broadcom presents a subtler menace. Their bespoke silicon solutions, crafted through intimate partnerships with tech titans, offer performance gains at the cost of flexibility. It’s the computing equivalent of commissioning a Savile Row suit: perfect for its intended purpose, useless for anything else. Small fry need not apply.

The trillion-pound gorilla in the room

Nvidia’s assertion that global data center spending will reach £3-4 trillion by 2030 initially provoked the sort of skepticism reserved for a man claiming he’s “absolutely certain” about anything. Yet Wall Street’s subsequent nods suggest this projection might not be pure fantasy.

A 42% compound annual growth rate would transform Nvidia from a £4.58 trillion enterprise into a £25 trillion colossus by 2030. To put this in perspective, that’s roughly three times the GDP of the entire United States. While such figures strain credulity, they’re not entirely implausible in this AI-driven fever dream.

Of course, should the AI bubble deflate like a poorly inflated soufflé, Nvidia’s shares might plummet with the grace of a lead balloon. But for those who believe – as this author does – that we’re merely witnessing the opening act of an AI-first era, the current valuation appears less a price and more a bargain-bin sticker.

Investors seeking certainty should stick to government bonds. For the rest of us, Nvidia’s trajectory remains as compelling as a first edition of Private Lives – albeit with rather more silicon and considerably fewer witty one-liners. 🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2025-10-19 13:09