Well, well, well! As the S&P 500 prances about, puffed up like a rooster in springtime, every investor in the land seems fervently fixated on those sprightly growth stocks. Yet, those who have the good sense to peer through the fog of market mood swings-like seasoned sea captains charting a course through stormy weather-understand that there’s gold to be found in the deep, dark well of dividend stocks, come rain or shine.

Now, if you’ve got your nets cast for passive income, particularly with the golden years of retirement peeking over the horizon, let me tell you a tale of a company called Clorox (CLX)-a veritable treasure chest for your income stream if ever there was one.

A Long Overdue Recovery

Clorox stands at a crossroad, teetering on the brink of revival or disaster, and investors, bless their hearts, are waiting with bated breath to see if this comeback is more than just smoke and mirrors.

You see, during the raucous summer of COVID-19, Clorox found itself riding a wave taller than a Mississippi River steamboat, with sales soaring like a kite in a strong wind. But alas, in a miscalculation worthy of a slap on the back of the head, they overestimated demand. The result? A mighty plummet of their margins, like a lead balloon at a fancy party. And just when you thought it couldn’t get worse, a cyberattack in 2023 turned their operations into a two-headed hydra of chaos-product shortages abounding!

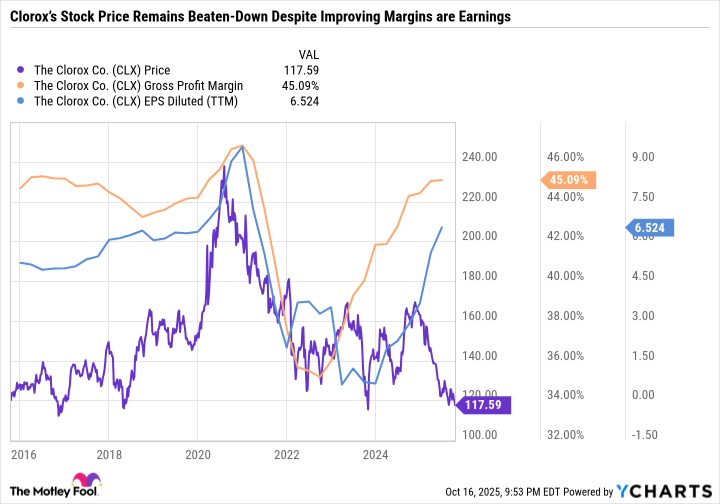

Now, should you glance at the chart I’ve provided, it’ll tell you the heartbreaking tale of Clorox’s recovery, one that drags on like molasses in January, leaving investors with more patience than hope, as the company’s stock price finds itself as low as a snake’s belly in a wagon rut.

Far from Business as Usual

As fate would have it, Clorox is set to report its fiscal year 2026 results on the third day of November, a date that may be marked with a circle and an exclamation point on many investor calendars. But lo and behold, the guidance looks weaker than a droopy flower, with organic sales expected to tail off by a grim 5% to 9%. Make no mistake, the anticipated decline in adjusted earnings per share between 18% and 23% doesn’t exactly paint a rosy picture of a successful turnaround.

Still, the folks at Clorox are pitching fiscal 2026 as a “transition year,” waving the flag for their new enterprise resource planning (ERP) system-a fancy term for a hopeful upgrade to their operational toolkit. They’ve set their sights on transforming from a relic of the past to a sleek, cloud-based platform, aiming to lower costs and correct course in their internal ship.

But hold your horses; while they’re busy polishing their systems, their short-term results are getting pillaged. In a hastily concocted strategy to prepare for this overhaul, Clorox has been shipping an excess of products, inflating their fiscal 2025 sales numbers like a balloon at a summer fair. But beware, the retailers will soon tire of Clorox’s extra bounties and may not need to buy significantly in the near future.

A Good Time to Turn Around

Ah, the numbers may look a tangled mess right now, but perhaps all these one-time investments could beautifully set the stage for the long haul. Clorox needed a good old-fashioned tune-up after its pandemic blunders and IT failures suffocated its growth prospects.

Pulling forward that demand in fiscal 2025 might yet turn out to be a stroke of genius. Yes, the whole consumer staples sector is grappling with inflationary pressures akin to a catfight at dusk, but what a time for Clorox to invest for the future, even if it tangles their operations in this present. Companies like Procter & Gamble and Colgate-Palmolive are also nestled comfortably close to their 52-week lows, leaving room for Clorox to root around for growth and reinvestment.

Clorox Has Fallen Far Enough

For those long-term gamblers-erm, investors-who are patient enough to wait for Clorox’s grand performance to unfold, it is a buy worth considering. Warren Buffett bravely mused once that “You pay a very high price in the stock market for a cheery consensus,” but goodness gracious, the consensus here is as dreary as a rainy Sunday. The present gloom around Clorox due to its ERP transition and wider economic uncertainties means that investors today can scoop the stock for a price that harks back over a decade, a potential steal if the company finds its footing once more by fiscal 2027.

Moreover, Clorox offers a dividend as smooth as a well-aged bourbon. With 48 straight years of payout increases, it raised its quarterly offering to $1.24-or $4.96 annually-just this past July. The laggard stock price has combined with robust dividend growth to hoist its yield up to 4.2%, the highest it’s been in a decade-a compelling lure for investors to maintain their holds as the company’s fortunes realign.

Time to Load Up on This Passive Income Powerhouse

Alas, Clorox has endured chaos worthy of a Broadway tragedy for far too long, and investors are growing weary of the suspense. Yet, looking down the road, there lies potential aplenty. Clorox boasts a remarkable array of brands like Clorox, Burt’s Bees, Pine-Sol, Hidden Valley, Brita, and Kingsford-a cornucopia of household names just waiting for the right management to align their stars.

Clorox has nary a need for new acquisitions. All they really need is to squeeze every drop of efficiency out of what they already possess. Should the operational grandeur and supply chain improvements take root, one might find Clorox’s investment story growing merrier with each passing year.

In summary, Clorox is a splendid contrarian pick for those patient souls willing to invest in the right time and place. 🌟

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Underrated Films by Ben Mendelsohn You Must See

- ICP: $1 Crash or Moon Mission? 🚀💸

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2025-10-19 10:23