Crypto Chaos: Bitcoin Outflows Surge Amid Market Woes

In the bleak corridors of market despair, Bitcoin-a once mighty titan of digital gold-has stumbled. Dropping sixteen percent from its zenith, it now languishes in a correctional abyss, waving a flag of vulnerability. The trend, oh the trend!-a treacherous path of risk and uncertainty-snakes onward, as ETF outflows continue their relentless march. Ah, the spectacle of hopes dashed and portfolios shriveled-what a charming dance of doom! 😄

- Behold! Bitcoin’s double-top pattern, a symbol of impending downfall, haunts the daily chart-like a ghost with a grin. 👻

- Over $1.6 billion evaporated from spot Bitcoin ETFs this week-poof! Gone. Just like that.

- Investors’ hearts are pounding-liquidations and fears swirl in a toxic cocktail of panic and regret.

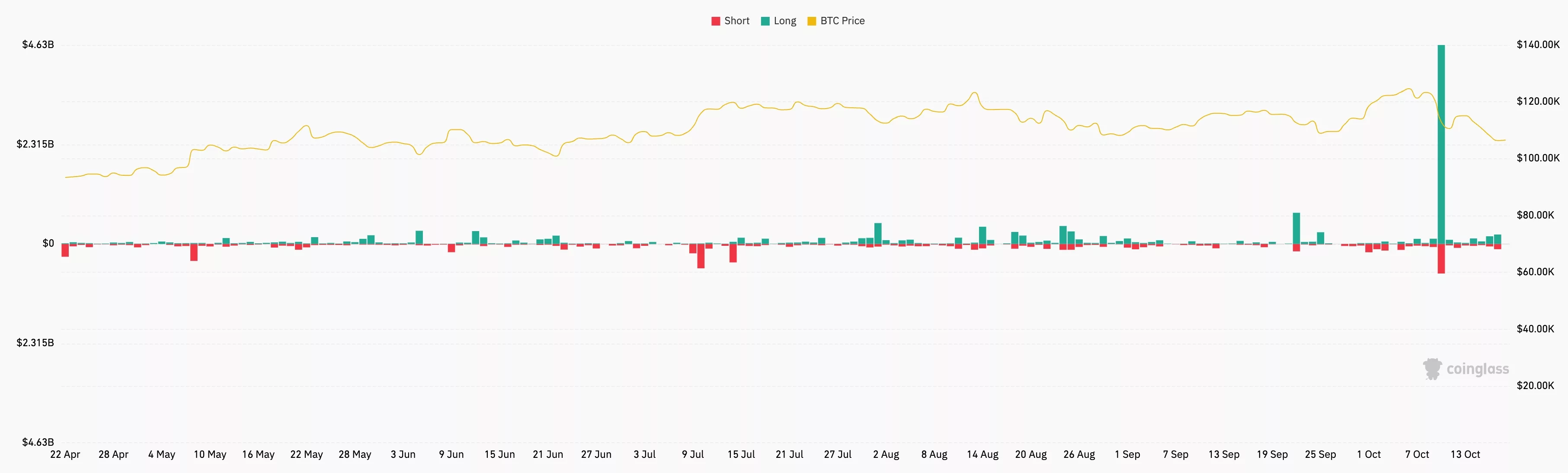

Americans, brave and bold, decided to part ways with their Bitcoin holdings faster than you can say “cryptocurrency crash.” As the crypto Fear and Greed Index slumped into the abyss of fear-where only the brave or truly foolish tread-liquidations surged forth like a broken dam. 💧

Data from SoSoValue (because who doesn’t trust a platform with a whimsical name?) reveals a staggering $1.23 billion vanished from Bitcoin ETFs in just one week. BlackRock’s IBIT shed over $268 million, and Fidelity’s FBTC? Well, it lost count after a while. Since inception-January last year-these outflows have accumulated to a neat $61.54 billion. That’s nearly enough to buy a small island or perhaps just a really fancy coffee machine. ☕️

All of this chaos is a sharp reversal from the previous two weeks, which saw a measly $6 billion-child’s play, really-added into the coffers. Now? The tide has turned, and investors are fleeing faster than tourists from a city under siege after Friday’s liquidation blitz-over $4.65 billion wiped out in a market crash. Naturally, they’re either selling in despair or hiding in the sidelines, hoping the storm passes. 🌪️

The reasons? Oh, just the usual: Bitcoin morphing into a lesser safe haven as gold, the eternal safe meme, gains favor amidst rising risks. Trade wars, inflationary fires, Fed’s indecision, and the government playing hide-and-seek-regional banks in trouble with ‘fraud-related losses’-because who doesn’t love a little financial chaos? 🔥

Technical analysis: Bitcoin’s doom scroll

The daily chart looks about as cheerful as a rainy Monday-price down 14%, below the 50-day moving average, and the Supertrend indicator turning a fiery red. Oh, and that lovely double-top pattern at $124,355-an iconic bearish sign. It’s like seeing the stern warning lights flicker just before the crash. 📉

Measuring the distance from the head to the neckline gives a profit target around $92,345-lowest since April. So, if it manages to climb above $113,000, perhaps the bears will . . . yawn, take a nap. But until then, expect more pain, more chaos, and perhaps a few laughs at the spectacle of it all. Cheers to the wild world of crypto! 🥂

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 15 Western TV Series That Flip the Genre on Its Head

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- PLURIBUS’ Best Moments Are Also Its Smallest

2025-10-18 19:20