In the vast tapestry of markets, the recent upheaval in Ethereum‘s fortunes unfolds like a tragicomic opera, with a hefty splash of drama, sarcasm, and perhaps a dash of hope. Once more, the mighty Ethereum, in its eternal quest for supremacy, has decided to shake the very foundations of its existence – this time, with a colossal purge of over ten billion dollars-because, apparently, even digital gods need a good cleanse. 😅

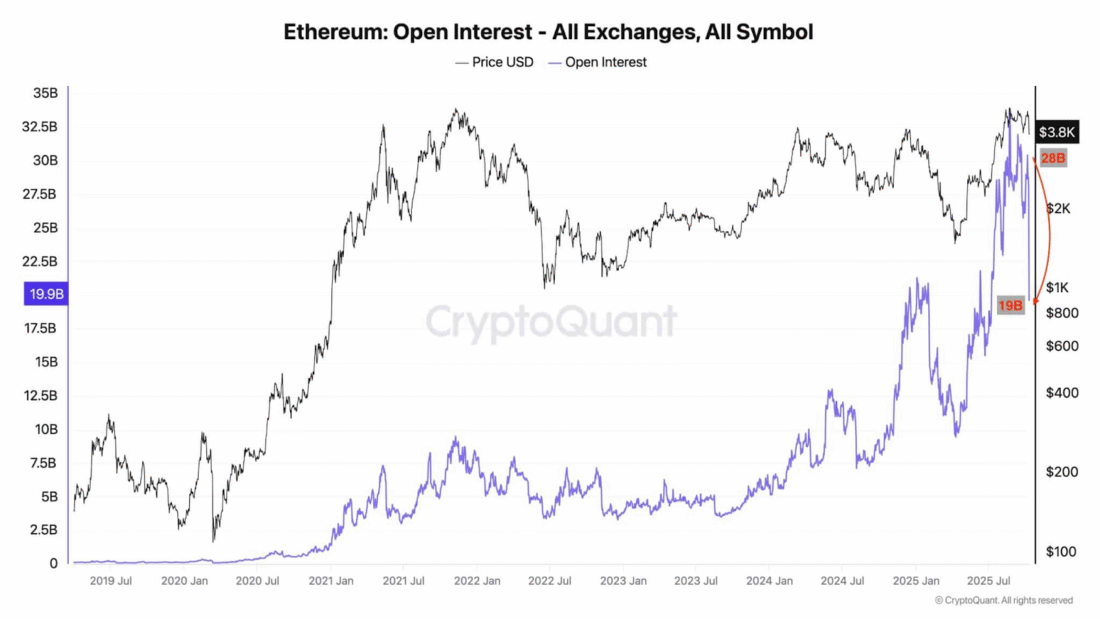

The scene is set: Ethereum, a creature of both wonder and chaos, has just endured its most ruthless liquidation, stripping away a staggering 28 billion dollars in interest-the kind of cleanup that would make even a hoarder tremble. Did someone say “market reset”? Indeed, that’s the polite term for what’s really a messy, albeit necessary, upheaval. The investors, some brave, others just reckless, watched as their cherished assets evaporated-poof!-like a magician revealing his secrets with a smirk. 👀

Source: CryptoQuant (because, obviously, nobody loves a good data dump more than we love a good data dump)

As the dust settled, the market environment, much like a grumpy old man after a tantrum, reasserted itself. When Ethereum’s love affair with leverage gets a bit too passionate and sells off more than Bitcoin, history suggests a rebound-probably faster than a cat chasing a laser pointer. Last September’s dance was no exception: ETH fell 18%, while Bitcoin merely took a 7% sip from the cup of sorrow. Two weeks later? ETH bounced back 14%, leaving Bitcoin’s modest 10% in the dust-perhaps slightly confused, perhaps just enjoying the ride.

This relentless volatility, courtesy of derivative markets with leverage thicker than grandma’s gravy, keeps us all on the edge of our seats-or hiding under desks. Ethereum’s penchant for dramatic swings suggests it’s more akin to a rollercoaster with a fuel injection-fast, furious, and never boring. 🎢

Whale Watching: The Big Fish Play Poker, and Sometimes, Win

Enter BitMine (BMNR), the digital whale with enough dough to make a seafood platter blush. Their latest feat? Snapping up over 128,000 ETH during the dip, worth about 480 million smackers-because even whales love a good bargain. With an average cost of roughly $3,730 per ETH, they’re clearly here for the long haul, or just to give FUDsters a headache. 💰

BMNR isn’t just swimming in the market; it’s flipping the narrative, turning what looked like a disaster into a potential turning point. Their confidence seems to whisper: “Don’t be scared, FUDders. This is just a warm-up act for the real show.” And with that, ETH snagged a 2.27% intraday bounce, possibly just flexing its muscles in front of Bitcoin, which had a slightly less dramatic fall and rise.

$10B Open Interest Vanishes: Market’s Big Summer Reset

October 10 saw one of those days that traders will talk about for years-a $10 billion wipeout in Ethereum derivatives. Think of it as a giant digital spring cleaning, except instead of dust bunnies, you get wiped-out positions and a dash of geopolitical spice. Analysts call it overdue; the market calls it a needed slap-because sometimes, even markets need a timeout.

The chaos was partly fueled by tense international affairs, adding volatile spice to an already hot stew. But lo and behold, Ethereum, the resilient beast, came back swinging-proof that even in chaos, there’s opportunity (and FOMO). 🚀

Leverage’s Double-Edged Sword: Volatility’s Best Friend

High leverage is like giving a toddlers’ trampoline to a sumo wrestler-inevitably, someone’s going to get bounced. Ethereum’s love for leverage makes it a magnet for dramatic price swings-rallies, crashes, rinse and repeat. Fluctuations in open interest play a game of dominoes, setting off rapid moves that keep traders awake at night (or day, if they’re nocturnal). 🌙

As Ethereum dances through the fire, its ratios and whale buying activity hint at future rebounds-perhaps even enough to outshine Bitcoin. The short-term demand boosts from derivatives rollover and mammoth whale purchases are the market’s amusement park rides-fast, thrilling, and occasionally terrifying.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Top Actors Of Color Who Were Snubbed At The Oscars

- ‘The Conjuring: Last Rites’ Tops HBO Max’s Top 10 Most-Watched Movies List of the Week

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

2025-10-13 16:26