Oh, Eaton (ETN) stock. The kind of company that lures you in with promises of industrial might and electrification wonder, but the moment you blink, it could go full gonzo on you. I own the damn thing, no intentions of selling it-at least not today-but would I buy more at these levels? Hell no. Let’s dive into this nightmare scenario.

What the Hell Does Eaton Do?

Let’s get this out of the way: Eaton isn’t some fly-by-night tech startup with a killer app. No, my friend, it’s an industrial BEAST, over 100 years old, and-don’t quote me on this-it’s got more than $140 billion floating around in market cap. If you’re not already worried, you should be. It started out in the car world-making truck axles, a humble beginning. But now? It’s ALL about managing electricity, the lifeblood of the modern world. A long way from its roots, but you get the picture.

And it didn’t stop there. In 2012, Eaton swallowed up Cooper Industries like some kind of hungry corporate giant. They became a juggernaut, and in the Americas alone, they pull in 47% of their revenue from electrical sales. The rest of the world adds another 25%. The point? They’re all about power-literal, electrical, and metaphorical.

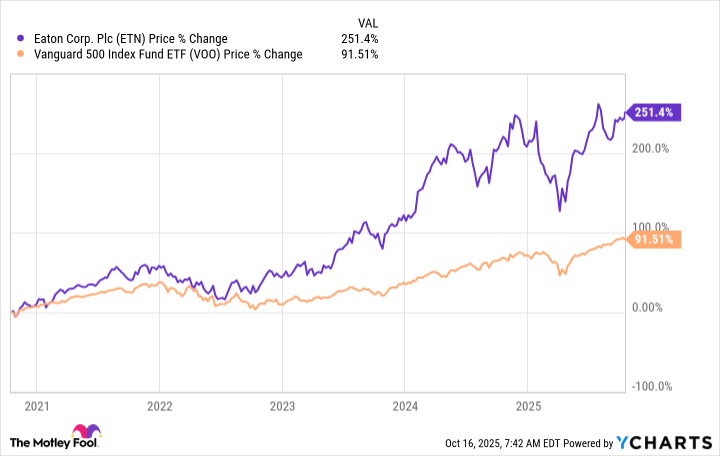

The company’s stock price has done the damn tango over the last five years-up more than 250%. It’s like riding a bull through a hedge maze, but damn, it’s left the S&P 500 trailing behind by a good 90%. Wild, right? But is that enough to keep riding? Nope. Not now, not at these prices.

The Opportunity Has Slipped Through Your Fingers

Here’s the grimy truth: I wouldn’t touch Eaton at these levels. Earlier in 2025, when the stock nosedived by about 30%, I was *this close* to throwing a handful of cash at it. But now? The thing is flirting with all-time highs, and that’s when the market looks like a dangerous poker game-one where you’re holding a losing hand.

Let’s crunch the numbers, shall we? Eaton’s price-to-sales ratio is at a shocking 5.8 right now, while its five-year average is 3.7. Its price-to-earnings ratio is floating around 38-hello?-compared to its long-term average of 32. That’s a serious stretch for a company that still needs to prove it can keep growing at this pace. And don’t get me started on the price-to-book ratio-it’s close to 8 now, when five years ago, it was a modest 4.5. This thing is overpriced, folks. It’s like buying a Ferrari at the price of a used Honda. It’s not smart.

Now, if you’re the kind of person who’s into dividends, like I am (old-school, right?), this next part should piss you off. The dividend yield is at a pitiful 1.1%. That’s not even enough to get a decent meal at a dive bar. Sure, it’s better than the average industrial stock-around 0.9%-but it’s still paltry compared to the 1.2% yield of the S&P 500. More importantly, Eaton’s yield is at the LOW END of its own historical range. All these factors-disastrous yield, overpriced metrics-paint a picture that doesn’t even look good through the haze of a bong hit. It’s bad.

Eaton: A Growth Stock, But a Very Expensive One

Look, if you’re a growth investor, you might be salivating at Eaton’s potential. I get it. The business is well-positioned, it’s got that electrification engine purring, but-good God-buying now means paying a premium that’s downright absurd. It’s like paying a premium for a ticket to a concert that’s already sold out.

But here’s the kicker: That 30% drop earlier in the year? That was the sweet spot. Eaton’s history is littered with dramatic sell-offs, and if you’ve got the patience-or the gall-to wait for the next crash, well, you might have an opportunity to get in when everyone else is in a panic. Until then, though, you’d be better off with a different ticker symbol, because Eaton’s stock is officially in the ‘too rich for my blood’ zone. Keep it on your watchlist, though-because when the next wave of insanity hits, you’ll want to be there with your shopping cart ready.

Get ready for the next big ride. 🍿

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2025-10-19 12:09