It is a truth universally acknowledged, that a financial market in possession of a strong trend, must be in want of a prudent observer. The venerable Stanley Druckenmiller, with his discerning eye, hath long maintained that the art of investment lies in understanding the grand design of economic forces. Chief among these is the conduct of monetary policy, a matter of no small consequence, for it is the Federal Reserve that holds the reins of interest rates and the flow of capital.

When the Fed, with measured grace, lowers its rates and swells the money supply, it is a signal to investors to take heart and purchase shares. Yet when it tightens its grip, raising rates and withdrawing liquidity, prudence is the order of the day. Though the market, that fickle creature, is rarely so simple as black or white. Hence the adage, ‘Do not fight the Fed,’ a maxim as enduring as it is wise.

In a recent address, the esteemed Jerome Powell, chair of the Fed, hinted that the time may soon come to ‘spike the punch bowl,’ a phrase that hath stirred much speculation. Should this transpire, the stock market, ever the sensitive soul, may yet be moved to a significant shift.

Preparing to spike the punch bowl

Long ago, in the year 1955, the venerable William McChesney Martin, then chair of the Fed, remarked that the central bank ‘is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.’ Thus was coined the phrase, which hath since become a byword for monetary policy. To ‘take away the punch bowl’ signifies the Fed’s tightening measures-higher rates or quantitative tightening (QT), wherein it shrinks its balance sheet and withdraws funds from the economy. ‘Spiking the punch bowl,’ its opposite, denotes the injection of liquidity through rate cuts and quantitative easing (QE).

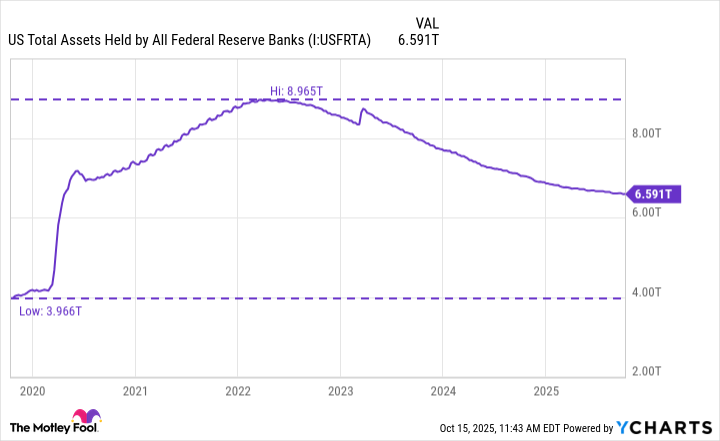

Though the market hath shown a robust spirit, the Fed hath been quietly removing some of the punch’s potency over recent years. This includes a vigorous campaign of rate hikes commencing in 2022, and QT to shrink its balance sheet after it swelled during the pandemic’s height. A most delicate task, to be sure.

As the chart above reveals, the Fed’s balance sheet stood at $4 trillion prior to the pandemic, largely due to the QE of 2008-09. That figure more than doubled in early 2022, as the Fed sought to buoy an economy that had, for a time, been in abeyance. Yet the agency hath since embarked on QT, reducing its assets to roughly $6.6 trillion. And let us not forget the rate cuts initiated in 2024, though they were paused for much of the year due to inflation’s persistent grip, only to resume in September.

Though many still debate the necessity of these cuts, and their number, Powell’s remarks at the National Association for Business Economics Conference in Philadelphia on October 14 hath stirred considerable surprise. He suggested the Fed may soon pause QT, a move that hath left investors in a state of suspense.

Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision. Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates.

Though the Fed’s balance sheet remains $2.5 trillion above pre-pandemic levels, Powell made it clear that normalization need not entail a return to those days. The agency seeks to avoid the missteps of 2019, when reserves grew too lean and repo rates soared, forcing an emergency infusion of liquidity.

Why it could trigger a big move in stocks

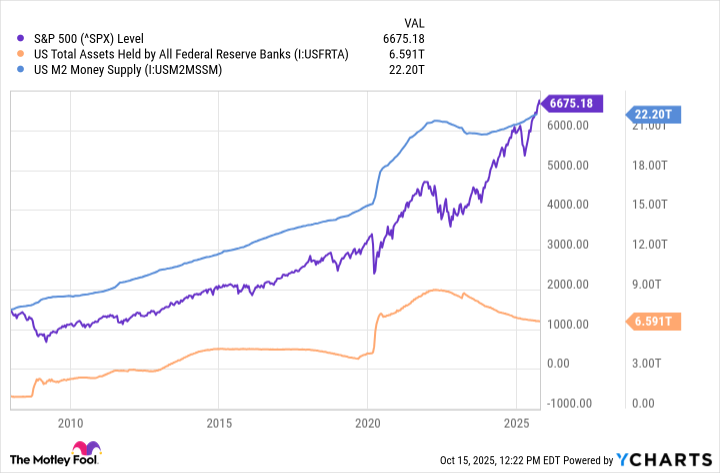

To consider the matter simply: the more money that circulates through the economy, the greater the likelihood it shall find its way into financial assets. Many scholars attribute the surges in housing prices and the stock market to the vast QE of recent years.

Though not a perfect correlation, there is a discernible pattern in the broader benchmark S&P 500 index, the Fed’s balance sheet, and M2 money supply. M2, that measure of liquid assets, encompasses cash, checking and savings accounts, and short-term instruments like money market funds.

It is vital to note that the Fed is not yet restarting QE. Yet if it curtails QT, more funds shall remain in the economy. Combined with rate cuts, this would constitute a ‘spike of the punch bowl,’ a historical boon for stocks.

Of course, other factors demand consideration-market valuations, the resilience of the AI sector, and the like. Hence, investors may yet find solace in dollar-cost averaging. Regardless, the end of QT shall likely foster a more favorable climate for the market’s next ascent.

📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2025-10-19 12:27