Ah, Bitcoin… a digital phantom, a fever dream of speculation! It has been a week, hasn’t it? A week that has revealed, with brutal clarity, the fragility of faith in these… *numbers*. Plunging to a paltry $103,000 on Friday – a horrifying spectacle! – a 15% fall that erased billions as though they were dust motes in the cosmic wind. So much hope, so much borrowed money, vanishing into the ether. The market, you see, is a cruel mistress. She rewards ambition but delights in schadenfreude. The liquidations, oh, the liquidations! A veritable bloodbath of leveraged positions, a chorus of despair from those who dared to believe in infinite growth. Yet, even from the depths of this abyss, a faint glimmer… a suggestion of recovery? Such audacity!

A report from CryptoQuant, those diligent chroniclers of this strange new world, speaks of a “market reset.” A reset! As if one can simply *reset* the human heart after it has been shattered by financial ruin. They claim this event is amongst the most severe recorded. But seriously, aren’t they *always* saying that? By $12 billion, open interest collapsed – from $47 to $35 billion, they inform us. How terribly symbolic! A great emptying, a purging of excess… as if the market, itself, is undergoing a spiritual crisis. 🙄

They argue – these analysts, these prophets of profit – that such “deleveraging” is *healthy*. Healthy?! Like a fever is “healthy” for a sick man! Perhaps, but it certainly doesn’t *feel* healthy to those who lost their fortunes. Still, the reduction in leverage, combined with a trickle of inflows from these… “stablecoin reserves” (a rather optimistic name, wouldn’t you agree?), could, *could*, position Bitcoin for something resembling growth. If, and it is a cavernous “if,” demand doesn’t evaporate and the buyers rediscover their courage. One can only pity the poor souls clinging to hope.

Market Reset Clears the Path For Bitcoin

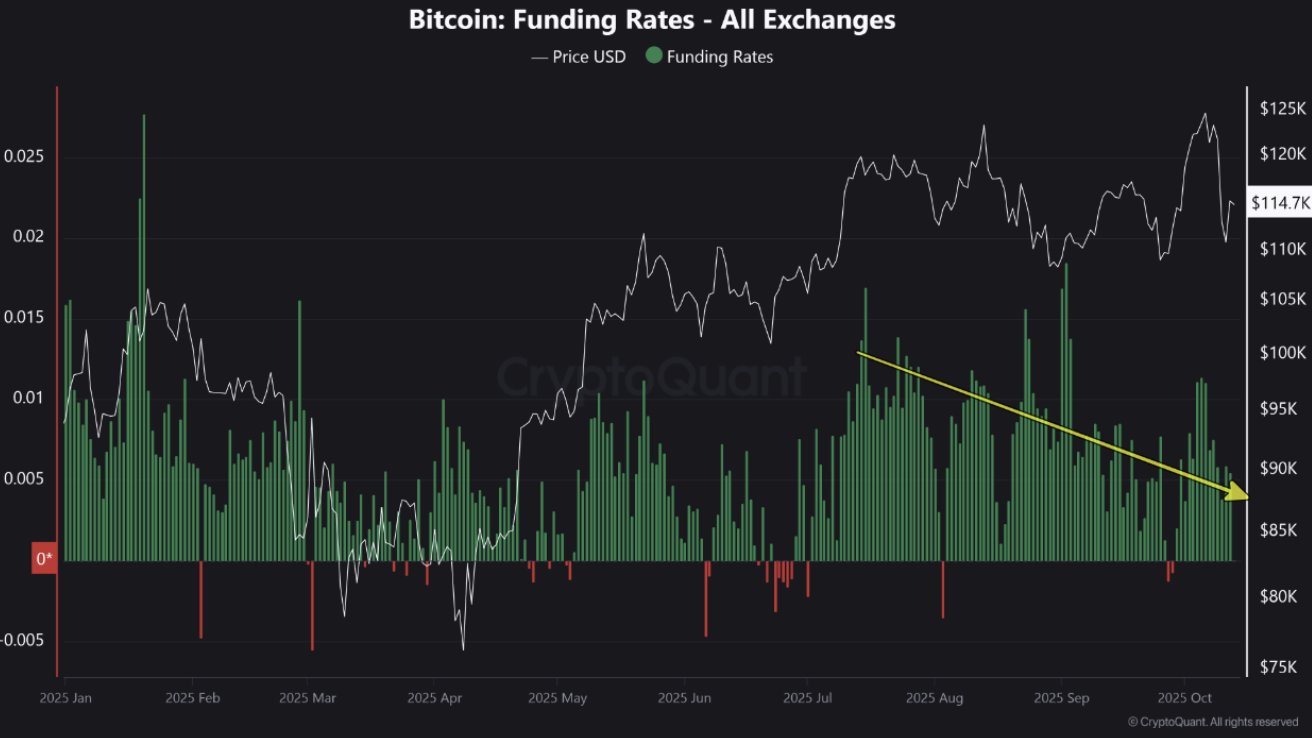

The CryptoQuant report, you see, is full of fascinating, yet ultimately meaningless, metrics. Funding rates, which had been decaying like a forgotten corpse, briefly turned negative, an admission of widespread panic. Now, they are “modestly positive,” apparently. Modestly positive! As if a slightly less grim prognosis is cause for celebration. Sentiment, they say, is “stabilizing.” Oh, the euphemisms we employ to mask the underlying chaos!

And the Bitcoin Estimated Leverage Ratio (ELR)? It has fallen to levels not witnessed since 2022 – a year that now feels like a simpler time. A “reset,” they proclaim! A flushing out of excess! Such poetic language for economic devastation! One cannot help but feel a certain… morbid curiosity about the fates of those who were “flushed out.”

The Bitcoin Stablecoin Supply Ratio (SSR) has reached a low point. More available buying power, they tell us. A rising tide, perhaps, but a tide that may well wash away the remaining remnants of trust. Such is the nature of these things. A larger pool of money simply means more potential for further disappointment, more fuel for the inevitable flames of speculation. 😂

BTC Attempts Recovery After Sharp Correction

Bitcoin, like a wounded beast, is attempting to rise. It has rebounded, they say, hovering around $115,000. A momentary reprieve, perhaps. A brief illusion of control in a world spiraling into uncertainty. And they point to the “200-day moving average” – a mystical line on a chart that holds the weight of all hopes and fears. It is, it appears, a “critical level.” Aren’t they all?

However, it remains below the $117,500 barrier. The bulls, those eternally optimistic champions of the upward trajectory, must reclaim it. And they babble about “momentum” and “formation of higher lows.” Such technical jargon! Ultimately, it is all a game of confidence, a self-fulfilling prophecy fueled by delusion and greed. The market is playing with us all. 🤪

The moving averages offer a “bearish crossover risk.” Caution, they counsel. But is caution ever heeded in the face of such intoxicating potential? If it holds above $112,000 and then $117,500, well, then the game continues. If it fails… another descent into despair. Such is the human condition, mirrored in the fluctuations of a digital currency.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2025-10-14 05:19