The cryptocurrency, trapped in a descending channel for nearly a decade (how charming!), is now sending technical signals so rare that they’ve barely been witnessed in traditional or digital markets. It seems like the cryptocurrency gods have decided to grace us with a glimpse of a technical miracle. Institutional momentum is rising, and technical indicators are aligning like the stars in a celestial pattern. Market sentiment, like the calm before the storm, is shifting toward what could be a seismic breakout phase, potentially rewriting the entire XRP price prediction saga. Hold on tight, folks!

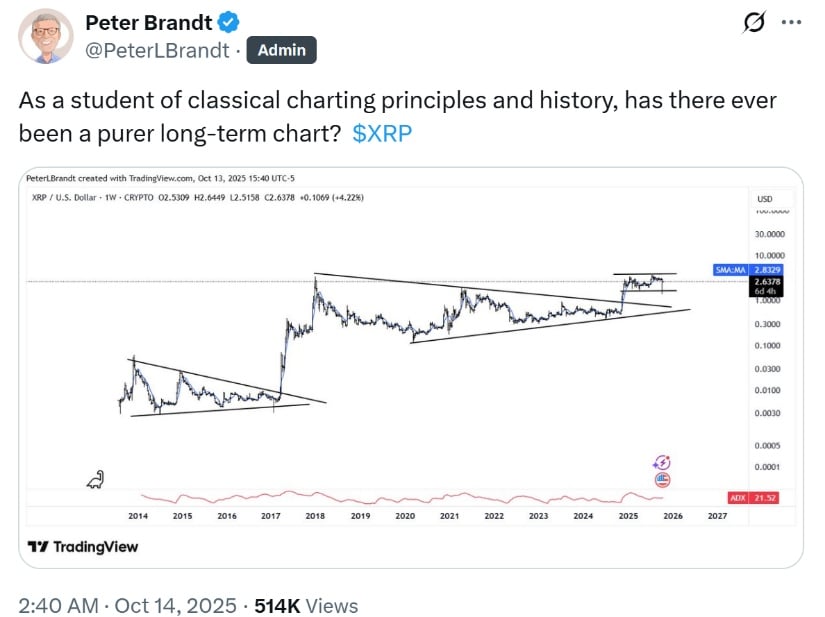

Peter Brandt Highlights Rare XRP Breakout Pattern

Veteran chartist Peter Brandt, whose trading experience spans five decades (yes, he’s been around long enough to remember the dinosaurs), has pointed to XRP’s multi-year logarithmic chart and dubbed it a “textbook breakout” from a descending channel that dates back to 2014. Brandt, who likely has more chart patterns in his sleep than most of us see in a lifetime, compared this structure to the explosive commodity bull runs of the past. This is no regular breakout; it’s a breakout with a capital B!

Brandt quips, “XRP is showing a clean breakout from a multi-year downtrend. Patterns like this don’t appear often, and when they do, they tend to lead to strong upside.” If the resistance levels hold, Brandt’s chart geometry is pointing to a potential rally that could take XRP beyond the $10 mark. That would represent a seriously tasty multiple increase from the current price of around $2.50. Are we about to witness a bull run like no other? Stay tuned, folks.

Institutional Demand Rises With CME XRP Options Launch

Just when you thought things couldn’t get any more bullish, CME Group has expanded its crypto derivatives lineup to include regulated options on XRP futures. That’s right, XRP is officially getting the institutional stamp of approval. This move follows the introduction of XRP futures in April 2025, right after Ripple Labs and the U.S. Securities and Exchange Commission decided to call it a truce. Why fight when you can profit, right?

The decision to launch XRP options on October 13, 2025, is perfectly timed with the increasing institutional demand and growing regulatory clarity in the U.S. The potential for the Commodity Futures Trading Commission (CFTC) to become the primary crypto regulator has traders rubbing their hands in glee. All signs point to XRP becoming the cool kid at the institutional crypto party.

Analysts predict that XRP’s newfound institutional spotlight will open the doors for both retail and institutional investors. This could lead to the next big phase of the rally. Grab your popcorn, because this could get wild.

Oversold Conditions Fuel Recovery Expectations

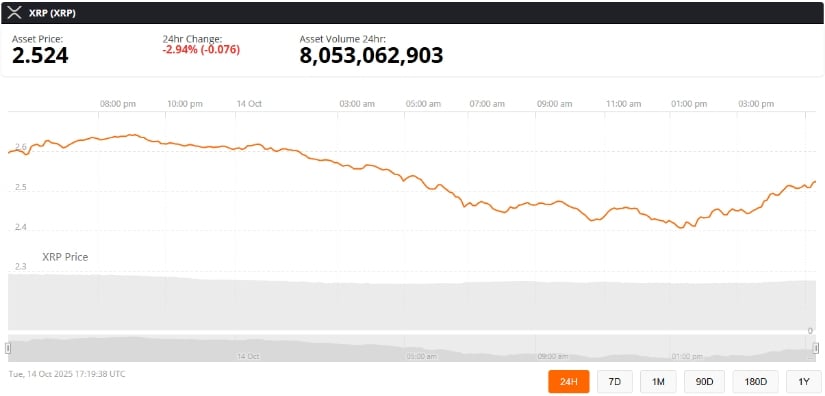

On the technical front, XRP’s recent price action is like a phoenix rising from the ashes. Despite a dramatic 41% flash crash earlier in the week (yes, things got ugly), XRP has pulled a Houdini and rebounded strongly, trading back around $2.50. A Stochastic RSI reading of 8.98 on the weekly chart indicates it’s in deep oversold territory. Historically, this is the zone where major reversals like to take place. Could this be the perfect storm brewing for XRP?

Previous rebounds from similar conditions have led to extended rallies. The bounce from $2.37, combined with improving derivatives stability, suggests that XRP might be setting up for a rally bigger than your last birthday cake.

Derivatives Market Stabilizes as Leverage Unwinds

Ripple XRP derivatives data shows that excessive leverage was flushed out during last week’s sell-off. The market is now in a healthier state, with Open Interest (OI) averaging $4.34 billion-higher than the four-month low seen just a few days ago. All of this points to a market ripe for renewed participation from traders and investors. It’s like spring cleaning, but for the derivatives market.

“With excessive leverage purged and structural risks reduced, the market setup now looks far healthier. We view the coming weeks as an opportune window for capital deployment,” said K33 Research. Meanwhile, short-term momentum is still a little fragile. The Relative Strength Index (RSI) is sitting at 35, signaling a weak upside conviction. To prove that this breakout is real, traders are waiting for XRP to break above the 200-day Exponential Moving Average at $2.63. Will it break or will it break our hearts?

$10 Target Gains Traction Among Analysts

While volatility still lingers like an uninvited guest at a party, the technical and fundamental signals surrounding XRP price are looking more bullish by the day. The breakout from a decade-long descending channel, rising institutional participation, and those tasty oversold technical conditions have analysts eyeing a $10 price target. If these trends keep up, XRP could hit uncharted territory faster than you can say “blockchain.”

If the trend continues, XRP might soon be sitting at $10, a level not seen before. Only time will tell whether this pattern turns into a full-fledged bull run or if it’ll face another round of resistance. But for now, XRP is holding steady above $2.50, and traders are anxiously awaiting the breakout that’s been teased for years.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Noble’s Slide and a Fund’s Quiet Recalibration

- XRP’s $2 Woes: Bulls in Despair, Bears in Charge! 💸🐻

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2025-10-14 23:44