After a marathon week of wallets bulging with shiny coins, Bitcoin ETFs finally decided they had better do a dramatic exit, bleeding a cool $4.5 million. Meanwhile, Ether’s funds, feeling less like a sneaky cat and more like a party guest overstay, vacated the premises with an impressive $174.83 million in theatrical outflows. Turns out, investors are just like your overly dramatic aunt at a wedding-happy to cheer, but equally ready to bolt when the music stops.

Bitcoin ETFs Slip Red With $4.5 Million Exit While Ether Sees $175 Million Drain

The unstoppable, ever-so-steady rally has hit a speed bump-possibly a derailment, maybe just a really slow pedestrian crossing. After nine glorious days of cash flowing into digital piggybanks, Bitcoin ETFs finally decided to embrace their inner grumpy old men and turn red. Meanwhile, Ether’s funds, not to be outdone in the dramatic exit department, kept their recent trend going into day two of theatrical red ink. Once upon a time, there was a steady stream of institutional demand-then, quite abruptly, that stream turned into a puddle, and traders took a deep breath, sighing like someone who just remembered the milk expired last Tuesday.

Bitcoin ETFs hemorrhaged $4.50 million in a single day, marking the first time in what felt like a century (or two weeks, whichever is shorter) that they’ve dipped into the red. The selloff was a group effort-five funds, to be exact, with Bitwise’s BITB leading the parade with a graceful exit of $37.45 million. Grayscale’s GBTC followed, clutching its pearls with a deplorable $19.21 million out. Fidelity’s FBTC was notabouttomissout, shedding $10.18 million, and the smaller players Ark 21Shares’ ARKB and Grayscale’s Bitcoin Mini Trust also threw red flags, at $6.21 million and $5.68 million respectively. It’s like a speed dating session, but for funds to say goodbye.

But amidst the doom and gloom, Blackrock’s IBIT showed a rare flicker of hope, pulling in a tidy $74.22 million. Not enough, though, to save the day from the broader sell-off. Trading volume hit a record-shattering $9.78 billion, yet net assets tumbled – oh, what a tragic romance – down to $158.96 billion.

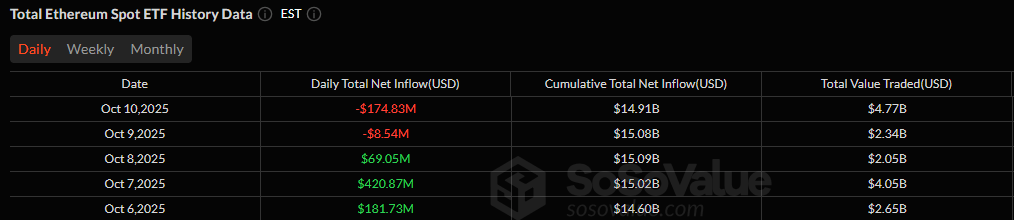

Ether ETFs decided to throw a farewell party in the red zone, spilling out $174.83 million like a bad soap opera. Blackrock’s ETHA was out in front, shedding a painful $80.19 million, followed by grayscale’s ETHE with $30.57 million, Fidelity’s FETH doing its best impression of a drained pool at $30.07 million, and Bitwise’s ETHW holding the line with $21.58 million. The Ether Mini Trust decided to earn its red badge with an extra $12.41 million. All in all, they traded a hefty $4.77 billion-like trying to drink from a firehose-while their net assets shrank to a modest $27.51 billion.

Apparently, even in the cryptocurrency kingdom, the long winning streak is just a good story. The numbers on Friday reminded everyone that momentum isn’t quite as relentless as a herd of cats chasing shiny objects-sometimes, even crypto needs a timeout.

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 39th Developer Notes: 2.5th Anniversary Update

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Top Actors Of Color Who Were Snubbed At The Oscars

- TON PREDICTION. TON cryptocurrency

2025-10-13 12:08