Well, well, well! Ethereum is still stuck in its cozy little range, after bouncing around like a kid on a trampoline. But guess what? It’s still holding tight above those oh-so-important institutional demand zones. What does this mean, you ask? It means we’re in a “consolidation” phase, where the market is taking a breather before it makes a decision. And when that decision comes, you can bet it’ll be a wild one-thanks to liquidity displacement. Who knows what’ll happen next? 🎢

Technical Analysis

By Shayan

The Daily Chart

Here’s the deal on the daily chart: Ethereum is dancing between two major zones like a drunk ballerina. On the one hand, we’ve got the institutional supply area at around $4.6K to $4.7K (aka the “not-so-happy place”), and on the other, the demand zone at $3.4K-$3.5K (where the big money is lurking). After Ethereum lost the lower trendline support earlier this month, it’s been trying to give that line a high-five from below. But alas, the line’s been all like, “Nope, not today!”

Ethereum is currently in a “mid-range equilibrium” phase. This sounds fancy, but it just means no one’s winning. It’s like watching two toddlers fight over the last cookie. The 100-day moving average (that’s the fancy term for a line showing price direction) has turned into resistance near $4.1K-$4.2K. And the 200-day MA? Well, that’s holding the fort at around $3.1K. If ETH can stay above the $3.4K demand zone, everything’s peachy. But drop below it, and we’re looking at a trip down to the $3.0K-$2.9K pit of despair. Not fun. 😱

The 4-Hour Chart

The 4-hour chart is showing a descending wedge. Sounds like something you’d find in a treasure hunt, right? But no, it’s a price pattern, and it’s not all that exciting unless you like steep declines. This wedge formed after Ethereum got rejected from the $4.2K zone-talk about a sharp slap in the face! The price is getting squeezed in this wedge, and like toothpaste out of a tube, volatility is about to explode. If Ethereum breaks through the resistance at $4.0K-$4.1K, it could surge to $4.4K-$4.6K. If it crashes below $3.7K, well, we’re in for a bumpy ride down to the $3.4K demand zone. Tension is rising, people!

Sentiment Analysis

By Shayan

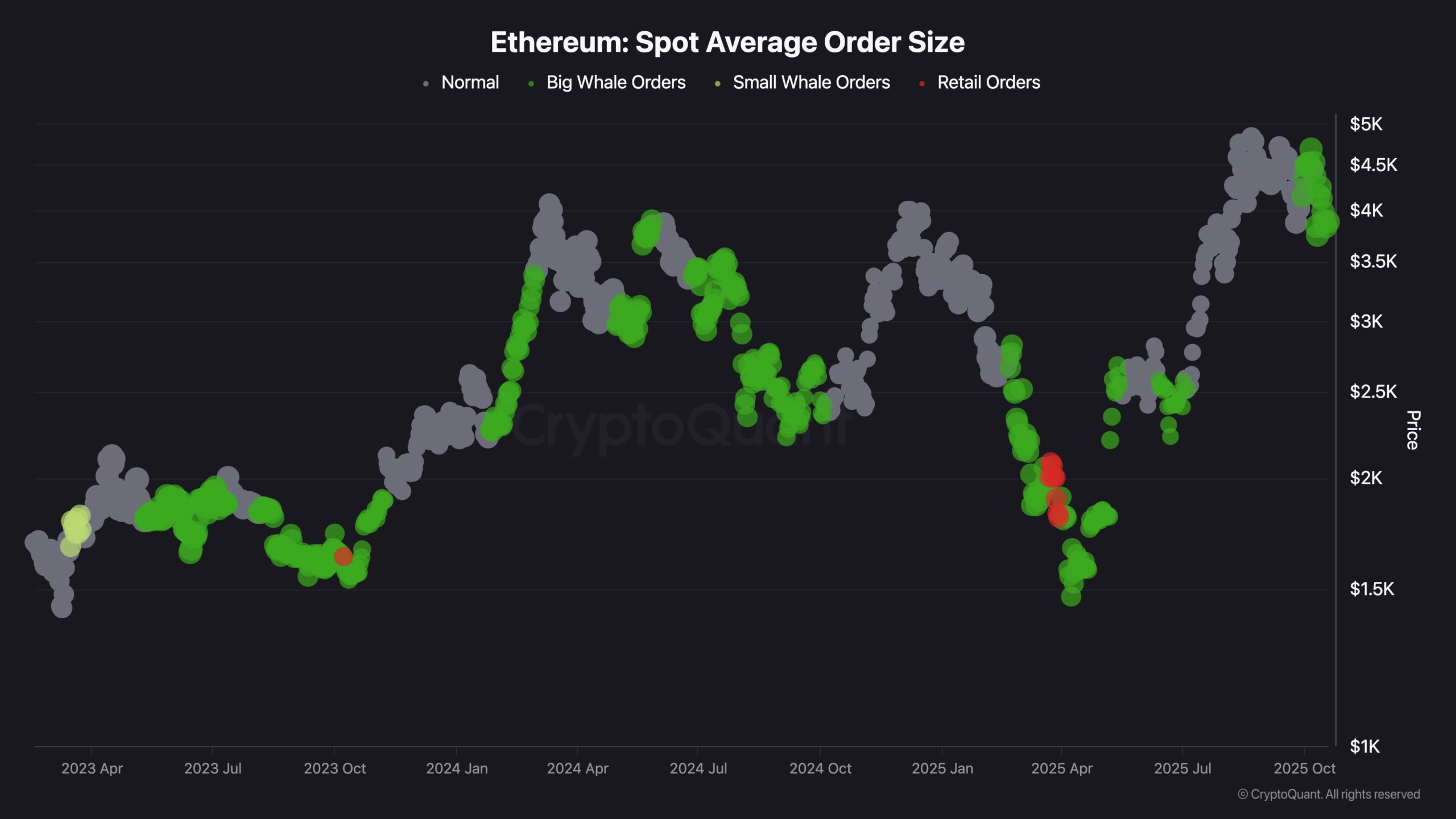

Now, let’s get to the juicy part. The on-chain data is showing signs of something brewing-like a storm in a teacup. Since mid-October, two major things have happened: first, exchange reserves are dropping faster than your favorite TV show’s plot twists. Second, whale transactions are making a comeback! And by “whale,” I mean those deep-pocketed folks who think $100K is just pocket change. 🤑

ETH’s price is sitting pretty just below $4K, but don’t be fooled-the market is quietly shifting. Whale orders (those huge green clusters) are increasing, while Ethereum’s presence on exchanges has dropped to one of the lowest levels in 2025. This is prime real estate for the big guys to scoop up ETH while the rest of us scramble for breadcrumbs. With liquidity getting tighter, any fresh demand could send the price soaring-or crashing. Who can say? It’s like playing with fire in a hurricane! 🔥🌪️

It’s starting to feel like late 2020 all over again-when Ethereum was quietly gathering strength before it rocketed to the moon. Could this be the calm before the storm? If things line up, Ethereum could be ready for another massive rally. Just remember, folks: things can change faster than you can say “HODL!” 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2025-10-19 12:56